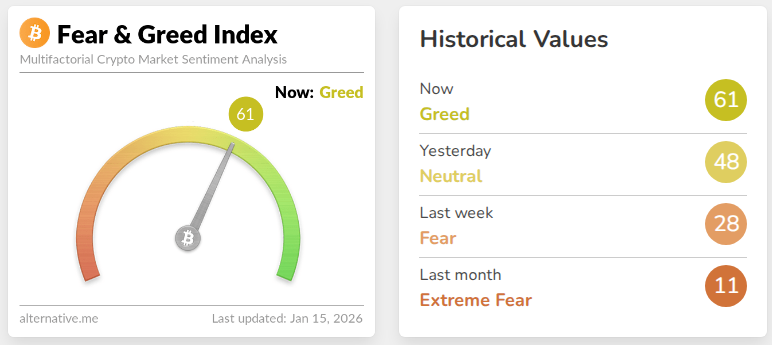

In line with the Crypto Worry & Greed Index, investor temper has swung again towards optimism, registering a rating of 61 on Thursday. That’s the first time the gauge has moved into the “greed” zone for the reason that massive market fallout on Oct. 11, when roughly $19 billion in liquidations drove many merchants from altcoins. The index had climbed to 48 only a day earlier, transferring out of “impartial” and signaling a fast change in sentiment.

Crypto Worry And Greed Shifts

The index combines a number of alerts — value strikes, buying and selling exercise, momentum, Google search curiosity and social media chatter — to provide a single studying. Based mostly on reviews, the measure fell into low double digits a number of occasions throughout November and December after the October sell-off. A rating of 61 doesn’t indicate euphoria, nevertheless it does present rising confidence amongst merchants after weeks of tension and persistence being examined.

Bitcoin Value Rebounds

Bitcoin’s value has been transferring in keeping with the enhancing temper. Up to now seven days, Bitcoin rose from $89,750 to a two-month excessive of $97,720 on Wednesday, in keeping with knowledge from CoinMarketCap. That degree was final seen on Nov. 14, when the market was nonetheless struggling and sentiment readings have been weak whilst costs briefly touched comparable highs. Market watchers say the current rally has helped raise dealer confidence and is without doubt one of the important causes the index improved so quick.

Retail Exit And Trade Provide

In line with market intelligence agency Santiment, there was a web drop of 47,244 Bitcoin holders over a three-day stretch. Experiences have disclosed that many small buyers left their positions, a response blamed on FUD and impatience. On the similar time, the quantity of Bitcoin held on exchanges fell to a seven-month low of 1.18 million BTC. Much less provide sitting on alternate platforms tends to decrease the quick threat of a giant, sudden sell-off.

BTCUSD buying and selling at $96,567 on the 24-hour chart: TradingView

What This Means For Merchants

Merchants use sentiment instruments as one enter amongst many when deciding whether or not to purchase, promote or wait. A return to “greed” suggests extra individuals are prepared to purchase, which might push costs larger if shopping for stress continues. Alternatively, sentiment can flip shortly; a pointy transfer again down would probably make some merchants nervous once more. Analysts level out {that a} shrinking pool of retail members can go away the market within the arms of extra dedicated holders, which regularly helps steadier value motion.

From Anxiousness To Optimism

Based mostly on reviews and present readings, the market has shifted from nervousness towards a extra upbeat temper, backed by Bitcoin’s current good points and decrease alternate balances. That mixture is seen by many former skeptics as a more healthy setup than the panic-filled buying and selling seen after the October liquidations. The image is cautiously optimistic: optimism is rising, however the swings that outline crypto markets haven’t disappeared.

Featured picture from Unsplash, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.