- Ethereum is caught in a good vary as provide and demand stay evenly matched

- Heavy staking exercise is lowering liquid provide, with whole staked ETH nearing file ranges

- Rising leverage and lengthy positioning enhance the chance of a bull lure if demand fails to comply with

Threat property proceed to float in a good vary, with provide and demand pulling in reverse instructions. In this type of surroundings, clear breakouts are uncommon. As an alternative, worth tends to cut till a transparent bid–ask imbalance emerges. In line with AMBCrypto, how large-cap property deal with this rigidity will probably resolve their subsequent main transfer.

Ethereum is already exhibiting early alerts. The acquainted debate of “purchase the worry or promote the power” is again, and a few giant gamers seem to have made their selection. BitMine not too long ago staked one other $340 million price of ETH, pushing its whole staked holdings to roughly $3.69 billion. That sort of dedication doesn’t occur on a whim.

Staking Exercise Tightens Provide Beneath the Floor

The staking pipeline continues to fill. Round 2.16 million ETH are at present queued to be staked over the approaching days. If these deposits undergo with out main exits, whole staked Ethereum might strategy 37.8 million ETH, a brand new excessive for this era.

That regular lock-up of provide creates a delicate squeeze. Ethereum hovering across the $3,000 zone begins to resemble a textbook breakout setup, no less than on paper. Bids are current, staking is draining liquid provide, and worth refuses to interrupt down. The danger, although, is whether or not this power is actual or just setting the stage for a lure.

Derivatives Positioning Heats Up, however Dangers Stay

Liquidity in derivatives markets is thickening quick. CoinGlass knowledge reveals almost $2.95 billion in brief positions sitting in danger if ETH strikes one other 11% larger. On the similar time, Binance’s 4-hour perpetual contract is now roughly 70% lengthy, suggesting late bullish positioning is catching up.

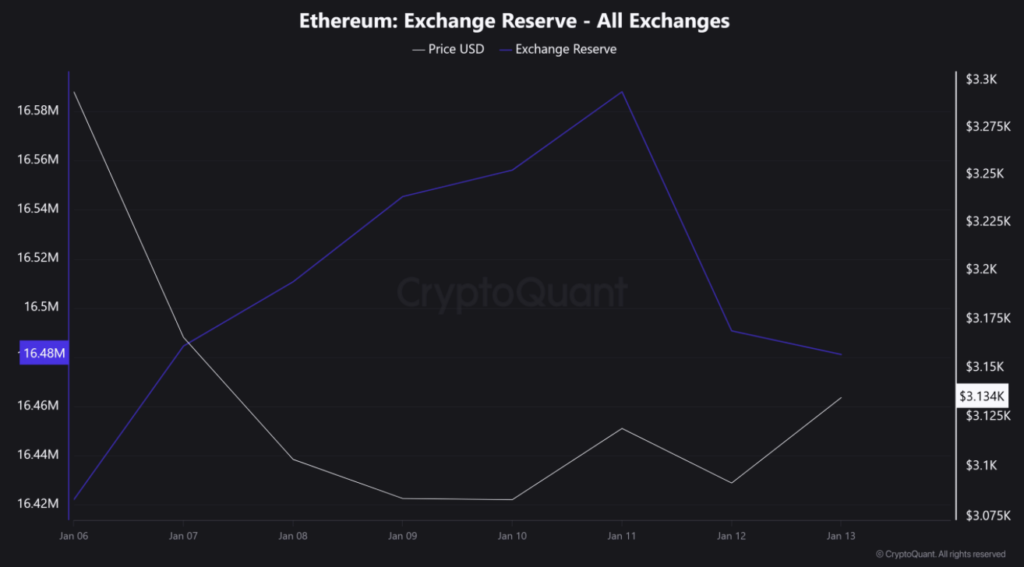

That bias aligns with Ethereum’s bettering technicals and ongoing staking flows. Nonetheless, it’s not a clear provide squeeze but. Roughly 160,000 ETH moved again into reserves simply this previous week, a reminder that sellers haven’t stepped apart fully. One other BlackRock-related deposit has additionally hit the community, including to the complexity.

Open Curiosity is climbing as nicely, rebounding towards ranges final seen in early October. Rising OI normally means merchants are crowding in, which frequently results in sharper strikes, however not at all times within the anticipated route.

Is Ethereum Setting a Lure Close to $3,000?

Right here’s the place the bid–ask imbalance issues most. Staking continues to scale back accessible provide, however promote strain nonetheless exists. Lengthy publicity is constructing quicker than confirmed spot demand, leaving the bid considerably fragile.

Consequently, Ethereum’s sideways grind stays uncovered. As an alternative of a clear breakout, the present setup might evolve right into a bull lure if momentum fades and crowded longs unwind. The construction appears to be like promising, however till demand clearly takes management, the chop round $3,000 could have extra to say.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.