- Institutional staking is quietly eradicating ETH from circulation and tightening provide

- Leverage has surged with out worth enlargement, rising volatility threat

- Ethereum stays compressed inside a liquidity-driven vary, not a bearish development

Ethereum has been quietly constructing a distinct type of energy. Whereas worth hovered close to $3,090 and seemed nearly boring on the floor, institutional conviction stored rising beneath. Giant-scale staking continued to empty liquid provide, at the same time as leverage throughout derivatives markets began heating up once more.

That distinction, calm worth versus aggressive positioning, is beginning to matter.

Institutional Staking Tightens Ethereum’s Provide

Tom Lee’s Bitmine has ramped up its Ethereum staking exercise in a giant approach, including one other 86,400 ETH value roughly $266.3 million. That pushed its complete staked holdings to about 1,080,512 ETH, now valued close to $3.33 billion. This isn’t short-term hypothesis, it’s long-duration positioning with endurance baked in.

Every staking deposit quietly removes ETH from the spot market, shrinking sell-side liquidity with out creating fast worth stress. Staking rewards additional encourage holders to sit down tight quite than chase volatility. Consequently, Ethereum has been absorbing provide steadily, with out the type of explosive worth response merchants usually anticipate.

That type of imbalance doesn’t normally disappear by itself. It tends to point out up later, as soon as demand begins urgent once more.

Breakout Holds as Momentum Begins to Recuperate

Technically, Ethereum has already made an necessary transfer. Value broke decisively above its descending channel, invalidating the bearish construction that had capped upside since September. The bounce from $2,767 set a transparent larger low, whereas reclaiming the $3,090 pivot confirmed that the market had stabilized.

Nonetheless, upside has not come simply. Value continues to stall beneath $3,307, an space the place provide retains pushing again. Above that, $3,909 stands out as the subsequent main resistance degree. For now, Ethereum is caught between enchancment and hesitation.

Momentum indicators lean cautiously bullish. RSI sits close to 51, a shift away from bearish territory and an indication consumers are regaining management, slowly. It’s progress, however not affirmation. With out sustained energy above resistance, continuation stays a query mark.

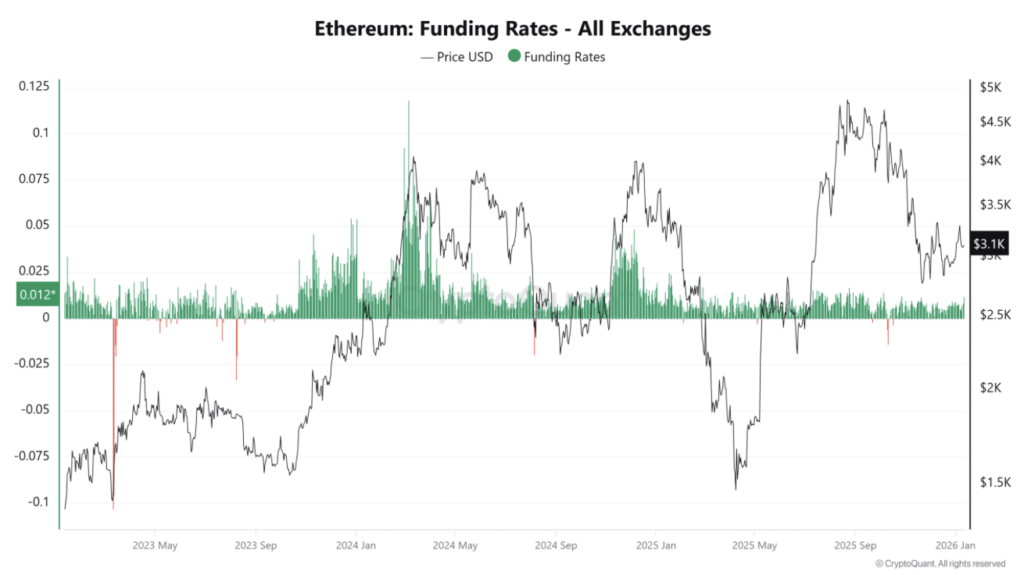

Leverage Surges With out Value Comply with-By

Whereas spot worth stays pinned, leverage has exploded. Funding charges jumped by 66.12%, climbing to 0.01275, which reveals merchants are paying as much as keep lengthy throughout perpetual markets. Optimism is clearly constructing, not less than in derivatives.

The issue is worth hasn’t adopted. Ethereum stays caught close to $3,090, making a rising hole between leverage and precise motion. Traditionally, setups like this don’t final. Both worth expands larger to reward longs, or stagnation forces a painful unwind.

To date, spot demand hasn’t confirmed the derivatives enthusiasm. Leverage is main sentiment, not the opposite approach round. That imbalance places Ethereum in a delicate spot, the place even a small transfer can set off an even bigger response.

Shorts Take Extra Injury as Draw back Weakens

Liquidation information reveals that bears are feeling the stress first. Quick liquidations totaled roughly $564,780, greater than double the $241,530 seen on the lengthy facet. Binance accounted for about $55,030 in brief losses, whereas HTX noticed roughly $247,370 wiped from bearish positions.

What stands out is that that is occurring and not using a main worth surge. Shorts are taking hits at the same time as Ethereum trades sideways, suggesting draw back makes an attempt are failing quietly. Every failed breakdown strengthens the bottom, even when progress feels gradual.

Nonetheless, resistance hasn’t cracked. Bears proceed to defend key ranges, which is why stress is constructing regularly quite than exploding upward.

Liquidity Retains Ethereum Vary-Certain

The ETH/USDT liquidation heatmap on Binance highlights why worth feels trapped. Dense liquidity clusters sit just under worth round $3,050 to $3,100, and simply above it close to $3,150 to $3,200. These zones act like magnets throughout low-volatility situations.

Above $3,225, liquidity thins out, hinting that resistance might weaken rapidly if worth breaks larger. On the draw back, liquidity fades beneath $3,000, which can restrict how aggressively worth can fall if help offers approach.

For now, Ethereum is boxed in by liquidity, not development. Till one in every of these clusters clears decisively, worth is prone to hold oscillating.

Compression, Not Weak point

Ethereum isn’t displaying indicators of breakdown. As an alternative, it seems compressed. Institutional staking continues to soak up provide, momentum indicators are enhancing, and shorts are slowly absorbing stress. On the identical time, leverage is stacking up, rising the stakes.

Whether or not this resolves larger or forces a reset will rely upon which facet offers in first. One factor is obvious although, the calm most likely received’t final for much longer.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.