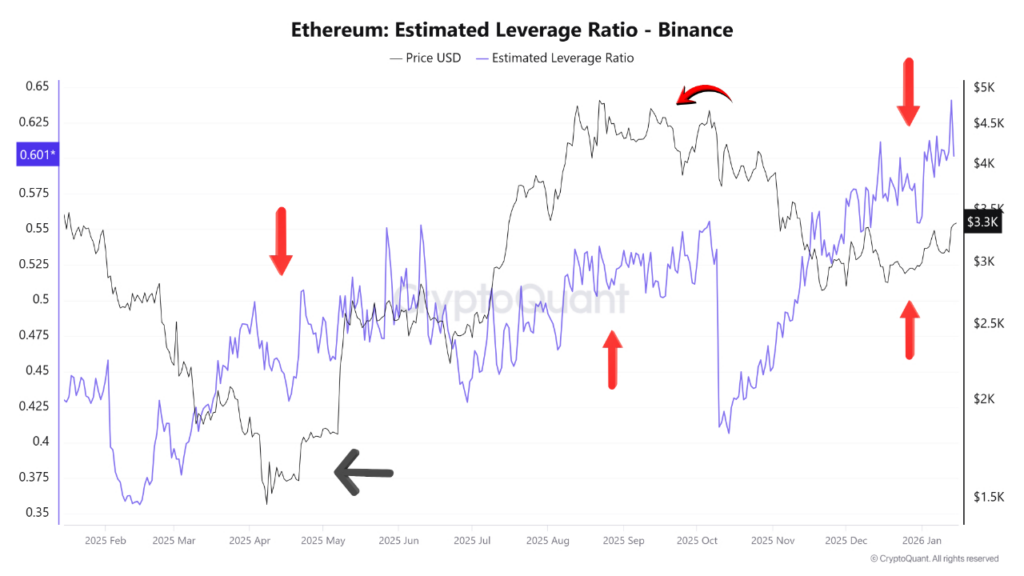

- Rising leverage on Binance has repeatedly preceded quick dips and powerful ETH rallies.

- Present leverage stays elevated, signaling persistent threat urge for food.

- A pullback towards the $3,050–$3,170 zone might arrange the following upside transfer.

Ethereum’s value motion is probably not achieved testing merchants simply but. Crypto analyst Pelin Ay has highlighted a recurring construction in ETH’s leverage dynamics that has performed out a number of instances earlier than. When leverage on Binance rises sharply forward of value, it usually results in a quick draw back wick that flushes out overleveraged lengthy positions. What tends to observe is a powerful upside response, as soon as extra threat is cleared from the system.

A Sample That Repeated All through 2025

This leverage-driven sequence appeared a number of instances final 12 months, notably in February, April, September, and November. An analogous setup additionally unfolded in October, when a sudden spike in leverage triggered a fast dump earlier than the broader uptrend resumed. In every case, leverage growth created fragility, and value wanted a brief reset earlier than transferring larger once more.

Proper now, ETH’s estimated leverage ratio on Binance sits close to 0.60, which is comparatively elevated. What stands out is that leverage hasn’t meaningfully declined regardless of current value features. That indicators persistent threat urge for food amongst merchants. Traditionally, pullbacks from these leverage ranges have preceded rallies within the 10% to 25% vary, suggesting Ether should still be organising for upside after one remaining liquidity sweep.

Spot Holder Habits Tells a Completely different Story

Whereas leverage stays elevated, on-chain knowledge paints a extra cautious image amongst spot holders. Glassnode analyst Sean Rose famous that regardless that Ether has outperformed Bitcoin for the reason that January lows, ETH’s spent-output revenue ratio stays under 1. In easy phrases, realized losses throughout the community nonetheless outweigh realized income. That contrasts with Bitcoin, the place holder conviction seems stronger, and suggests ETH traders could also be faster to promote into energy.

Why a Quick-Time period Dip Nonetheless Seems Probably

Ether not too long ago printed its highest every day shut since November 12, 2025, settling round $3,324. A 25% rally from that degree would push ETH above $4,100, however the near-term likelihood of a pullback stays elevated. On the every day chart, ETH fashioned an order block between roughly $3,050 and $3,170 in the course of the newest impulse transfer.

That zone aligns with the purpose of management on the Seen Vary Quantity Profile, an space the place essentially the most buying and selling quantity has occurred since September 2025. Costs usually revisit these areas because the market seeks truthful worth, particularly when leverage is stretched.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.