Ethereum wants “higher decentralized stablecoins,” Vitalik Buterin mentioned this weekend, arguing that the subsequent iteration has to unravel three design constraints that as we speak’s fashions hold skirting. His feedback landed alongside a broader declare from MetaLeX founder Gabriel Shapiro that Ethereum is more and more a “contrarian guess” versus what a lot of the venture-backed crypto stack is optimizing for.

Shapiro framed the cut up in ideological phrases, saying it’s “more and more apparent that Ethereum is a contrarian guess towards most of what crypto VCs are betting on,” itemizing “playing,” “CeDeFi,” “custodial stablecoins,” and “’neo-banks’” as the middle of gravity. In contrast, he argued, “Ethereum is tripling down on disrupting energy to allow sovereign people.”

Why Ethereum Lacks A Decentralized Stablecoin

Buterin’s stablecoin critique begins with what to stabilize towards. He mentioned “monitoring USD is ok quick time period,” however steered {that a} long-horizon model of “nation state resilience” factors to one thing that isn’t depending on a single fiat “value ticker.”

“Monitoring USD is ok quick time period, however imo a part of the imaginative and prescient of nation state resilience must be independence even from that value ticker,” Buterin wrote. “On a 20 yr timeline, properly, what if it hyperinflates, even reasonably?”

That premise shifts the stablecoin drawback from merely sustaining a peg to constructing a reference index that may plausibly survive macro regime adjustments. In Buterin’s framing, that’s “drawback” one: figuring out an index “higher than USD value,” a minimum of as a north star even when USD monitoring stays expedient close to time period.

The second situation is governance and oracle safety. Buterin argued {that a} decentralized oracle should be “not capturable with a big pool of cash,” or the system is pressured into unattractive tradeoffs that finally land on customers.

“In the event you don’t have (2), then you must guarantee price of seize > protocol token market cap, which in flip implies protocol worth extraction > low cost fee, which is sort of dangerous for customers,” he wrote. “This can be a huge a part of why I continuously rail towards financialized governance btw: it inherently has no protection/offense asymmetry, and so excessive ranges of extraction are the one method to be steady.”

He tied that to a longer-running discomfort with token-holder-driven management buildings that resemble markets for affect. In his view, “financialized governance” tendencies towards methods that should repeatedly extract worth to defend themselves, fairly than counting on a structural benefit that makes assaults meaningfully tougher than regular operation.

The third drawback is mechanical: staking yield competes with decentralized stablecoins for capital. If stablecoin customers and collateral suppliers are implicitly giving up a couple of proportion factors of return relative to staking ETH, Buterin referred to as that “fairly dangerous,” and steered it turns into a persistent headwind until the ecosystem adjustments how yield, collateral, and danger work together.

He laid out what he described as a map of the “answer house,” whereas stressing it was “not endorsement.” These paths ranged from compressing staking yield towards “hobbyist stage,” to making a staking class with related returns however with out comparable slashing danger, to creating “slashable staking appropriate with usability as collateral.”

Buterin additionally sharpened what “slashing danger” truly means on this context. “In the event you’re going to attempt to purpose via this intimately,” he wrote, “keep in mind that the ‘slashing danger’ to protect towards is each self-contradiction, and being on the improper facet of an inactivity leak, ie. participating in a 51% censorship assault. Typically, we expect an excessive amount of concerning the former and never sufficient concerning the latter.”

The constraint bleeds into liquidation dynamics as properly. He famous {that a} stablecoin “can’t be secured with a hard and fast quantity of ETH collateral,” as a result of massive drawdowns require energetic rebalancing, and any design that sources yield from staking should reckon with how that yield turns off or adjustments throughout stress.

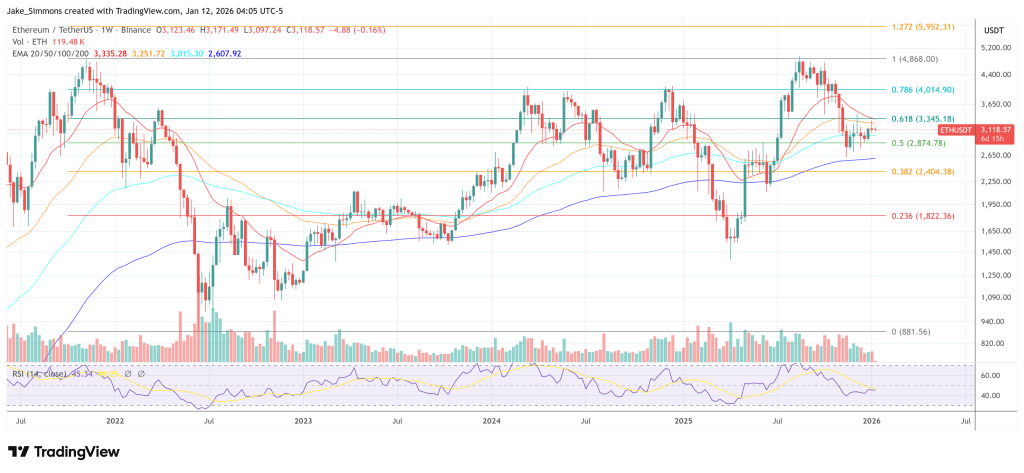

At press time, ETH traded at $3,118.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.