- Aave’s DAO-Labs dispute triggered a pointy sentiment shock, however the worst worry now seems priced in

- On-chain exercise stayed resilient in the course of the sell-off, with indicators of accumulation close to native lows

- Robust TVL and payment era counsel Aave’s core fundamentals had been by no means actually broken

Aave has been again within the highlight currently, although not due to a clear value breakout or some flashy new improve. As a substitute, consideration shifted after a really public disagreement between the DAO and Aave Labs rattled confidence and despatched the token decrease. At first look, it appeared messy. However as soon as the noise fades, the image beneath feels a bit extra nuanced.

A Sentiment Shake, Then a Reset

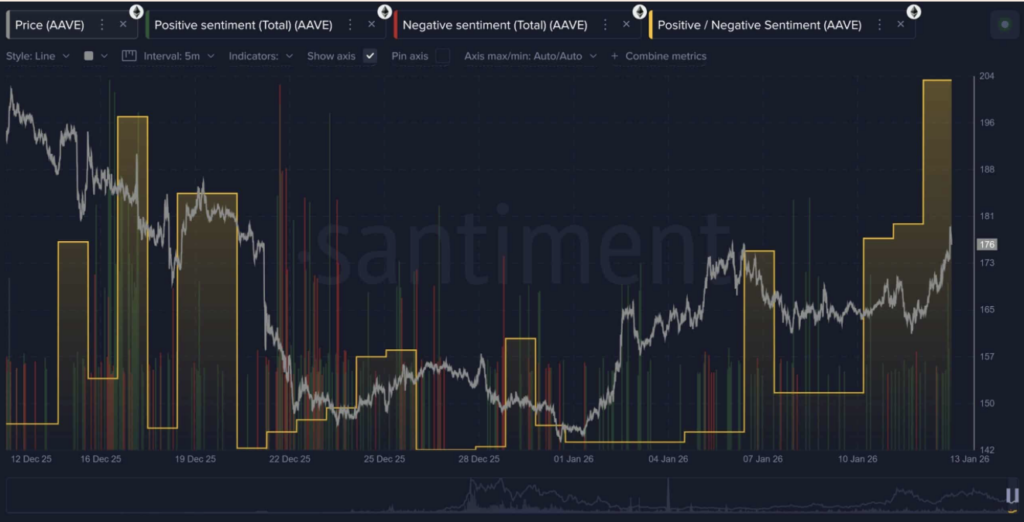

December was tough for AAVE. Because the DAO-Labs dispute performed out in public, sentiment soured rapidly and the worth adopted. Roughly $500 million in market worth was erased, in response to Santiment information, as merchants reacted to uncertainty fairly than fundamentals. Worry tends to maneuver quicker than info.

What’s fascinating is how short-lived that temper turned out to be. As January rolled in, unfavourable chatter started to chill, changed by a extra balanced tone. Constructive mentions began to outpace the unfavourable ones simply as the worth stopped printing decrease lows. It felt much less like blind optimism and extra like acceptance that the worst-case eventualities had been unlikely. The market, in typical vogue, could have overreacted first and requested questions later.

On-Chain Exercise Instructed a Totally different Story

Whereas headlines centered on governance drama, on-chain information was quietly sending one other sign. Day by day lively addresses picked up round AAVE’s native lows in late December, with brief bursts of community development showing proper when value appeared weakest. That type of timing often isn’t random.

Token circulation additionally elevated in the course of the dips, suggesting repositioning fairly than panic exits. In easy phrases, cash had been transferring, however not fleeing the ecosystem. Since early January, value motion has slowly leaned increased, supported by regular shopping for beneath the floor. The protocol itself by no means missed a beat, even whereas sentiment swung wildly.

The Core Didn’t Crack

That is the half that issues most. Regardless of the noise, Aave’s fundamentals stayed intact. Whole worth locked remains to be hovering round $36 billion, solely barely off its highs and comfortably above mid-year ranges. That type of stability is difficult to faux.

Income has held up too, with annualized protocol charges sitting close to $700 million. Customers didn’t vanish, liquidity didn’t evaporate, and capital didn’t rush for the exits. In different phrases, the system saved doing what it’s speculated to do.

That resilience helps clarify why each sentiment and value are beginning to recuperate. If the DAO and Aave Labs handle to resolve their variations with out dragging issues out, the injury could find yourself being extra psychological than structural. Generally the market simply wants a reminder that sturdy foundations don’t disappear in a single day.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.