Be part of Our Telegram channel to remain updated on breaking information protection

Bitcoin worth broke out of a two-month consolidation to achieve a excessive of round $97,704 on Wednesday. The world’s largest cryptocurrency was up 1.7% on the day, buying and selling at $96,442 as of 1:13 a.m. EST, with the value at its strongest stage since mid-November.

The advance triggered an estimated $455.07 million in liquidations of crypto quick positions, together with about $187.1 million tied to BTC, in accordance with Coinglass.

The crypto house additionally edged up a fraction of a proportion to a $3.26 trillion market capitalization, because the CMC Crypto Concern and Greed Index climbed to 54, sustaining a impartial urge for food out there whereas buyers place.

CZ Predicts Bitcoin Value May Rally To $200K

Changpeng Zhao, Binance co-founder, has asserted that Bitcoin will attain $200,000, which he states is extra about timing than chance and the obvious guess.

That is the obvious factor on this planet to me.

(not monetary recommendation) https://t.co/iy7qg4PpJN

— CZ 🔶 BNB (@cz_binance) January 14, 2026

In an AMA, CZ famous that there are presently no indications of a peak in its worth and emphasised Bitcoin’s sturdy progress potential.

Moreover, he talked about that the U.S. Securities and Change Fee (SEC) won’t prioritize digital property in 2026 examination efforts. Subsequently, the shift is anticipated to scale back enforcement dangers and foster a extra supportive atmosphere for BTC.

This comes even because the Senate Banking Committee delayed markup of a bipartisan market construction invoice (CLARITY ACT), extending uncertainty across the laws’s timeline. The invoice was aimed toward defining regulatory jurisdiction for crypto between the SEC and Commodity Futures Buying and selling Fee (CFTC).

CZ’s Bitcoin predictions are usually not remoted. Fundstrat’s Tom Lee shares an optimistic outlook for the main cryptocurrency within the quick time period. He means that BTC might attain roughly $200K-250K, pushed by supportive insurance policies and elevated institutional funding.

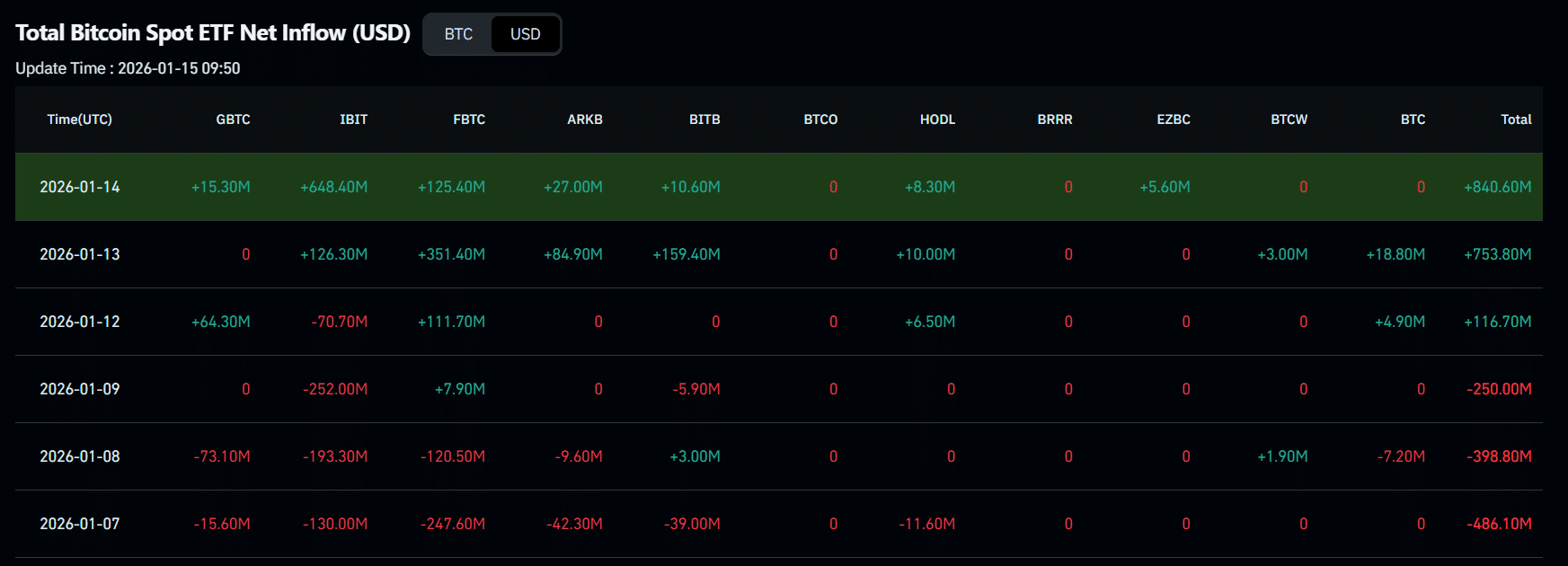

Bitcoin ETFs Attract Over $840 Million As BTC Surges

A surge in Bitcoin’s worth to above $96,000 has triggered the strongest single day of inflows for US spot exchange-traded funds (ETFs) in three months, with these merchandise including $840.6 million on January 14, in accordance with Coinglass knowledge. This can be a third consecutive day of web inflows this week.

