- Establishments are reframing Bitcoin as insurance coverage in opposition to governance danger.

- Its enchantment facilities on mounted guidelines and independence from political management.

- Bitcoin is being positioned as a hedge alongside, not as an alternative of, fiat techniques.

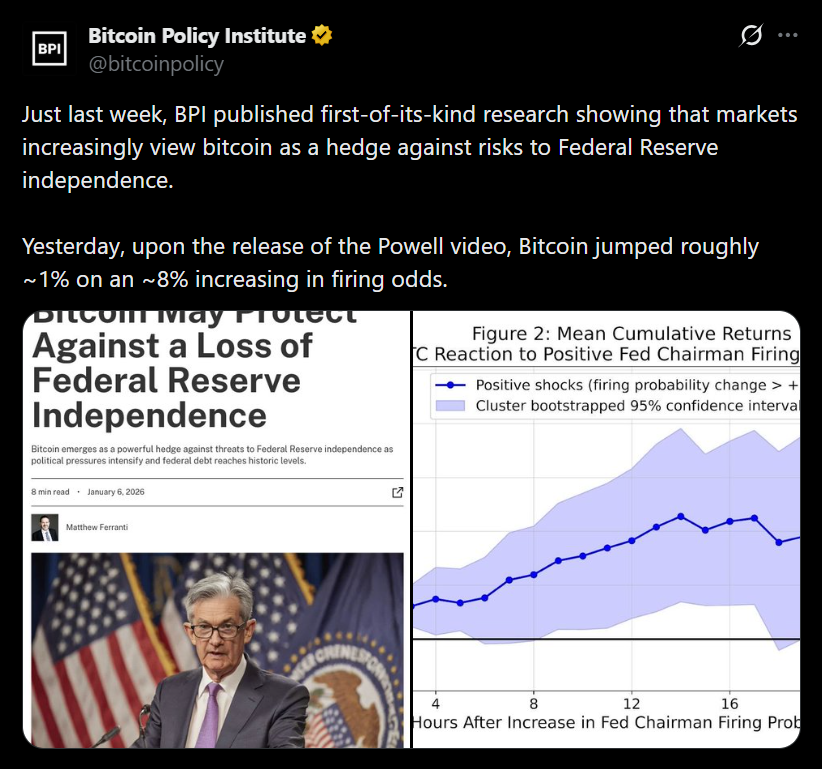

The way in which establishments discuss Bitcoin has shifted, and it’s delicate however vital. It’s not framed primarily as a high-risk development commerce or a leveraged guess on tech optimism. As an alternative, it’s more and more mentioned as insurance coverage. Not in opposition to inflation within the conventional sense, however in opposition to governance danger. When giant allocators describe Bitcoin at this time, they focus much less on upside and extra on what it isn’t — not issued by a state, not adjusted by committees, and never depending on political stability to perform.

Why Non-Sovereign Belongings Are Instantly Engaging

Establishments worth predictability, and recently that’s been in brief provide. Coverage reversals, emergency fiscal measures, regulatory uncertainty, and visual strain on central financial institution independence have pressured allocators to suppose in situations slightly than forecasts. Bitcoin matches neatly into that framework. Its financial coverage is mounted, its provide is clear, and its guidelines don’t change with management cycles. For these managing tail danger, that reliability issues greater than debates round funds or adoption curves.

A Parallel Hedge, Not a Fiat Rejection

This shift doesn’t imply establishments are abandoning fiat techniques. They nonetheless function inside them and depend on them every day. Bitcoin is more and more considered as a parallel hedge, very similar to gold sits alongside money and bonds. The distinction lies in portability, instantaneous verifiability, and the absence of sovereign strings. When political danger turns into a part of the financial equation, property with out discretionary management begin to look much less speculative and extra strategic.

Belief, Not Worth, Is the Core Driver

Bitcoin’s rising institutional enchantment isn’t actually about worth targets anymore. It’s about belief, or extra precisely, the place belief is thinning. As uncertainty round coverage, regulation, and governance continues to floor, capital seems to be for property that exist exterior these techniques. Bitcoin’s non-sovereign nature is not a slogan or philosophical stance. For a lot of establishments, it’s your entire level.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.