- Bitcoin stays range-bound between $90,000 and $93,000 after rejection at $94,000

- Bitfinex whales are closing longs, a transfer that has preceded main rallies previously

- Key breakout ranges sit above $94,000, whereas $88,000 stays crucial draw back assist

Bitcoin’s newest try at a bullish continuation misplaced steam a couple of days in the past after value was firmly rejected close to the $94,000 stage. Since then, BTC has slipped into a good vary, shifting backwards and forwards between roughly $90,000 and $93,000. It’s the form of value motion that normally alerts hesitation, a market caught at a call level, not fairly able to commit.

On the time of writing, Bitcoin is buying and selling round $90,739, down a light 0.12% on the day. On the floor, nothing dramatic is occurring. However beneath that calm, futures market habits, particularly from whales, is beginning to shift in a means merchants don’t normally ignore.

Bitfinex Whales Are Quietly Closing Longs

Exercise within the Bitcoin futures market has picked up over the previous few periods. In response to CoinGlass knowledge, there are at present extra 2x lengthy positions than shorts, which suggests merchants are nonetheless leaning bullish general. Sentiment hasn’t collapsed, not less than not but.

That stated, a notable change is underway. Massive Bitcoin holders on Bitfinex have begun decreasing publicity by closing lengthy positions, a transfer that’s usually seen throughout late-stage consolidations reasonably than outright selloffs. After practically a 12 months of steadily declining leverage, whales are actually exiting positions at a noticeably quicker tempo.

Traditionally, this habits has mattered. The final time Bitfinex whales aggressively closed longs, Bitcoin went on to rally roughly 50% in simply over 40 days, ultimately pushing into a brand new all-time excessive close to $112,000. That transfer adopted a cascade of brief liquidations, catching a lot of the market off guard. If historical past even partially repeats, BTC might be establishing for one more sizable leg greater, probably erasing losses seen since October 2025.

Liquidity Favors a Brief Squeeze, For Now

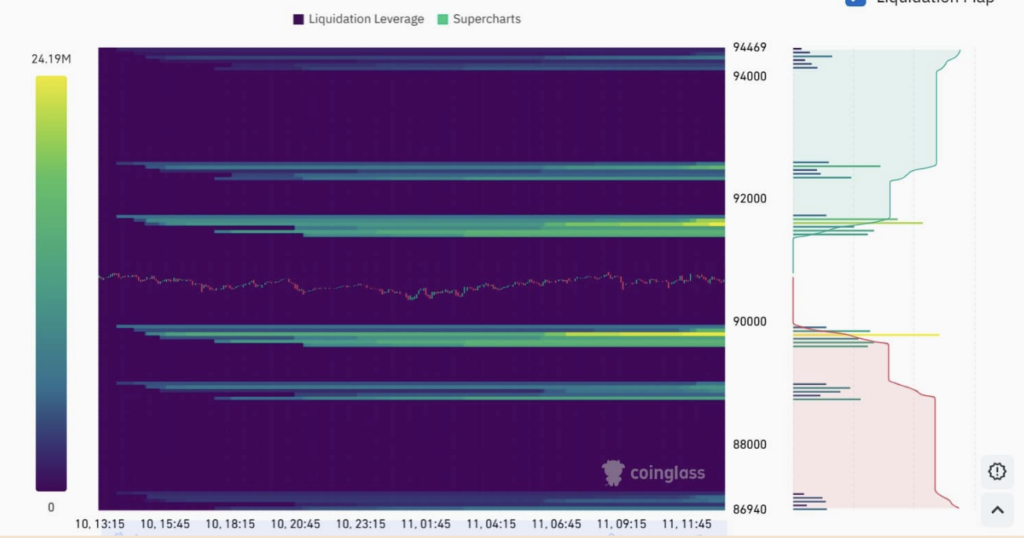

Bitcoin’s present value sits between two main liquidation zones, in keeping with Coinglass heatmap knowledge. On the upside, clusters of brief liquidations are stacked between $91,800 and $92,200, with one other band close to $93,800 to $94,200. A clear break into these areas might power shorts to shut quickly, triggering a traditional brief squeeze.

On the draw back, lengthy liquidation zones are concentrated round $89,000 and $88,000. A drop beneath both of these ranges might shortly enhance promoting stress, particularly if leverage begins unwinding abruptly.

Regardless of this steadiness, general liquidity stays skewed towards shorts. Information from Cryptopulse exhibits that whereas there are notable lengthy positions close to $88,000, brief sellers nonetheless maintain the higher hand. Bitcoin’s Lengthy/Brief Ratio has remained beneath 1 for 5 straight days, hovering round 0.9 at press time. When this ratio stays depressed, it normally means merchants are leaning bearish and actively betting in opposition to value continuation.

Momentum Weakens because the Standoff Continues

From a momentum standpoint, Bitcoin is displaying indicators of fatigue. The Relative Power Index has slipped from 65 all the way down to round 52, marking a bearish crossover. That transfer displays weakening demand, although it doesn’t but affirm that sellers are totally in management.

These situations level to a tug-of-war reasonably than a breakdown. If the present steadiness holds, Bitcoin might stay caught in a sideways grind for longer than many anticipate, irritating each bulls and bears.

Nonetheless, decision tends to reach all of a sudden. If patrons regain management and push BTC above $94,000, brief liquidations might gasoline a pointy upside transfer. On the flip facet, failure to defend the $90,000 assist might ship Bitcoin towards $88,000, the place lengthy liquidations could amplify draw back stress.

For now, Bitcoin is calm on the floor, however positioned for volatility beneath. One facet will ultimately blink.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.