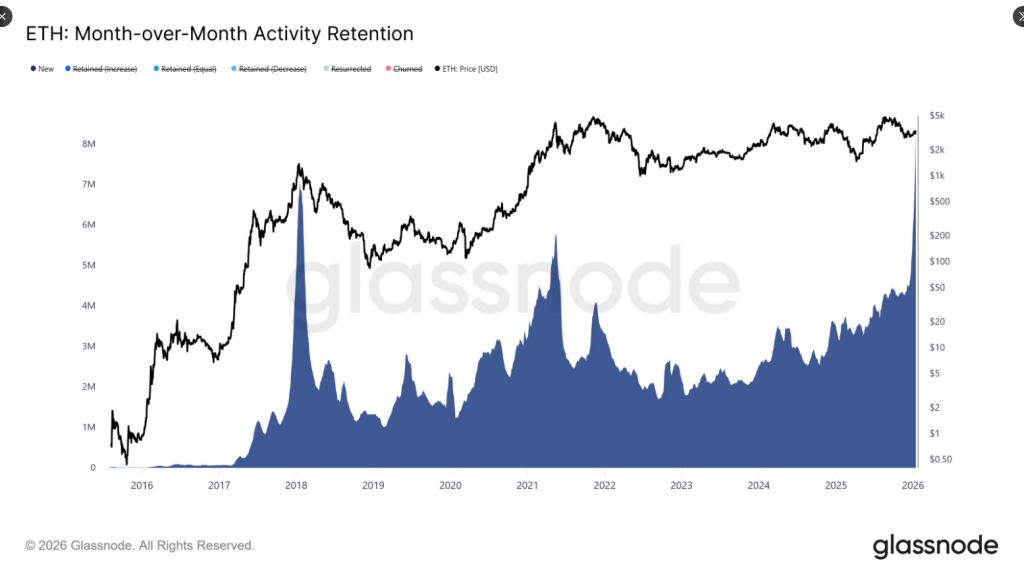

Ethereum’s on-chain exercise has jumped sharply, pushed by a wave of first-time customers and heavier transaction movement throughout the community. In response to Glassnode, new exercise retention roughly doubled this month — rising from about 4 million to round 8 million addresses — a transfer that factors to a contemporary cohort of wallets interacting with Ethereum slightly than simply repeat customers.

Associated Studying

Surge In New Customers

Every day transactions hit a document excessive of two.8 million on Thursday, a determine that’s up 125% from the identical interval final 12 months. Based mostly on experiences from Etherscan, lively addresses have greater than doubled year-over-year, shifting from roughly 410,000 accounts to over 1 million as of Jan. 15. These numbers recommend actual, broad-based engagement is growing, not merely short-lived spikes.

Ethereum’s Month-over-Month Exercise Retention reveals a pointy spike within the “New” cohort, indicating a surge in first-time interacting addresses over the previous 30 days.

This displays a notable inflow of latest wallets partaking with the Ethereum community, slightly than exercise being… pic.twitter.com/h8Zw7hXOSX— glassnode (@glassnode) January 15, 2026

Transaction Growth And L2 Results

Observers hyperlink the transaction development partially to rising stablecoin exercise and decrease charges. Stories have disclosed that many transfers are migrating execution to Layer 2 networks whereas settlement stays on Ethereum’s important chain, which retains finality safe and helps push down gasoline prices. Staking has additionally climbed, reaching practically 36 million ETH, including one other layer to the community’s tightening provide dynamics.

On the similar time, market conduct stays cautious. Energy in US equities has helped stabilize crypto costs, but cash flowing into Ethereum appears selective slightly than broad.

Plainly positioning is slightly conservative; merchants choose ready for extra correct indicators concerning ETH costs as an alternative of trying to foretell a breakout. In flip, ETH is consolidating round a correction, however there’s not sufficient momentum-driven shopping for.

Analyst Views & Value Motion

There have been additionally those that cited optimism primarily based on enhancements to on-chain fundamentals. For example, LVRG Analysis reported that the growing variety of transactions and staking actions inspired a optimistic community.

Some merchants argue the compression in value motion may precede a breakout. Ether traded close to a two-month excessive of $3,400 on Wednesday and was round $3,300 in early buying and selling on Friday, reflecting the tug of battle between renewed demand and protracted warning.

Regardless of the stronger metrics, technical hurdles stay. Stories and up to date evaluation recommend the market is in a restore section, not a confirmed uptrend.

Overhead provide nonetheless constrains sustained advances, and lots of market members wish to see ETH reclaim key long-term resistance ranges, such because the 200-day EMA, earlier than committing large-scale capital.

That explains why short-term merchants function inside an outlined vary whereas longer-term gamers maintain again.

Associated Studying

What This Means For Merchants And Traders

Community well being has improved materially — extra customers, extra transactions, and better staking — however value motion has not but matched these positive factors.

Based mostly on the information offered, cautious optimism is cheap. Merchants might discover likelihood to commerce the vary, whereas buyers searching for conviction ought to look ahead to cleaner technical affirmation earlier than assuming a sustained rally.

Featured picture from Blockzeit/EthBurn, chart from TradingView