Bitcoin pushed above the $92,000 degree late-Sunday as a authorized escalation round Federal Reserve Chair Jerome Powell grew to become public. The catalyst was Powell’s resolution to publicly tackle Division of Justice subpoenas and a legal probe he characterised as political strain tied to the administration’s fee preferences.

In a video launched Sunday night, Powell instantly addressed US President Donald Trump: “The specter of legal costs is a consequence of the Fed setting charges based mostly on our greatest evaluation of what is going to serve the general public, relatively than following the preferences of the President.”

BREAKING: Fed Chair Powell responds after Federal prosecutors open a legal investigation into him:

“The specter of legal costs is a consequence of the Fed setting charges based mostly on our greatest evaluation of what is going to serve the general public, relatively than following the preferences of… pic.twitter.com/y1dRdoQ1fm

— The Kobeissi Letter (@KobeissiLetter) January 12, 2026

Bitcoin Group Reacts To The Information

The Bitcoin and broader crypto market responded instantly with an honest push larger, whereas “metals [were] blasting to new highs,” as analyst Will Clemente wrote through X.

Associated Studying

The timing issues for crypto merchants: the Fed is heading into its January 28 assembly with the market more and more primed for a pause in cuts, amplifying sensitivity to any notion that financial coverage is being pulled into partisan battle.

For Bitcoin-native observers, the episode learn like a real-time stress check of institutional belief: one which flatters Bitcoin’s pitch. Clemente added through X: “This setting is actually what Bitcoin was created for. The President is coming after the Fed chair. Metals are ripping as sovereigns diversify reserves. Shares & threat property at file highs. Geopolitical threat rising.”

Alex Thorn, head of firmwide analysis at Galaxy, put the distinction in financial regimes entrance and middle, arguing that Bitcoin’s “credibly impartial, predictable, clear, and censorship resistant financial coverage appears fairly good right here,” after flagging Powell’s view that the subpoenas are “pretexts” for administrative meddling in financial coverage.

Associated Studying

Others used the second to widen the indictment past any single persona. Bitwise advisor Jeff Park argued that “independence alone can’t be a advantage when the establishment at its core is incompetent,” including that “the age of Bitcoin is drawing nearer.” Walker, a outstanding pro-Bitcoin voice, framed it as a structural downside: “The issue isn’t President Trump or Jerome Powell. The issue is a centralized cabal of unelected banker-bureaucrats set the worth of cash and print it out of skinny air.”

Notably, the bullish reflex wasn’t rooted in sympathy for Powell. Attempt CEO Matt Cole wrote he had “zero sympathy” for the Fed chair and accused the central financial institution of “gaslight[ing] the American folks” on independence, concluding: “Bitcoin is much more underpriced than we realized…”

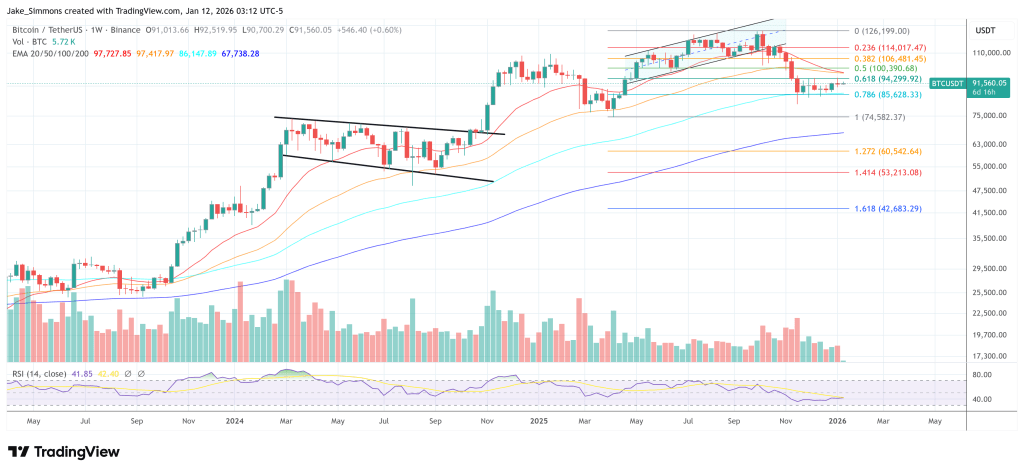

Bitcoin’s transfer by way of $92,000 places that narrative onto a worth chart, however the identical political-legal suggestions loop that fuels the “impartial cash” thesis may also intensify volatility. “For the primary time ever, Fed Chair Powell is preventing again: During the last 12 months, Fed Chair Powell has remained silent amid President Trump’s criticisms,” The Kobeissi Letter wrote through X, including: “Right now, that modified. […] Trump vs Powell will lead to much more volatility.”

At press time, Bitcoin traded at $91,560.

Featured picture created with DALL.E, chart from TradingView.com