- Solana ETFs have recorded eight straight weeks of inflows, reinforcing institutional demand

- Derivatives knowledge exhibits rising Open Curiosity and heavier brief liquidations

- Technical indicators level to enhancing momentum, with $145 and $150 as key ranges to observe

Solana began the week on a agency footing. SOL edged about 2% greater on Monday, extending Sunday’s almost 3% achieve, and the transfer didn’t really feel random. A gentle stream of capital into US spot Solana ETFs continues to sign deeper institutional curiosity, whereas new developments on the community itself are beginning to catch consideration.

On the similar time, Solana is testing concepts round non-public transactions by means of a newly launched hackathon. That mixture, institutional demand on one facet and have enlargement on the opposite, is quietly reshaping sentiment round SOL.

ETF Inflows and Privateness Experiments Acquire Consideration

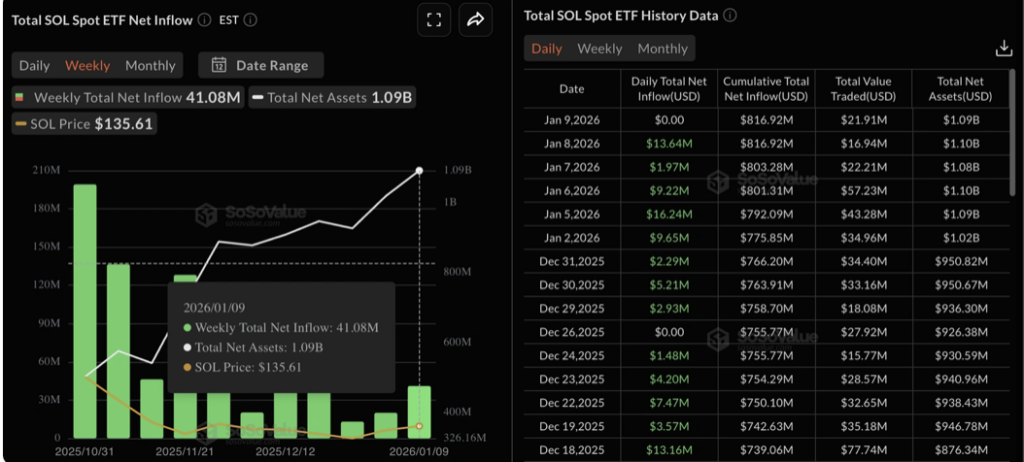

Solana-focused ETFs pulled in roughly $41.08 million in inflows final week, marking their eighth straight week within the inexperienced. That consistency suggests establishments aren’t simply dabbling, they’re sticking round. As this demand builds, Solana can also be exploring privateness instruments that would ultimately place it nearer to networks like Zcash or Monero in sure use instances.

The Privateness Hack, which kicked off on Monday, is providing $75,000 in rewards throughout a number of tracks. These embody non-public cost options, a launchpad, and an open class for different privacy-focused concepts. Submissions are open till February 1, with winners set to be introduced on February 10. It’s an experiment for now, however one that would broaden Solana’s enchantment past velocity and price effectivity.

Derivatives Information Reveals Bulls Gaining Floor

On the derivatives facet, merchants look like leaning extra bullish. CoinGlass knowledge exhibits Solana futures Open Curiosity climbing 4.90% over the previous 24 hours, reaching about $8.58 billion. That rise suggests contemporary capital is coming into the market, not simply repositioning.

The 24-hour long-to-short ratio sits close to 1.02, indicating barely extra lengthy positions than shorts. Liquidation knowledge backs this up. Brief liquidations totaled round $12.61 million, considerably greater than the $2.14 million in lengthy liquidations. In easy phrases, bearish bets are getting squeezed extra typically than bullish ones.

Technical Construction Turns Constructive

From a chart perspective, Solana is beginning to look more healthy. Value has pushed above the 50-day EMA close to $136 and is now buying and selling above the R1 pivot stage round $142. At press time, SOL was inching nearer to the $150 area, a stage many merchants are watching intently.

Solana additionally crossed above the Supertrend indicator, flipping it right into a purchase sign and confirming a contemporary uptrend. Nonetheless, one hurdle stays. The November 4 low close to $145 has capped upside makes an attempt since mid-November. A every day shut above that stage would strengthen the restoration narrative and open the trail towards $150, adopted by the R2 pivot close to $159.

Momentum indicators assist the bullish case, not less than for now. RSI is hovering round 63, transferring again towards overbought territory after a short pullback final week. MACD has additionally turned supportive, with inexperienced histogram bars increasing above the zero line, pointing to constructing bullish momentum.

In fact, danger hasn’t disappeared. If Solana fails close to $146 and reverses decrease, a break beneath the 50-day EMA might expose the December 18 low round $116. That’s the draw back merchants will need to bear in mind as value pushes greater.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.