Russia is making ready a transition of their crypto market laws, with a brand new draft invoice anticipated to achieve the State Duma throughout the spring 2026 parliamentary session.

The proposal, led by Monetary Markets Committee chairman Anatoly Aksakov, would take away digital property from the nation’s “particular monetary regulation” class and permit wider participation in crypto markets. Whereas the transfer alerts broader acceptance of crypto in on a regular basis finance, it additionally introduces clear danger limits.

If authorized, the laws would characterize one in all Russia’s most vital coverage modifications relating to digital property in recent times, reshaping each home buying and selling and cross-border cryptocurrency use.

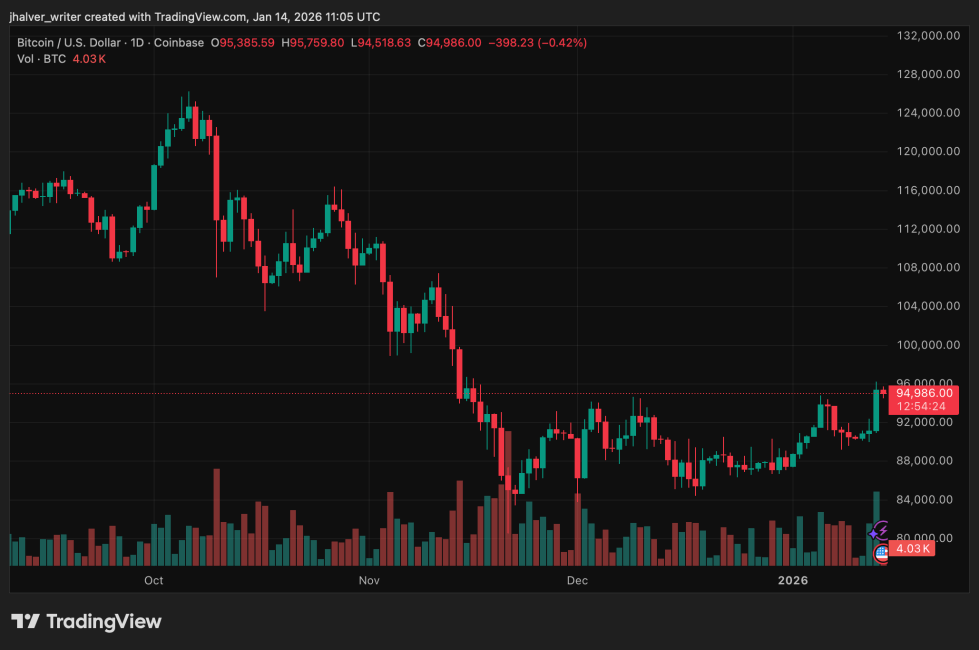

BTC's value developments to the upside on the each day chart. Supply: BTCUSD on Tradingview

Retail Entry Will get Clear Funding Limits

Below the draft invoice, non-qualified buyers, those that don’t meet skilled or institutional requirements, can be allowed to purchase cryptocurrencies value as much as 300,000 rubles (about $3,800). The cap is designed to mitigate monetary danger for on a regular basis customers whereas nonetheless offering them with entry to the market.

Certified {and professional} contributors, together with monetary corporations, wouldn’t face related restrictions. This two-tier system displays the federal government’s method to placing a steadiness between market entry and investor safety.

Regulators are additionally contemplating a risk-awareness take a look at for retail contributors. The Financial institution of Russia beforehand proposed that non-qualified buyers endure a fundamental evaluation earlier than buying and selling digital property, making certain they perceive the potential volatility and related monetary dangers.

Equally, the central financial institution has reaffirmed its opposition to nameless and privacy-focused cryptocurrencies. These property would stay restricted underneath the brand new framework to keep up transparency and regulatory oversight.

Cross-Border Funds and Regulatory Implications

Past home buying and selling, the invoice might develop the usage of crypto for worldwide settlements. Aksakov has acknowledged that the framework could allow Russian-issued digital tokens for use in international markets, doubtlessly facilitating cross-border funds.

This aligns with Russia’s earlier resolution to legalize cryptocurrency for sure worldwide transactions, following Western sanctions that restricted entry to conventional banking techniques. Digital property are more and more considered as a substitute software for commerce and monetary transfers the place typical channels are restricted.

Officers have additionally mentioned recognizing crypto mining as an export-related exercise, given its affect on international foreign money inflows regardless of the dearth of bodily cross-border motion.

What It Means for Traders and the Market

For retail buyers, the overhaul means regulated entry to crypto inside outlined limits. The 300,000-ruble cap and potential testing necessities purpose to scale back systemic and private monetary danger whereas nonetheless permitting participation in digital asset markets.

For the broader market, the change alerts a shift towards integrating cryptocurrency into normal monetary techniques, quite than treating it as a distinct segment or experimental asset class.

Russia can be advancing its digital ruble venture, with a full rollout throughout state monetary techniques anticipated by September 2026. Collectively, these developments counsel a wider push towards modernizing the nation’s digital monetary infrastructure.

Cowl picture from ChatGPT, BTCUSD chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.