Be part of Our Telegram channel to remain updated on breaking information protection

Bitcoin value, after hitting resistance above $97,000, has cooled to commerce barely above $95,500. BTC is buying and selling at $95,699 as of two:01 a.m. EST, with buying and selling quantity down 16% to $55.8 billion, signaling a droop in exercise as the worth pulled again.

The drop comes amid a decline in total market capitalization to $3.3 trillion, with BNB being the one top-5 asset to register a optimistic achieve within the day.

The drop comes even because the US Senate is about to restart the BTC and crypto market construction hearings, and information reveals that Iranians elevated BTC withdrawals amid the continued political disaster.

Senate Banking Committee Lawmakers Say Crypto Invoice Is Nearer

Regardless of its postponement, US lawmakers struck an optimistic tone on crypto laws as talks superior. Posts shared on the social media platform X present that negotiations are advancing towards consensus on market construction guidelines, signaling confidence that bipartisan laws to assist the digital asset business is inside attain.

As Senate Banking Committee Chairman Tim Scott continues main negotiations amongst committee members, the White Home, and business stakeholders on crypto market construction laws, Senator Cynthia Lummis acknowledged.

“Due to Chairman Scott’s management, we’re nearer than ever to giving the digital asset business the readability it deserves. Everybody continues to be on the negotiating desk, & I look ahead to partnering with him to ship a bipartisan invoice the business & America could be pleased with.”

I’ve spoken with leaders throughout the crypto business, the monetary sector, and my Democratic and Republican colleagues, and everybody stays on the desk working in good religion.

As we take a short pause earlier than shifting to a markup, this market construction invoice displays months of…

— Senator Tim Scott (@SenatorTimScott) January 15, 2026

In the meantime, Senator Invoice Hagerty stated he was assured {that a} consensus product could be reached in brief order on Thursday.

I applaud Chairman @SenatorTimScott for his management, in addition to @SenLummis and the White Home, for working day and night time with all of the members of the Banking Committee on the crypto market construction laws. I’m assured we’ll get to a consensus product in brief order.… https://t.co/YJshwUjnd1

— Senator Invoice Hagerty (@SenatorHagerty) January 15, 2026

If the invoice may go, it might usher in probably the most consequential regulatory restructuring of US monetary markets. The principles set will maintain innovation onshore and strengthen long-term financial management.

Iran Turns To Crypto Amid Disaster

In the meantime, in response to Chainalysis information, crypto utilization in Iran has spiked amid the nation’s mass protests, with Iranians withdrawing BTC to protect worth amid instability.

Chainalysis stated in a report on Thursday that Iran’s crypto ecosystem reached $7.78 billion in 2025, accelerating amid the continued unrest and a considerable improve in each day crypto transfers.

🚨 IRAN: $7.8B CRYPTO SURGE!

In keeping with a Chainalysis report, crypto exercise in Iran has reached $7.8 Billion amid an financial disaster and protests.

• Individuals are utilizing Bitcoin to hedge towards 40-50% inflation.

• The IRGC controls 50% of inflows to bypass worldwide… pic.twitter.com/fJ7bNQIIcX

— Crypto Aman (@cryptoamanclub) January 16, 2026

In keeping with the report, BTC’s position within the ongoing disaster is not only confined to capital preservation. Bitcoin has additionally grow to be a component of resistance, offering liquidity and optionality in an more and more restricted financial surroundings.

Will Bitcoin Worth Surge To $100K In 2026?

