- Dogecoin jumped after a Senate crypto invoice hinted at favorable regulatory remedy

- The transfer seems pushed by hypothesis, not long-term structural change

- DOGE’s lack of utility and ecosystem development stay its greatest challenges

Dogecoin caught a sudden bid in mid-January, and for as soon as, it wasn’t sparked by memes or a celeb publish. As an alternative, the transfer got here from Washington. A provision buried inside a newly launched Senate draft crypto invoice gave DOGE a regulatory tailwind, at the least on paper, and the market reacted shortly.

Why Dogecoin Spiked After the Senate Draft Invoice

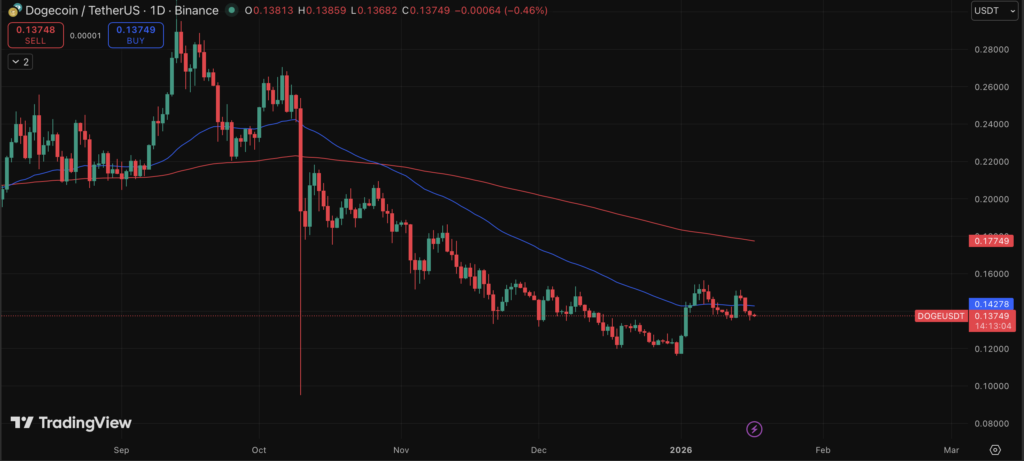

DOGE climbed roughly 8% on January 13, briefly pushing towards the $0.15 degree. The timing lined up virtually completely with the discharge of a 278-page Senate draft crypto invoice, which builds on the Readability Act handed by the Home final yr. The purpose of the invoice is to lastly kind digital property into clearer regulatory buckets, one thing the business has been ready on for years.

The framework introduces a cut up between “ancillary property” and “digital commodities.” Ancillary property wouldn’t be handled as securities, however they might nonetheless fall beneath SEC oversight and face stricter disclosure and buying and selling guidelines. Digital commodities, however, would reside in a lighter regulatory lane. The SEC would largely resolve which property land the place, which is the place issues get fascinating for Dogecoin.

How the Invoice Quietly Favors DOGE

There’s a particular clause within the draft that caught merchants’ consideration. It states that any crypto already serving as the first asset in an current exchange-traded product wouldn’t be categorized as an ancillary asset. Dogecoin qualifies beneath that definition, thanks to 3 spot Dogecoin ETFs already available on the market, the primary permitted again in September 2025.

That successfully locations DOGE in the identical regulatory class as Bitcoin, at the least beneath the present draft language. As soon as that element began circulating, value adopted. XRP and Solana have been additionally talked about in an analogous context, however DOGE’s transfer stood out given its standard reliance on sentiment fairly than coverage.

This Seems to be Like a Speculative Pop, Not a Structural Shift

As good because the inexperienced candles might look, this rally feels extra speculative than foundational. The invoice continues to be a draft, and there’s no assure it ever turns into legislation in its present kind. The truth is, stories recommend greater than 75 amendments are already being mentioned. By the point something passes, the language may look very completely different.

Even when the availability survives, the benefit it offers Dogecoin is pretty slender. Simpler ETF inclusion helps, certain. It lowers friction for each retail and institutional traders preferring publicity with out coping with wallets or custody. However over the long term, reducing regulatory purple tape doesn’t repair deeper points.

Dogecoin’s Larger Downside Hasn’t Modified

Outdoors of regulation, Dogecoin nonetheless struggles with relevance. It lacks significant utility, developer momentum is skinny, and the ecosystem seems largely stagnant. DOGE is down greater than 55% over the previous yr and practically 80% from its 2021 peak. A look at its official web site tells an analogous story, with minimal updates and restricted indicators of lively growth.

In the meantime, the crypto business is transferring towards stablecoins, tokenization, and infrastructure-driven use circumstances. None of these traits meaningfully contain Dogecoin. The truth is, wider stablecoin adoption may chip away at DOGE’s already restricted position as a medium of change.

The neighborhood and model stay Dogecoin’s strongest property, no query. However with no clear path to transform that spotlight into sustained utility, regulatory classification alone gained’t transfer the needle a lot. The Senate invoice gave DOGE a second. It didn’t remedy its fundamentals.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.