BlackRock’s IBIT led the inflows with a $648.4 million netflow. Constancy’s FBTC adopted intently with $125.4 million netflow.

The shopping for stress boosted complete web property throughout all US spot BTC ETFs to roughly $122.9 billion, roughly 6.5% of Bitcoin’s $1.89 trillion market capitalization.

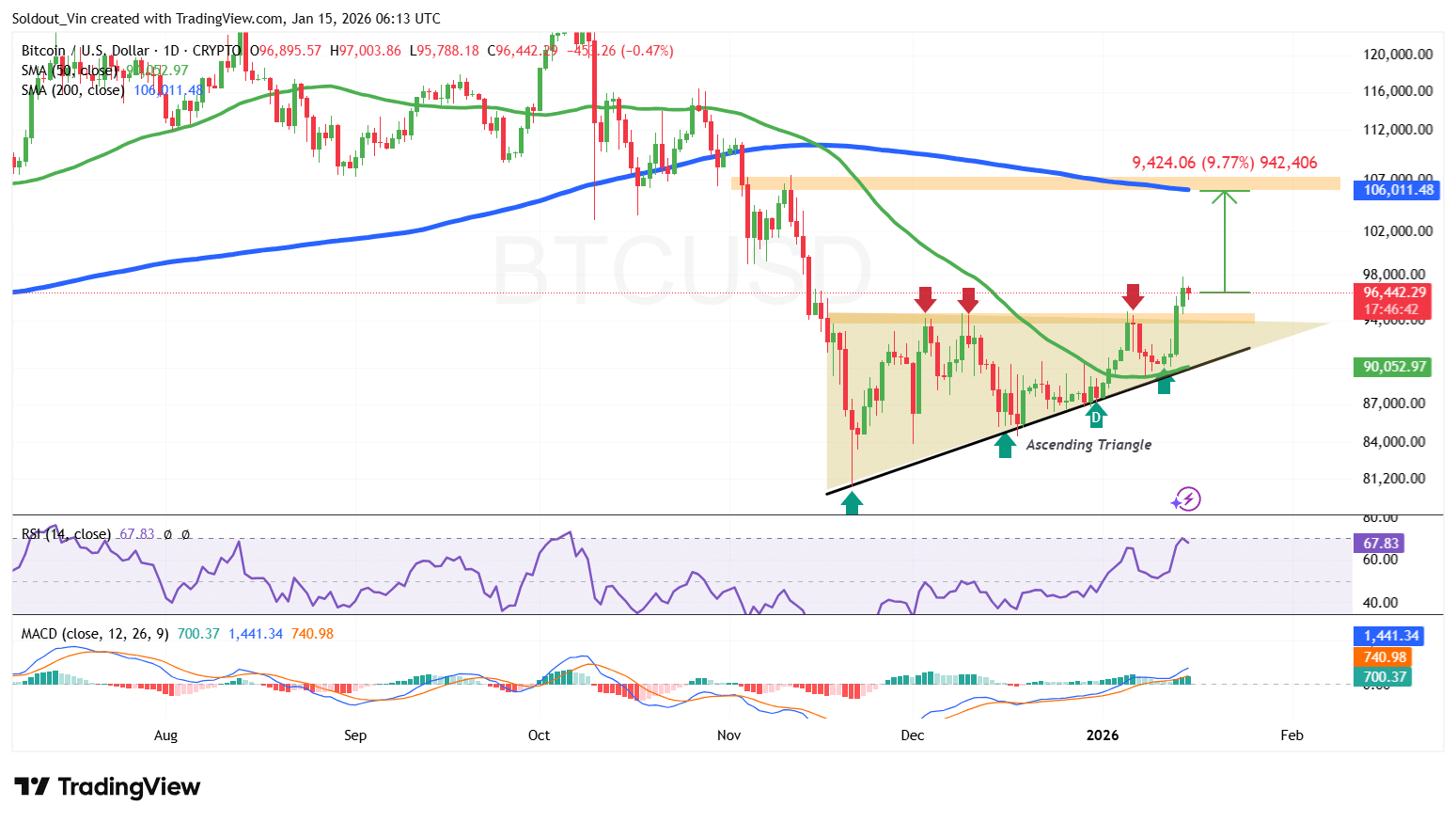

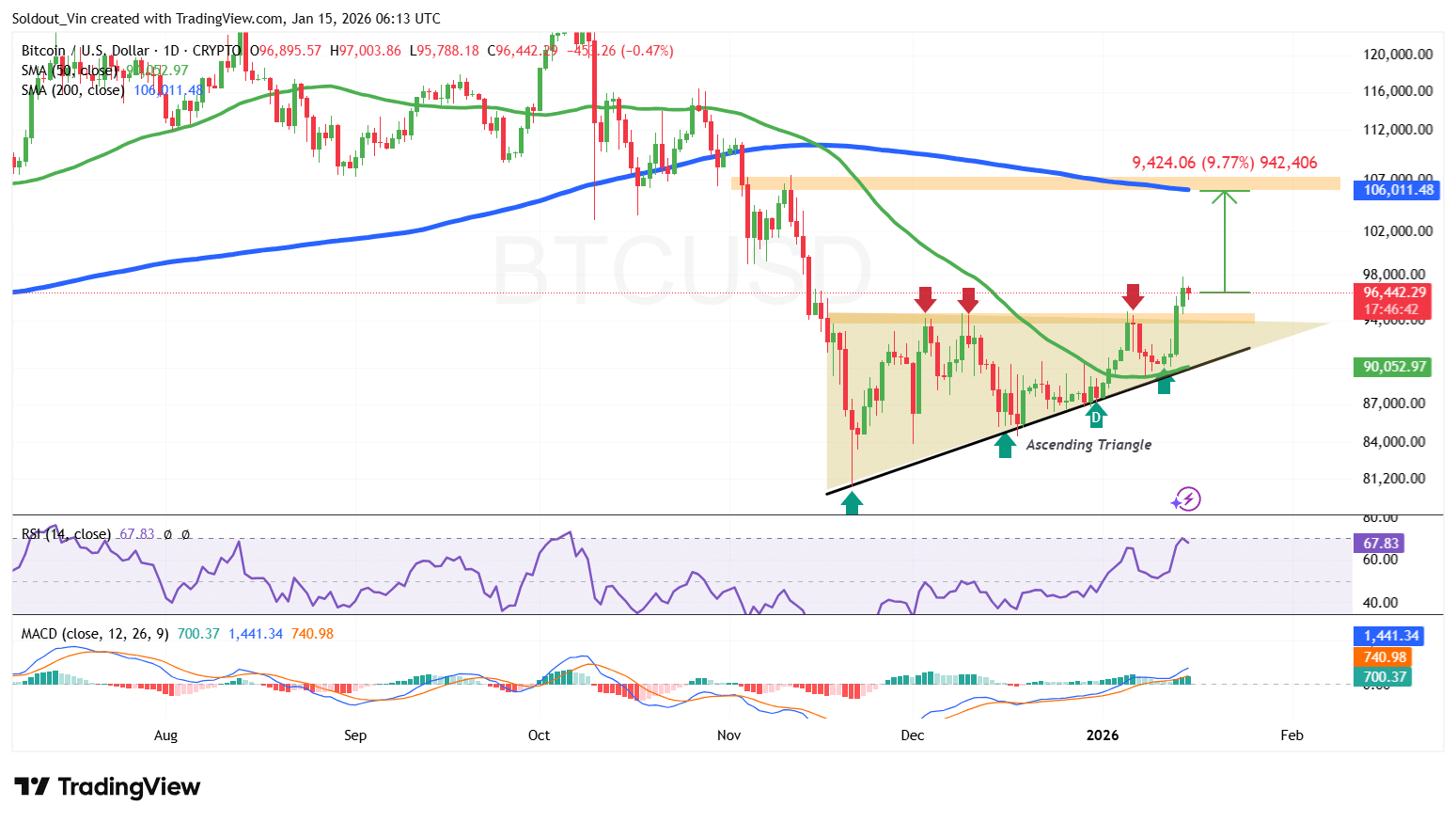

BTC Breaks Out Of An Ascending Triangle

After consolidating for 2 months inside an ascending triangle sample, the BTC worth has lately damaged out above $94,000 within the final 3 candles inside the day by day chart. Technically, this transfer is vital as a breakout above this sample usually signifies a sustained bullish rally.

By crossing the resistance space round $94,000, Bitcoin worth signaled that the value being capped in a sideways sample would possibly lastly be over.

The climb above the $90,000 space has since pushed the value of Bitcoin again above its 50-day Easy Transferring Common, signaling a bullish outlook within the quick time period.

Bitcoin’s Relative Energy Index (RSI) can also be close to the overbought area, presently at 67.83, which signifies that patrons are in management with out the value being overbought. This can be a signal that the value nonetheless has room to rally once more.

In the meantime, the Transferring Common Convergence Divergence (MACD) has additionally turned optimistic, with the blue MACD line crossing above the orange sign line.

Can the Momentum Be Sustained?

The 1-day BTC/USD chart evaluation reveals that the breakout above the triangle could possibly be sustained. If this occurs, patrons are taking a look at a 9.77% surge to the $106,011 stage inside the 200-day SMA.

Conversely, because of the 7% surge within the final week, short-term buyers should still take income, which can push the value all the way down to the $89,000 help.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection