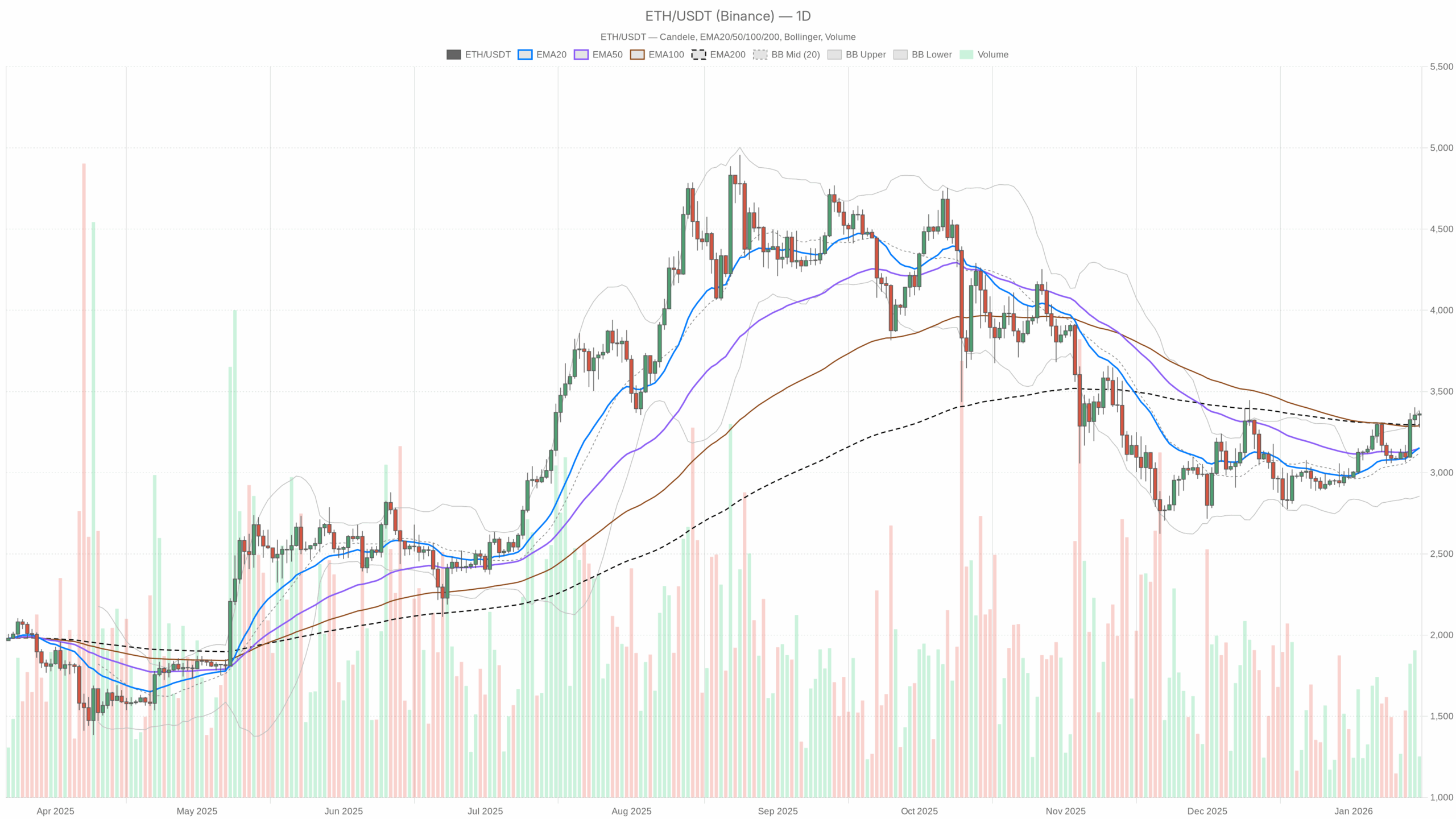

With crypto threat urge for food nonetheless constructive and BTC dominance elevated above 57%, Ethereum value is urgent into an important resistance pocket between $3,300 and $3,400.

Day by day chart: Ethereum bias is bullish, however getting prolonged

On the day by day timeframe, Ethereum value (ETHUSDT) is buying and selling at $3,362, comfortably above all its key shifting averages and close to the higher fringe of its latest volatility envelope.

Pattern construction – EMAs

– Value: $3,362

– EMA 20: $3,153.68

– EMA 50: $3,149.85

– EMA 200: $3,297.05

All three EMAs are clustered under spot, with the 20- and 50-day primarily on prime of one another and each now barely above the 200-day. This can be a constructive setup: the quick and medium pattern have flipped clearly bullish and have simply reclaimed the long-term pattern line. Furthermore, it means latest dips have been constantly purchased and the trail of least resistance continues to be up. The hole between value and the 20/50 EMAs, although, is getting vast sufficient {that a} pullback to go to these averages could be regular slightly than an indication of pattern failure.

Momentum – RSI

– RSI (14d): 66.45

Day by day RSI is pushing into the excessive 60s, slightly below textbook overbought territory. Consumers are clearly dominant, however we’re not within the stealth accumulation zone; this can be a late-phase impulse contained in the uptrend. Traditionally, RSI within the mid-to-high 60s can maintain for a while in robust markets, nevertheless it additionally marks the zone the place failed breakouts usually begin. That mentioned, upside continues to be open, however the reward-to-risk for recent, unhedged longs is much less enticing than it was every week in the past.

Pattern high quality – MACD

– MACD line: 66.52

– Sign line: 38.42

– Histogram: 28.09

MACD on the day by day is firmly optimistic with the road comfortably above the sign and a strong optimistic histogram. That confirms the pattern is not only a brief squeeze; it’s a sustained bullish leg. Nonetheless, the space between MACD and its sign is now pretty stretched, which regularly precedes momentum cooling or at the least a sideways digestion. Bulls are in management, however the simple cash section of this leg is probably going behind us.

Volatility & vary – Bollinger Bands and ATR

– Bollinger center band (20d): $3,120.95

– Higher band: $3,386.33

– Decrease band: $2,855.56

– ATR (14d): $114.83

Ethereum value is hugging the higher Bollinger Band, sitting just some {dollars} under it. That’s basic late-stage momentum habits: the pattern is wholesome, however value resides on the increased finish of its latest volatility vary. With a day by day ATR of roughly $115, the market is signalling {that a} regular one-day swing of three–4% in both path is completely on the desk. Buying and selling close to the higher band plus elevated ATR is a textbook setup for sharp intraday reversals if liquidity thins or BTC sneezes.

Brief-term ranges – day by day pivots

– Pivot level (PP): $3,339.58

– R1: $3,401.17

– S1: $3,300.42

Spot is simply above the day by day pivot, buying and selling between the pivot and R1. This can be a mildly bullish intraday posture: patrons have defended the pivot and are probing overhead resistance. The important thing micro-battlefield on the day by day is the $3,300–3,400 pocket. Holding above the pivot and turning R1 into help would maintain the upward grind intact; slipping again under $3,300 would sign that this push is shedding steam, at the least briefly.

Day by day conclusion: The principle situation on the day by day chart is bullish. Pattern, momentum, and construction all help additional upside, however the market is stretched sufficient {that a} pullback or sideways consolidation could be a wholesome reset, not a shock.

1-hour chart: bullish, however momentum is flattening

The 1-hour timeframe is the place you see the primary indicators of this leg getting somewhat drained. The pattern continues to be up, however momentum is not exploding.

Pattern construction – EMAs

– Value: $3,361.12

– EMA 20: $3,334.31

– EMA 50: $3,293.06

– EMA 200: $3,196.83

– Regime: bullish

Value is above all key intraday EMAs, with a clear staircase increased: 20 > 50 > 200 and spot above the 20. That is as easy a 1H uptrend as you’ll get. The gap from the 200 EMA is sizable, which confirms power but in addition exhibits how far we’ve got come with no correct 1H imply reversion. Consequently, short-term merchants shopping for listed here are paying a premium versus the bottom of the transfer, which will increase the danger of getting caught in a snap-back to the 50 or 200.

Momentum – RSI

– RSI (14h): 60.03

Hourly RSI is sitting round 60, a reasonable bullish studying. The robust overbought readings are gone; that is extra of a managed grind than a runaway rally. That’s constructive for pattern continuity, nevertheless it additionally says the rapid upside impulse is not as robust because it was. Bulls are nonetheless dictating path, simply with much less urgency.

Pattern high quality – MACD

– MACD line: 13.13

– Sign line: 12.91

– Histogram: 0.22

On the 1H, MACD stays barely optimistic, however the line is nearly glued to the sign and the histogram is near flat. Momentum continues to be leaning bullish, but there isn’t any robust acceleration. That is what you usually see earlier than one among two issues: both a renewed push increased if patrons step again in, or a sluggish roll-over right into a consolidation or shallow pullback.

Volatility & bands – Bollinger Bands and ATR

– Bollinger center band: $3,341.34

– Higher band: $3,392.77

– Decrease band: $3,289.91

– ATR (14h): $24.39

ETH is buying and selling barely above the mid-band on the hourly. The prior squeeze into the higher band has already cooled off, and value is now oscillating within the higher half of the band construction. With an hourly ATR round $24, intraday swings of roughly 0.7% are enterprise as common. This portrays a managed advance slightly than a blow-off transfer, nevertheless it additionally leaves room for a fast tag of both band if BTC injects volatility.

Intraday ranges – hourly pivots

– Pivot level (PP): $3,362.71

– R1: $3,364.29

– S1: $3,359.53

Value is nearly precisely on the hourly pivot cluster. R1 and S1 are compressed just some {dollars} away, signalling a slim equilibrium zone intraday. This can be a market ready for a catalyst. A clear break and maintain above the $3,365 space opens the door for an additional try on the day by day R1 area; slipping below $3,360 and holding under into the session would put the short-term focus again on help nearer to the hourly 50 EMA round $3,290.

1H conclusion: Bullish regime, however momentum is flattening and the market is buying and selling round an intraday equilibrium. ETH is in drift up or consolidate mode slightly than a recent breakout section on this timeframe.

15-minute chart: tactical execution, micro uptrend

The 15-minute chart is principally helpful for timing, not for deciding directional bias. Proper now it aligns with the upper timeframes, however it’s extra stretched.

Pattern construction – EMAs

– Value: $3,361.19

– EMA 20: $3,344.96

– EMA 50: $3,335.87

– EMA 200: $3,291.57

– Regime: bullish

Value is stacked above all 15m EMAs with a transparent optimistic alignment. The unfold between spot and the 20/50 EMAs is modest, however the distance to the 200 EMA is substantial. In follow, which means the micro-trend is unbroken, but the true worth space of this entire short-term leg is much under present value. Any sudden volatility spike can rapidly drag value again towards the 50 and even 200 EMA with out doing actual harm to the upper timeframes.

Momentum – RSI

– RSI (14, 15m): 64.33

On the 15-minute chart, RSI sits in a bullish however not excessive zone, similar to the day by day studying in character. Brief-term, patrons are nonetheless urgent their benefit after latest upticks, however they’re dancing near ranges the place native pullbacks usually emerge. It’s an intraday surroundings the place chasing inexperienced candles turns into riskier than shopping for managed dips.

Pattern high quality – MACD

– MACD line: 12.11

– Sign line: 8.91

– Histogram: 3.19

On the 15-minute chart, MACD is clearly optimistic with an honest hole above its sign and a strong optimistic histogram. This is without doubt one of the few locations the place momentum continues to be visibly increasing. Very short-term, that favors continuation increased, however keep in mind that decrease timeframes flip first. If the histogram begins contracting whereas value fails to make new highs, that will be an early warning of intraday exhaustion.

Micro-volatility & pivots

– Bollinger center band: $3,339.85

– Higher band: $3,379.78

– Decrease band: $3,299.93

– ATR (14, 15m): $11.28

– Pivot level (PP): $3,362.73

– R1: $3,364.34

– S1: $3,359.58

ETH is buying and selling slightly below the 15m pivot with bands vast sufficient to help $10–15 swings with out altering the image. ATR at $11 factors to roughly 0.3% noise per quarter-hour, which is sufficient to cease out tight intraday trades however not but an indication of panic. The clustering of the 15m and 1H pivots within the $3,360 space reinforces this area because the rapid tug-of-war stage between scalp bulls and bears.

Market context: risk-on, BTC-dominant backdrop

Past Ethereum’s personal chart, the macro crypto backdrop is constructive however not with out threat. Whole crypto market cap is round $3.36T and rising, but 24h quantity is down roughly 5%. BTC dominates at about 57.5%, with ETH sitting close to 12% of whole market cap. The setup is robust threat urge for food, however capital continues to be closely Bitcoin-centric.

The worry and greed index at 61 (Greed) confirms what the charts already indicate: the market is leaning risk-on, however we’re transitioning from discount searching into momentum chasing. In that section, Ethereum usually lags preliminary BTC impulses however then performs catch-up aggressively, which aligns with the present technical image of a powerful however barely overextended pattern.

Bullish situation for Ethereum value

From the present configuration, the dominant situation stays bullish, nevertheless it depends on the pattern staying intact throughout timeframes.

What bulls need to see

On the day by day, bulls need Ethereum value to carry above the $3,300 space, which roughly aligns with the day by day S1 at $3,300.42 and sits comfortably above the 20/50 EMAs close to $3,150. So long as ETH defends that higher-low construction, the uptrend stays clear. A sustained push by means of the day by day R1 at $3,401.17 would doubtless set off trend-followers and will ship value probing the higher Bollinger Band and past.

On intraday charts, a decisive transfer above the $3,365–3,380 pocket, the 15m and 1H R1 area overlapping with the higher intraday bands, with rising RSI and increasing MACD histogram would sign one other leg of momentum. In that case, day by day RSI can simply experience into the low-70s earlier than any important correction, and ATR would body 4–5% day by day ranges as a part of an ongoing pattern slightly than a prime.

Bullish path, in plain phrases: defend $3,300 on dips, convert $3,400 from resistance into help, and experience the pattern whereas day by day EMAs proceed to slope up beneath value.

What invalidates the bullish case?

The bullish construction begins to crack if Ethereum value breaks and closes the day under the $3,300 zone after which loses the day by day 20/50 EMAs clustered round $3,150. A day by day shut again below the 200 EMA at $3,297.05 could be the primary severe warning the present leg has topped for now.

On intraday charts, an early warning could be 1H value slipping under the 50 EMA, close to $3,293, with MACD turning damaging and RSI failing to get better above 50 on bounces. That may mark a shift from pattern with pullbacks into vary or distribution. In that surroundings, day by day MACD would doubtless begin rolling over from its elevated stage, confirming waning momentum.

Bearish situation for Ethereum value

The bearish case doesn’t dominate but, however the elements for a corrective section are in place: prolonged day by day momentum, euphoric positioning creeping in, and ETH buying and selling close to the higher finish of its volatility envelope.

What bears want

First, bears must win the $3,300–3,340 battle. A break and sustained commerce under the day by day pivot at $3,339.58, adopted by lack of S1 at $3,300.42, would sign patrons stepping again. With day by day ATR at roughly $115, as soon as that pocket offers approach, a slide into the $3,200–$3,230 space is a routine transfer, not an outlier. That zone sits nearer to the 200 EMA and would take a look at the conviction of medium-term bulls.

If promoting accelerates and ETH closes a day by day candle under the 20/50 EMAs, round $3,150, sentiment will doubtless flip from purchase the dip to attend and see. MACD would begin to compress towards its sign line; if it crosses decrease whereas RSI breaks below 50, the narrative shifts decisively from trending market to corrective market on the day by day timeframe.

On decrease timeframes, the primary tactical sign for bears could be successive failures on the $3,365–3,400 space with 15m and 1H MACD diverging, that means value making comparable or decrease highs whereas MACD and RSI roll over. That sample usually results in a quick imply reversion into the 1H 50 EMA and even the 200 EMA, successfully flushing late longs with out essentially ending the higher-timeframe pattern.

Bearish path, in plain phrases: reject $3,365–3,400, lose $3,300, then stress the $3,150–$3,200 help confluence. If these ranges fold on a closing foundation, bears achieve real management of the tape.

What invalidates the bearish case?

The near-term bearish situation is invalidated if Ethereum value can consolidate above $3,400, turning that area right into a secure flooring slightly than a ceiling. If value can repeatedly take a look at increased ranges with out dragging RSI again under 50 on the day by day and whereas MACD stays comfortably optimistic, any dips usually tend to be routine pullbacks inside a seamless uptrend, not the beginning of a broader reversal.

How to consider positioning from right here

Ethereum is in a bullish section on the day by day chart, supported by an uptrending construction and constructive macro crypto situations. On the identical time, it’s buying and selling near the higher fringe of its latest vary with stretched day by day momentum and a market sentiment profile tilted towards greed. That blend often favors positioning that respects the pattern however is trustworthy about draw back threat.

For directional merchants, the bottom line is timeframe self-discipline: the day by day sign continues to be up, however the 1H and 15m present a maturing leg slightly than a recent breakout. This argues in opposition to aggressive new longs at market except you might be comfy sitting by means of a possible pullback towards the day by day EMAs. In sensible phrases, it’s extra rational to give attention to how ETH behaves round $3,300 help and $3,400 resistance than to anchor on a particular value goal.

Volatility is elevated however not excessive: a $100+ day by day vary is regular proper now. Which means each upside and draw back strikes will be sharp sufficient to set off emotional selections if measurement and leverage aren’t calibrated. Tight stops in noisy intraday zones like $3,360 can get harvested simply, whereas very vast stops can flip a tactical commerce into an unintended swing place.

The trustworthy learn: Ethereum value is bullish till it isn’t, however the odds of a shakeout or sideways digestion are meaningfully increased now than they had been earlier within the leg. Being conscious of the important thing inflection ranges, particularly $3,300 help, $3,400 resistance, and $3,150–$3,200 as deeper help, and respecting the present volatility regime issues greater than making an attempt to nail the subsequent $50 transfer.

Buying and selling Instruments

If you wish to monitor markets with skilled charting instruments and real-time knowledge, you’ll be able to open an account on Investing utilizing our companion hyperlink:

Open your Investing.com account

This part accommodates a sponsored affiliate hyperlink. We could earn a fee at no extra price to you.

Disclaimer: This text is a technical and market-structure evaluation, not funding recommendation. Markets are risky and unpredictable; at all times do your personal analysis, contemplate your threat tolerance, and by no means rely solely on a single evaluation or indicator when making buying and selling selections.