At this time is Friday, Jan. 16, and the crypto market simply gave us three main setups going into the weekend: XRP noticed a 1.21% provide dip as a result of using ETF, Shiba Inu (SHIB) triggered a golden cross with 23% upside to the 200-day common and Cardano simply nailed a legendary cup-and-handle formation with 28% rally potential.

TL;DR

- $1.51 billion value of XRP now parked inside U.S. ETFs — 1.21% of provide off the desk.

- Shiba Inu (SHIB) golden cross between 23 and 50-day MAs targets $0.00001044, or 23% upside.

- Cardano (ADA) varieties traditional breakout sample, units sights on $0.517 if $0.423 neckline is cleared.

XRP surprised with $1.5 billion minimize from circulation

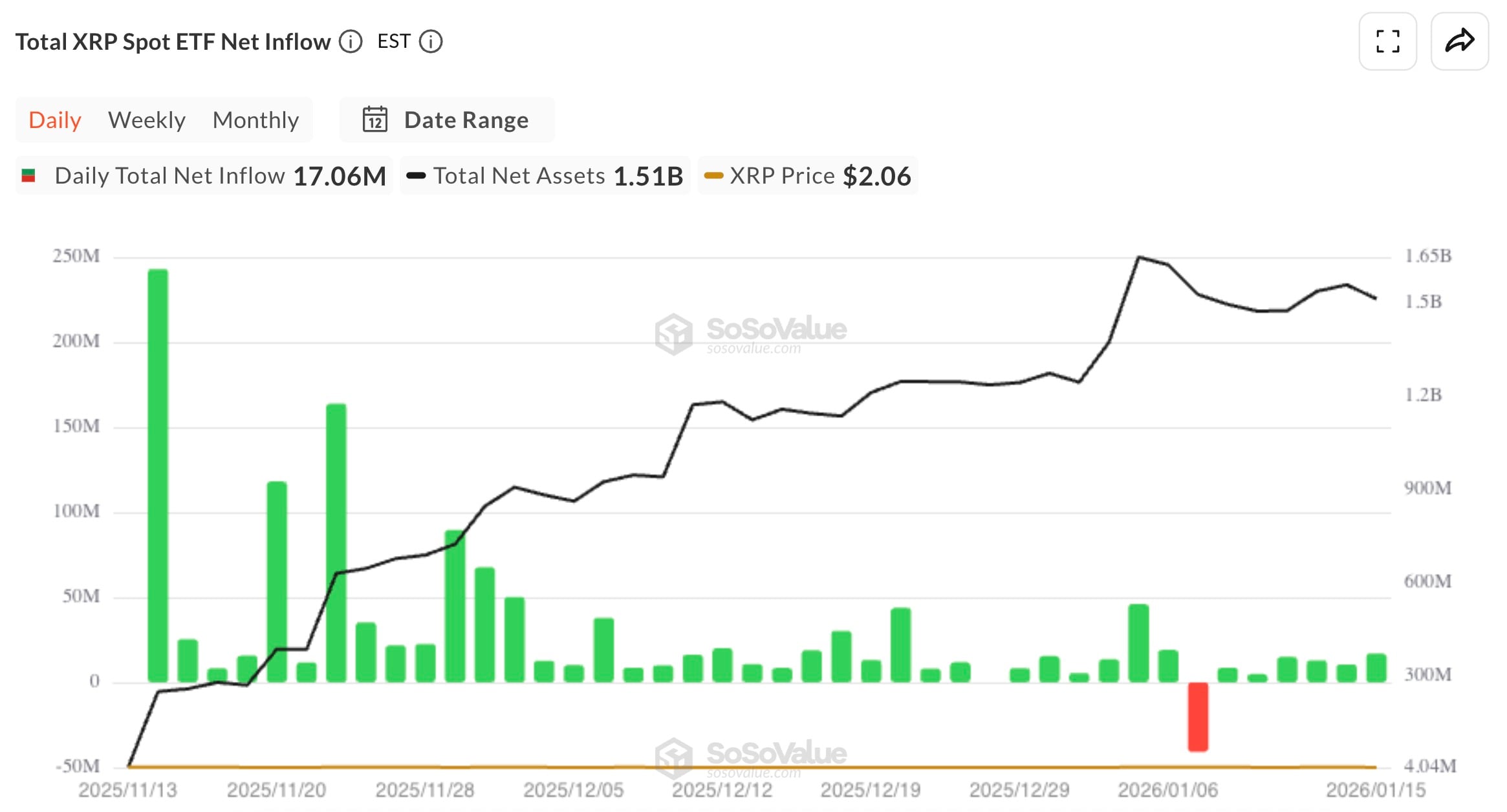

XRP simply hit a giant milestone that not many individuals are speaking about, however many will likely be quickly: as of Jan. 15, $1.51 billion in XRP is now locked inside U.S. spot ETFs. That’s 1.21% of XRP’s complete provide, wrapped and brought out of the buying and selling pool.

This isn’t a burn, although. These tokens are usually not gone, however they’re principally out of sight for now. They’re passive and never feeding volatility. That’s the structural change that nobody is pricing in for XRP, because it appears by trying on the TradingView chart.

After cooling barely in early January, inflows surged once more this week, including $55.71 million throughout XRPC (Canary), XRPZ (Franklin) and GXRP (Grayscale). This newest push brings the overall inflows of ETFs to $1.27 billion, with most of it now transformed into XRP and held in custody. This makes XRP the third most gathered altcoin by ETF quantity, behind solely BTC and ETH.

Key tickers like XRPZ and GXRP every added over $3 million in each day influx, whereas Bitwise’s XRP product leads with $7.16 million in new buys. In the meantime, $659,000 flowed out of XRPC (Canary) — the one detrimental print of the day.

With this stage of demand, the value construction is exhibiting indicators of anchoring close to the ETF Internet Asset Values, at present orbiting $2.01-$2.07, per SoSoValue. XRP is at present holding close to $2.10 after a surge in early January, and the following transfer will rely on whether or not patrons can push the value again as much as $2.32, which is the 200-day shifting common.

If inflows sustain and Q1 ETF demand hits $2 billion, XRP would possibly enter a brand new section: low-volatility institutional conduct. Assume much less cryptocurrency, extra commodity.

Shiba Inu (SHIB) lastly delivers golden cross: Prepare for 23% rally

Shiba Inu simply did one thing it had not carried out since November: it closed above its 50-day common. And extra importantly, it confirmed a golden cross between the 23-day and 50-day shifting averages — a setup that targets the 200-day shifting common at $0.00001044, precisely 23% above the present value.

That is greater than only a technical factor; the favored meme coin is near overtaking a bunch of so-called utility cash within the CoinMarketCap rating. Its present valuation of $4.98 billion is simply $100-200 million away from flipping Hedera (HBAR), Litecoin (LTC) and even stablecoin Dai (DAI).

If issues maintain going like this for the Shiba Inu coin, it would even go Avalanche (AVAX) at $5.92 billion.

Momentum will not be assured, however it’s rising, as the value construction has improved rather a lot. SHIB has reclaimed its 50-day curve and is sitting slightly below $0.00000900 in the intervening time, with the set off zone at $0.0000095. As soon as it’s breached, the repricing may occur quick — identical to it did in March 2024, when an analogous formation led to a 39% transfer in simply two weeks.

The golden cross is uncommon on SHIB as a result of it’s fairly risky, however when it occurs, SHIB typically jumps up within the ranks shortly. The subsequent few periods will present if it is a fakeout or the beginning of SHIB’s Q1 leaderboard breakout.

