Be a part of Our Telegram channel to remain updated on breaking information protection

The Ethereum worth has climbed 2% within the final 24 hours to commerce at $3,121 as Tom Lee’s BitMine continues to broaden its Ethereum treasury with one other 24,266 ETH following final week’s buy of 32,977 ETH.

This brings the corporate’s whole Ethereum treasury to about 4.17 million ETH, making it the biggest company holder of Ethereum on the earth with roughly 3.45% of the whole provide. The corporate’s technique is concentrated on rising the quantity of ETH held per share quite than relying solely on worth appreciation. BitMine can be rising its staking operations, with greater than 1.25 million ETH at the moment staked via numerous suppliers, producing further yield for the enterprise.

UPDATE🚨

Tom Lee’s Bitmine has acquired 24,266 $ETH price $75 million for its treasury.💰 pic.twitter.com/rb2RBDiIga

— Moby Media (@mobymedia) January 12, 2026

These purchases come simply days earlier than BitMine’s annual shareholder assembly on January 15 in Las Vegas. Shareholders will vote on a proposal to extend the variety of approved firm shares. Chairman Tom Lee has urged traders to help the plan, saying the corporate already has near 500 million accepted shares and wishes extra authorization to proceed shopping for ETH on the present tempo.

BitMine’s Shareholder Vote to Decide Future ETH Technique

Lee additionally defined that BitMine solely points new shares at a premium to its modified internet asset worth. In response to him, this method protects present shareholders whereas giving them higher publicity to Ethereum. Latest updates concerning the firm’s ETH staking actions have already helped push BMNR inventory larger, displaying robust investor curiosity in its crypto-focused technique.

VanEck’s Matthew Sigel has additionally inspired BitMine shareholders to participate within the vote. He warned that low turnout in comparable firms has beforehand led to delays, reconvened conferences, and uncertainty that harm traders. Sigel stated crypto traders typically underestimate the significance of company voting, although the outcomes can immediately have an effect on an organization’s future plans.

The end result of the January 15 vote might form BitMine’s long-term Ethereum technique. If accepted, the corporate is more likely to proceed aggressively accumulating ETH. If not, additional purchases might grow to be a lot more durable, slowing down its enlargement plans within the Ethereum market.

Ethereum Eyes Restoration as Patrons Acquire Energy

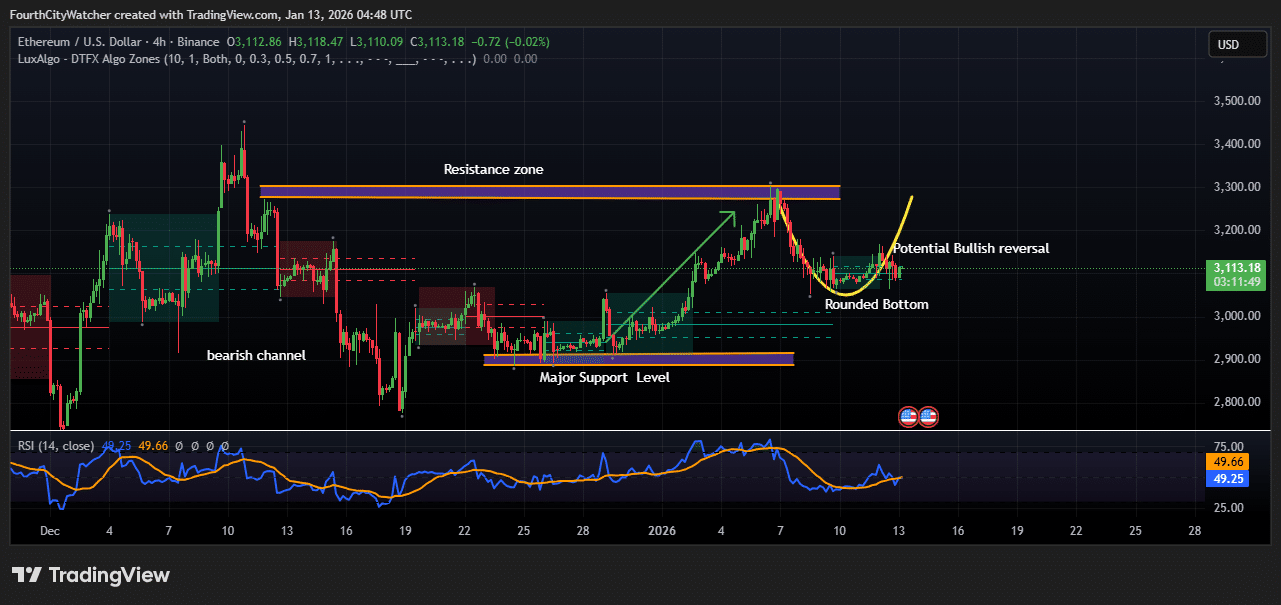

ETHUSD buying and selling pair alerts a possible bullish reversal on the 4-hour chart after forming a rounded backside close to key help ranges. The worth is at the moment buying and selling at $3,120 after pulling again from current highs close to $3,300. The worth motion signifies promoting strain is easing, and patrons are slowly regaining management, which might sign the beginning of a brand new upward transfer.

Earlier, Ethereum rallied towards $3,400 however then entered a bearish channel marked by decrease highs and decrease lows, indicating short-term weak spot. The market discovered robust help round $2,880–$2,920, stopping deeper losses. From this degree, Ethereum started forming a rounded backside, a gradual reversal sample displaying a shift from bearish to bullish sentiment. The worth slowly recovered from $2,900 towards $3,100, indicating a managed and regular return of shopping for curiosity.

ETHUSD Chart Evaluation. Supply: Tradingview

Assist stays robust at $2,880–$2,920, with one other degree at $3,000–$3,040 appearing as short-term help. On the upside, resistance lies between $3,280 and $3,320. A clear break above this zone might push Ethereum towards $3,400–$3,450.

Momentum indicators additionally help the bullish case, with the RSI at 52, barely above impartial, indicating bettering shopping for energy. Ethereum has additionally damaged out of the earlier bearish channel, suggesting sellers are shedding management whereas patrons acquire confidence.

Within the brief time period, Ethereum might comply with three eventualities. In a bullish case, holding above $3,050 and breaking $3,280 might goal $3,400 and better. In a impartial case, the worth might proceed ranging between $3,000 and $3,280 as merchants look forward to a transparent breakout. In a bearish case, a drop beneath $3,000 might retest $2,920 and even $2,800, invalidating the reversal setup. Robust fundamentals, together with staking development, institutional accumulation, ETF curiosity, and company adoption equivalent to BitMine, help long-term bullish sentiment.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection