- XRP is benefiting from early 2026 altcoin rotation.

- Analysts are watching key ranges round $2.22 to $2.39 within the close to time period.

- Longer-term targets close to $5 stay attainable below favorable circumstances.

Ripple’s XRP has by no means taken the simple route. Its climb again into relevance has been sluggish, contested, and at instances irritating, which is precisely why many traders now view it as resilient fairly than fragile. As Ripple continues to increase its technique throughout funds, banking infrastructure, and broader monetary rails, the query isn’t whether or not XRP has ambition. It’s whether or not that ambition reveals up in worth as 2026 unfolds.

Why XRP Is Transferring Once more

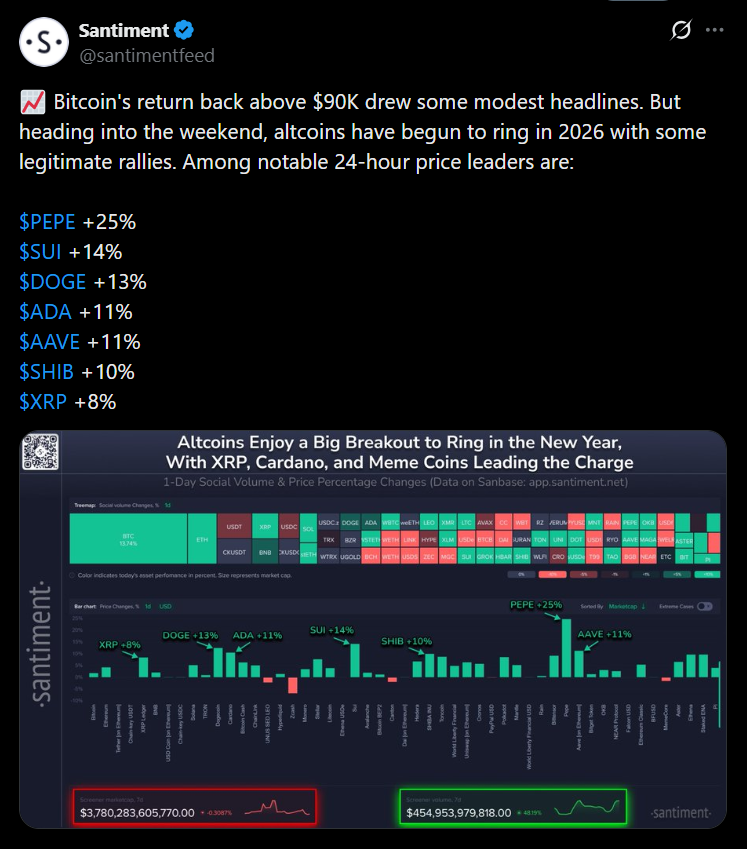

XRP’s current worth motion has been much less about headlines and extra about rotation. As Bitcoin pushed again above the $90,000 degree, consideration started drifting towards altcoins with established narratives. XRP benefited from that shift, rising roughly 8% within the first week of 2026. It wasn’t alone. The broader altcoin area has been displaying indicators of life as traders reassess danger and positioning after a cautious finish to final yr.

That issues as a result of XRP tends to maneuver when capital begins wanting past Bitcoin, not when the market is only defensive.

Close to-Time period Ranges Merchants Are Targeted On

In keeping with analyst Darkish Defender, XRP is at present navigating a technically delicate zone. Close to-term upside ranges being watched sit round $2.22, $2.26, and $2.39. The emphasis right here isn’t on predicting each tick, however on construction. The thought is straightforward: sustained closes above key ranges counsel continuation, whereas repeated closes beneath help open the door to draw back assessments.

Momentum indicators like RSI are already elevated on shorter time frames, which suggests volatility is probably going. That doesn’t invalidate the transfer, but it surely does elevate the significance of affirmation fairly than blind conviction.

Greater Targets Are Nonetheless on the Desk

Zooming out, longer-term projections haven’t disappeared. In earlier commentary, the identical analyst pointed to a possible transfer towards the $5 to $6 vary if XRP completes a full higher-timeframe cycle. That type of goal assumes favorable macro circumstances, continued regulatory readability, and sustained institutional curiosity. It’s not a short-term name. It’s a state of affairs.

Whether or not or not XRP reaches these ranges in 2026 relies upon much less on charts and extra on execution, adoption, and the way the broader crypto market behaves as soon as liquidity circumstances shift.

What This Means for Buyers

XRP isn’t being handled like a speculative flyer proper now. It’s being evaluated as a structured asset inside a rotating market. That doesn’t assure upside, but it surely does clarify why it retains reappearing in critical discussions. Worth targets will change. Narratives will evolve. What hasn’t modified is XRP’s position as a bridge between crypto and conventional finance.

Conclusion

XRP’s outlook for 2026 sits someplace between cautious optimism and conditional upside. Brief-term ranges matter for merchants, whereas longer-term targets hinge on macro tendencies and Ripple’s continued integration into monetary techniques. For now, XRP is again on the radar, not due to hype, however as a result of the market is beginning to rotate once more.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.