Is Cardano subsequent silver? Legendary bull sample says sure

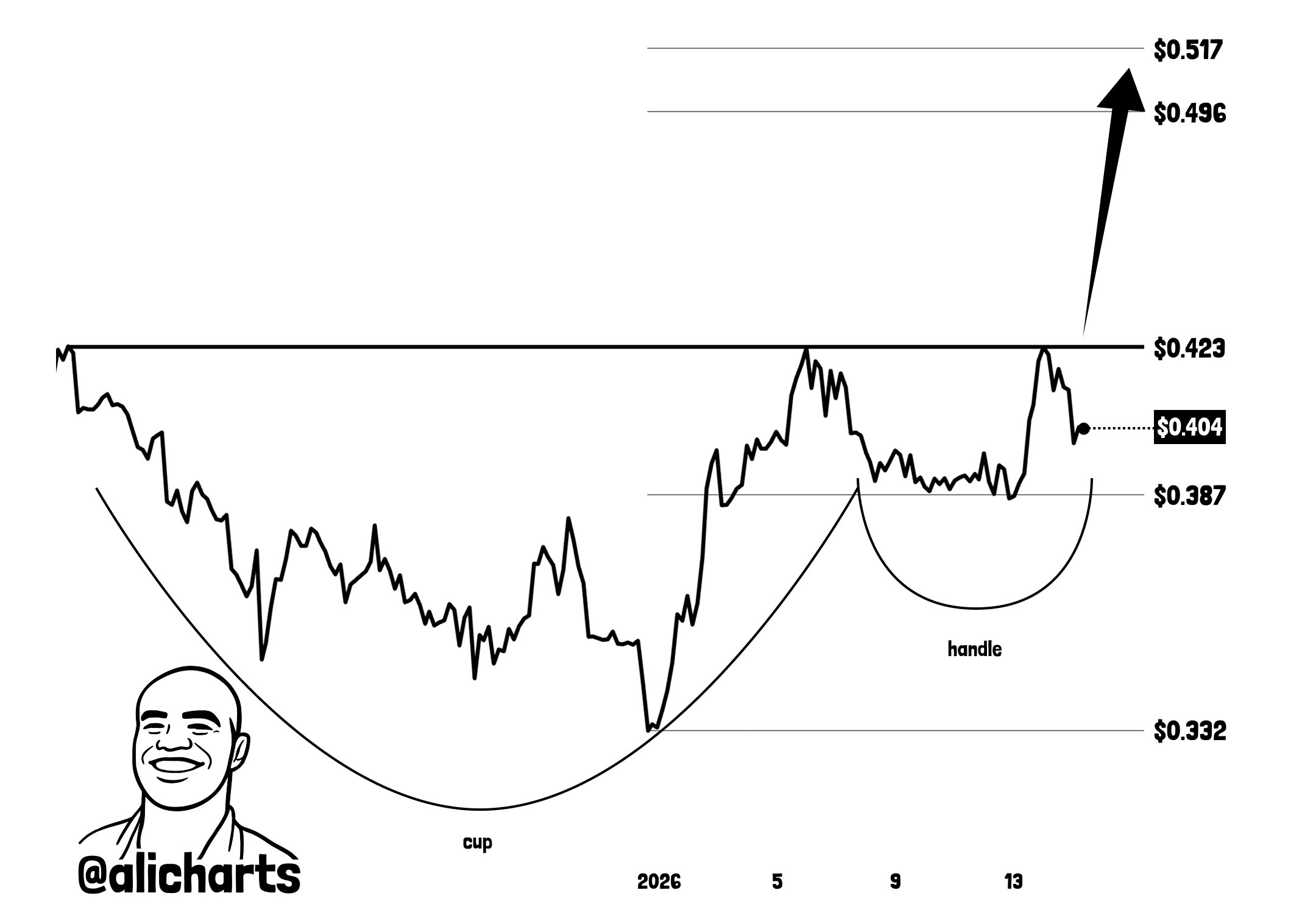

Cardano has one of many clearest cup-and-handle patterns in the entire crypto market proper now, and it isn’t only a bullish signal on paper. This setup led to 100%+ value hikes in gold and silver final 12 months, making them the primary and second most precious property. On this planet.

The technicals are spot-on: a deep, rounded base, which is the cup, adopted by a slim deal with formation that’s at present ranging between $0.387 and $0.404, all compressing beneath the neckline at $0.423. If ADA breaks above that stage, the measured transfer factors to $0.517, which is a 28% rally from spot, as seen on Ali Martinez’s chart.

The scenario is very necessary as a result of it’s taking place to a high 10 altcoin throughout a low-volatility section. Whereas Ethereum is stalling and XRP is seeing inflows, diverting value motion sideways, Cardano’s ADA is now one of many few majors with a contemporary construction and upside set off.

The sample mirrors setups that beforehand launched silver and gold out of multiyear accumulation phases.

If Cardano follows the script, this breakout may very well be the beginning of a sustained multi-week rally. This might put an finish to all of the hypothesis about ADA’s sustainability among the many crypto elite.

Is Bitcoin about to detonate altcoin breakouts?

Bitcoin’s value continues to be hovering round $96,000, and the ETF stream knowledge for Jan. 15 reveals $100 million value of inflows. You may see volatility compression throughout the board, however that’s precisely when setups have a tendency to interrupt out — a quiet spell, then growth.

- XRP: Holding round $2.05, proper beneath the 200-day MA of $2.32. Keep watch over how a lot is flowing into the ETF. The value would possibly hit the $2.07 NAV zone earlier than any push.

- Shiba Inu (SHIB): The development is again on observe with a golden cross. The important thing set off zone continues to be at $0.00000950, with a goal of $0.00001044. And the flows are getting quicker and quicker.

- Cardano (ADA): Watch the $0.423 neckline for a cup-and-handle breakout. Whether it is cleared, the goal sample is $0.517.

Weekend strikes would possibly rely on whether or not BTC breaks its personal compression vary. If that occurs, we may see a surge of capital into breakout setups like SHIB and ADA, whereas XRP continues to be pushed by rebalancing associated to the ETF.