Again in November final yr, I wrote an article on what ChatGPT thinks about BlackRock launching a spot XRP ETF.

In it, the mannequin argued that, though there was no present affirmation on the time, corporations like BlackRock are more and more exhibiting curiosity in numerous digital belongings.

So, what modified?

Spot XRP ETF Outlook in 2026

Spot XRP ETFs launched formally on November thirteenth, with the primary one referred to as XRPC by Canary Capital. Since then, 4 extra corporations have adopted swimsuit, and their present belongings beneath administration (as of January ninth) are:

- Canary Capital (XRPC) – trades on NASDAQ, AUM at $375M

- Bitwise (XRP) – trades on NYSE, AUM at $300MM

- Franklin Templeton (XRPZ) – trades on NYSE, AUM at $279M

- Grayscale (GXRP) – trades on NYSE, AUM at $271M

- 21 Shares (TOXR) – trades on CBOE, AUM at $246M

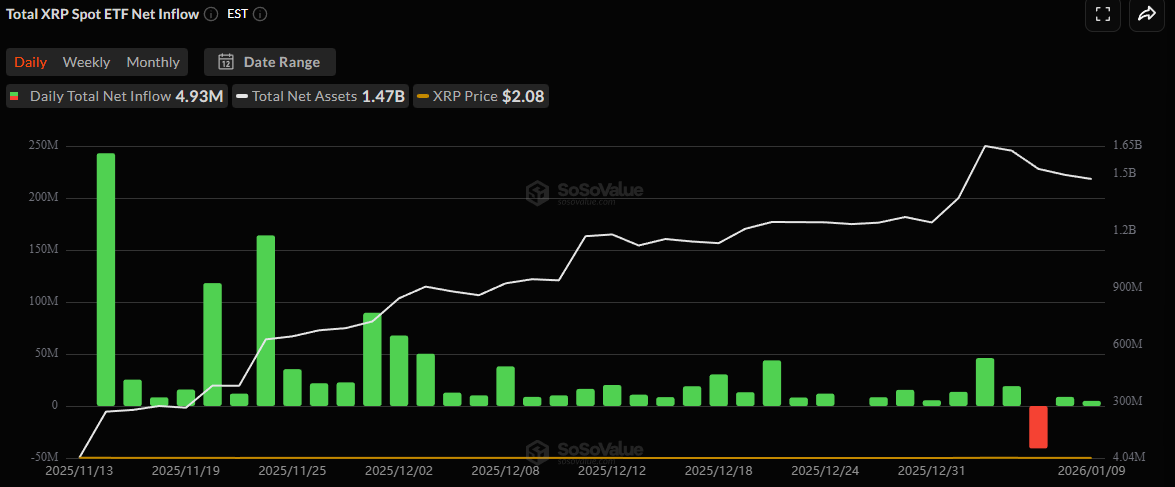

That makes for a mixed complete belongings beneath administration of round $1.5 billion, showcasing clear demand for the product.

Furthermore, information from SoSoValue exhibits that belongings beneath administration have been nearly consistently rising till January fifth. There’s been a drop in web AUM of round $150 million since.

For reference, spot ETH ETFs, though a lot bigger in absolute worth, have been bleeding belongings since October 2025. So, would BlackRock, given the present atmosphere within the crypto trade, be extra inclined to contemplate launching a spot XRP ETF?

Gemini Says the Chances are There

In line with Google’s Gemini, there’s a average to excessive chance that BlackRock will launch a spot XRP ETF later in 2026. The explanation? Worry of lacking out.

Gemini argues that, in contrast to earlier years, the trail for crypto is now clear.

“The regulatory blockers that beforehand stored conservative giants like BlackRock on the sidelines have largely been eliminated.”

The AI signifies that main rivals have already attracted over a billion in inflows, demonstrating that institutional demand is current.

Furthermore, again in August, the long-running authorized battle between Ripple and the US Securities and Change Fee successfully ended, clarifying that XRP shouldn’t be a safety when offered on secondary markets.

Furthermore, ChatGPT itself additionally assigned a average likelihood of as much as 50% for BlackRock to finally launch a spot XRP ETF later in 2026.

The put up Main Adjustments: Will BlackRock Launch a Spot XRP ETF in 2026? (AI Predicts) appeared first on CryptoPotato.