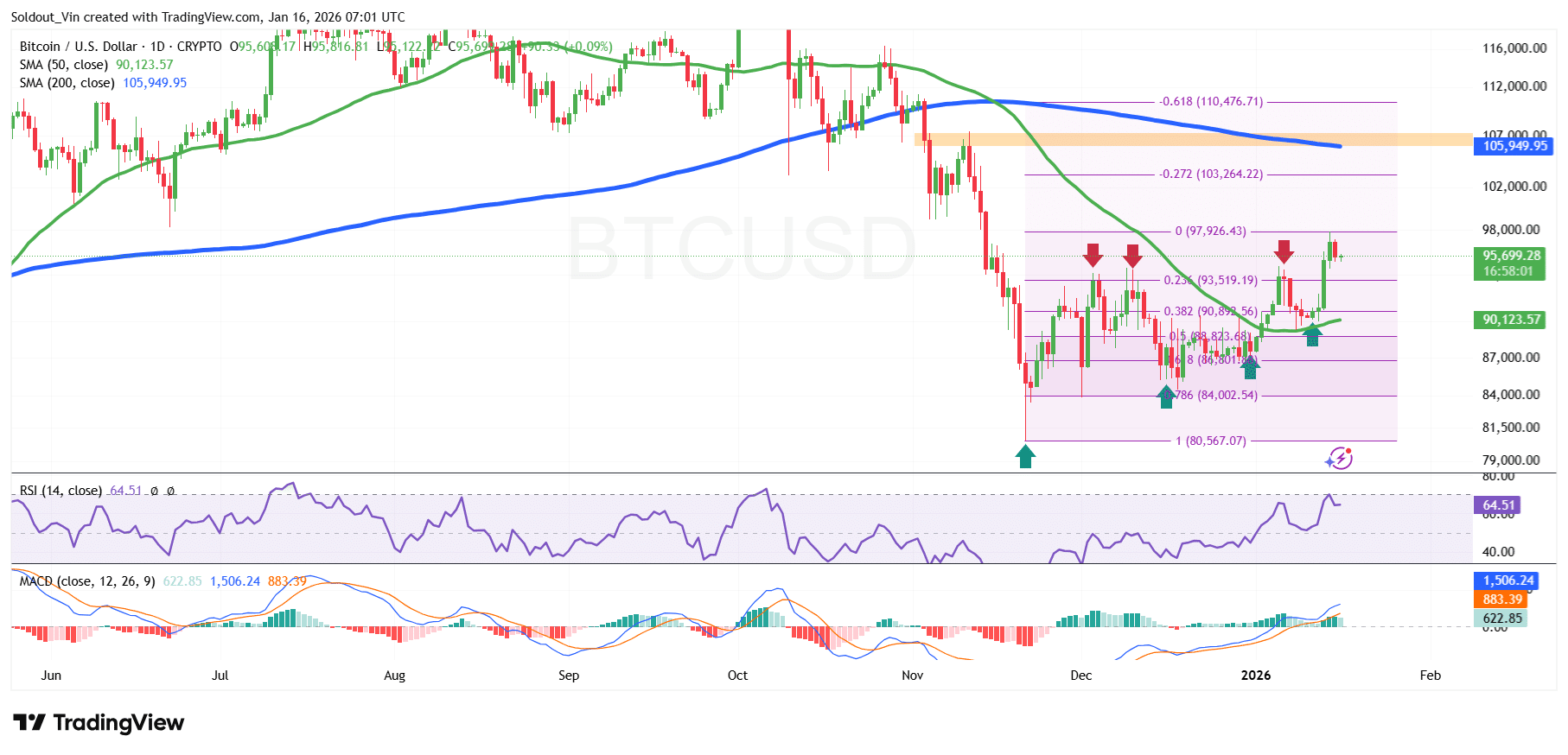

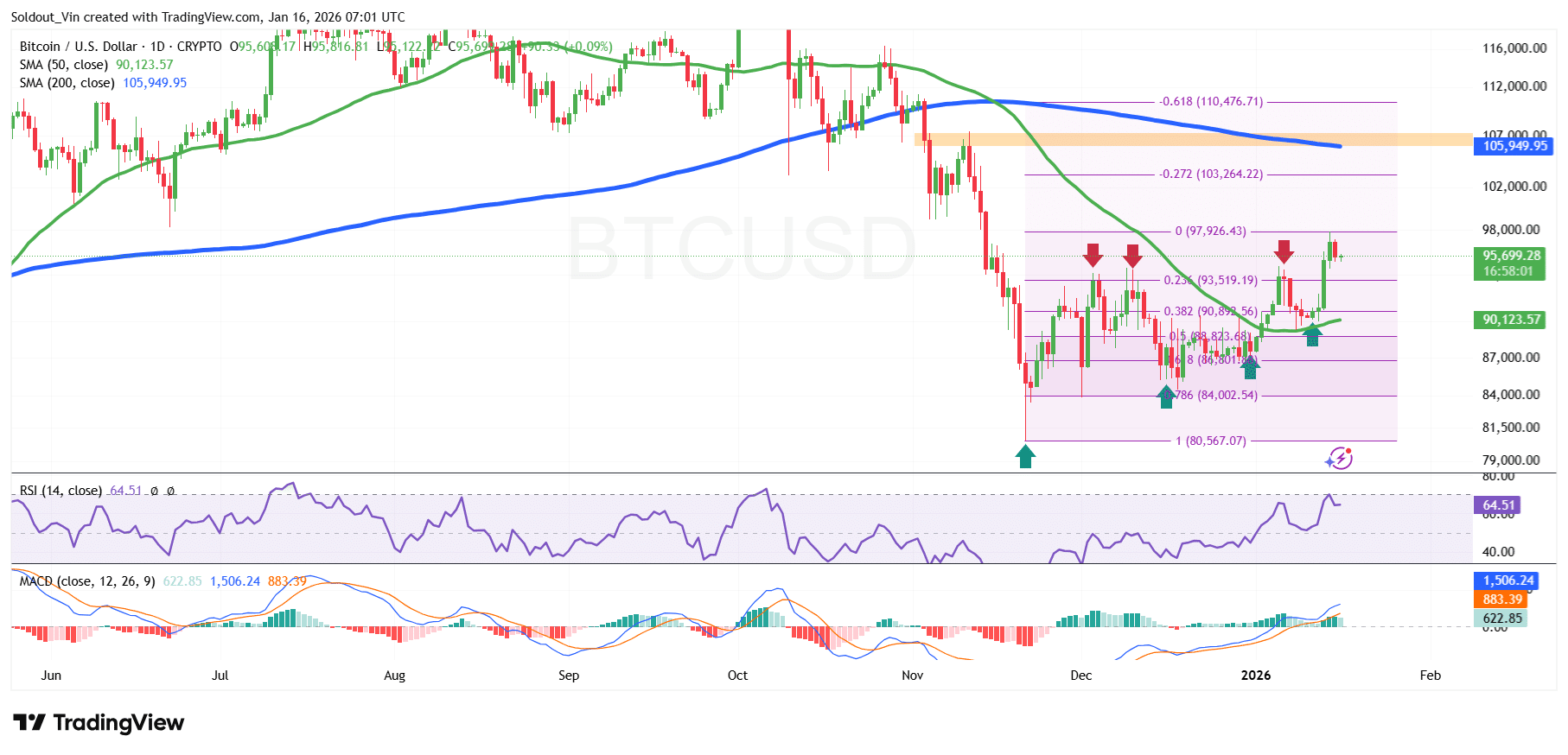

Bitcoin value is holding robust above the $93,500 assist and the 0.236 Fibonacci Retracement degree. The present soar above this space was pushed by the availability zone round $89,000.

In consequence, BTC has jumped above the 50-day Easy Shifting Common (SMA) at $90,123, which helps the general bullish outlook. In the meantime, the 200-day SMA acts because the overhead resistance at $105,949.

Bitcoin’s Relative Power Index (RSI) can be close to the overbought area, at the moment at 64.51, which signifies that patrons are in management with out the worth being overbought. This can be a signal that the worth nonetheless has room to rally once more.

In the meantime, the Shifting Common Convergence Divergence (MACD) has additionally turned optimistic, with the blue MACD line crossing above the orange sign line.

The 1-day BTC/USD chart evaluation reveals that Bitcoin value may surge above the 0 Fibonacci degree ($97,926), with the following resistance and goal on the -0.271 Fib zone at $103,264.

So as to add to the bullish case, over 17,700 BTC tokens have been amassed by exchange-traded funds (ETFs) up to now this week, which alerts a sustained buying and selling exercise.

17,700 Bitcoin $BTC.

That’s roughly $1.68 billion amassed by ETFs up to now this week! pic.twitter.com/Hs5E9feATg

— Ali Charts (@alicharts) January 16, 2026

Conversely, on account of the 5.4% surge within the final week, short-term buyers should still take income, which can push the worth all the way down to the $89,000 assist.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection