- Coinbase says it can’t assist the Senate crypto invoice as at the moment written.

- Issues middle on consumer privateness, stablecoin rewards, and SEC authority.

- The trade’s opposition may considerably influence the invoice’s final result.

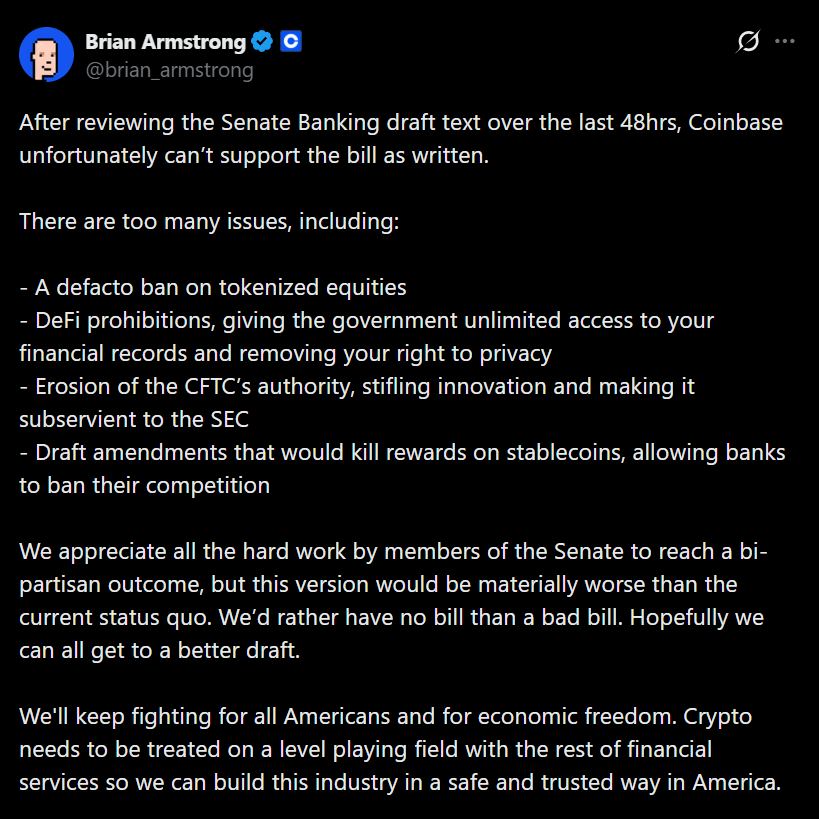

Coinbase has taken a agency stance towards the Senate Banking Committee’s sweeping cryptocurrency laws simply hours earlier than the panel is ready to vote. In a public put up on X, CEO Brian Armstrong mentioned the trade can’t assist the invoice in its present type, regardless of acknowledging the bipartisan effort behind it. His message was blunt: Coinbase would moderately see no invoice in any respect than one which leaves the business worse off than it’s immediately.

Why Coinbase Says the Invoice Falls Quick

In accordance with Armstrong, the proposal raises severe issues round decentralized finance, stablecoin rewards, and consumer privateness. He warned that elements of the invoice may grant the federal government what he described as “limitless entry” to customers’ monetary data, a line that instantly set off alarms throughout crypto circles. He additionally criticized amendments he believes would successfully remove rewards tied to stablecoins, a function many platforms depend on to draw customers.

The invoice itself is designed to make clear regulatory jurisdiction between the SEC and the CFTC, outline when digital belongings qualify as securities or commodities, and introduce new disclosure requirements. Whereas these objectives have broad assist in idea, Coinbase argues the execution misses the mark.

Stablecoin Rewards Turn out to be a Flashpoint

One of many greatest sticking factors is how stablecoin rewards are handled. Banking teams have already pushed again towards a separate stablecoin regulation referred to as GENIUS, which handed final summer season. That regulation prevents issuers from paying direct curiosity to stablecoin holders however permits third-party platforms like Coinbase to supply rewards. Critics now argue that the brand new invoice may shut that loophole, whereas crypto corporations say the problem was already settled and accuse banks of making an attempt to curb competitors.

SEC Authority Raises Outdated Fears

Armstrong additionally took challenge with what he sees as an enlargement of SEC authority on the expense of the CFTC. He described it as an erosion of the CFTC’s function that would stifle innovation and place an excessive amount of energy within the SEC’s palms. That concern runs deep within the business, particularly after former SEC Chair Gary Gensler’s tenure, which many crypto corporations affiliate with regulation by enforcement moderately than clear rulemaking.

Title I of the invoice, targeted on “Accountable Securities Innovation,” has drawn explicit scrutiny for giving the SEC the primary say in classifying sure digital belongings. For a lot of firms, that construction revives fears of unpredictable enforcement moderately than collaborative oversight.

Why This May Change the Invoice’s Destiny

Folks near the discussions say Coinbase’s opposition is a giant deal. When the most important US-based crypto trade publicly rejects a invoice, it sends a sign to lawmakers that business assist is much from unified. With the Senate Banking Committee getting ready to amend and vote on the laws, Coinbase’s stance may drive adjustments, delay the method, and even derail the invoice altogether.

For now, the message from Armstrong is obvious. Progress issues, however not at any price. In Coinbase’s view, regulatory readability solely works if it really improves the panorama moderately than tightening controls in ways in which sluggish innovation and erode belief.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.