- Litecoin sentiment is weakening as FUD spikes throughout low volatility

- Worth stays capped by heavy provide zones and a descending construction

- Prolonged consolidation or gradual draw back seems extra probably than a pointy breakout

Litecoin has carried the “undervalued OG” label for years now. It was one of many earliest altcoins to show it may operate at scale, but value has by no means actually adopted by in the way in which many anticipated. Even immediately, its all-time excessive nonetheless sits nicely under the psychological $500 mark, and that hole feels extra apparent as Bitcoin flirts with the $100K narrative whereas LTC struggles to carry floor close to $100. The distinction is tough to disregard.

Litecoin’s Market Tone Is Quietly Shifting

What’s modified currently isn’t value alone, however the tone beneath it. Volatility has compressed, and value swings have turn into smaller and fewer decisive. That often occurs when participation thins out and merchants begin rotating capital elsewhere. In environments like this, rallies are inclined to really feel fragile, and bounces lose follow-through rapidly.

This leaves a reasonably easy, however uncomfortable query on the desk. Is Litecoin simply pausing earlier than one other directional transfer, or is the rally dropping power altogether?

Sentiment Weakens as Concern Creeps Again In

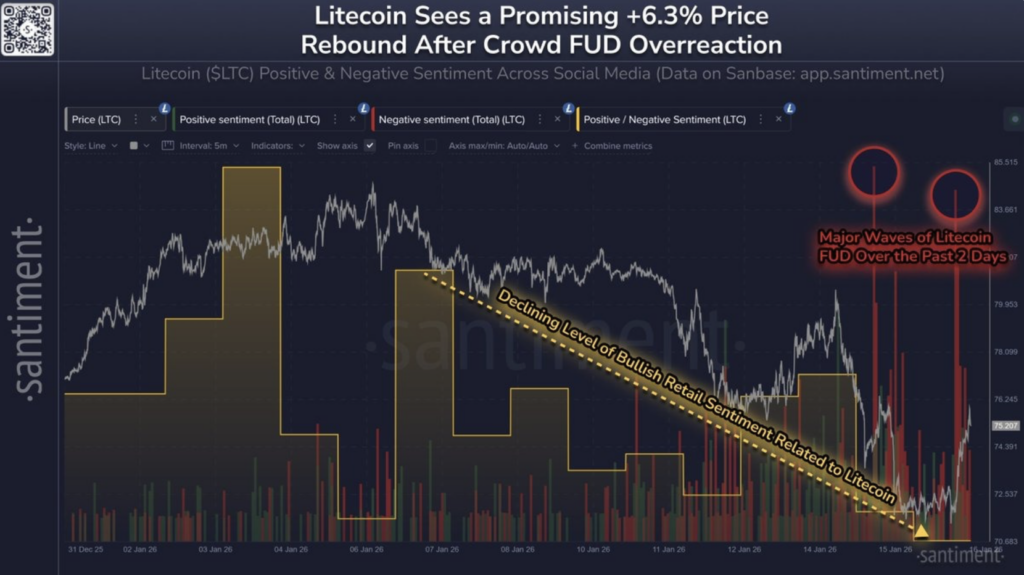

Latest sentiment knowledge leans towards the latter. Social metrics present optimism fading whereas fear-driven commentary spikes, a mixture that usually reveals up when conviction begins to crack. On the Santiment chart, Litecoin’s value makes an attempt to stabilize, however bullish sentiment continues trending decrease. That divergence isn’t nice.

During the last couple of days, sudden FUD spikes have appeared, which often displays nervous positioning reasonably than assured accumulation. In a wholesome consolidation, sentiment tends to flatten or slowly enhance. Right here, it doesn’t. That’s why the newest bounce seems extra like a short-term reduction transfer after panic promoting, not the beginning of a contemporary, demand-led rally.

Litecoin Worth Construction Stays Underneath Strain

From a technical standpoint, Litecoin continues to be deep in a cooldown section. Worth is buying and selling across the mid-$70s and stays under a number of key resistance zones. A number of overhead provide blocks and a falling trendline proceed to cap upside makes an attempt, whereas patrons have struggled to defend larger lows.

The chart reveals a transparent descending construction, with decrease highs and value urgent towards the decrease boundary of a falling channel or wedge. Provide stays stacked between roughly $82 and $90, and once more from $95 up towards $110. In the meantime, demand close to present ranges seems skinny, which suggests dip patrons aren’t stepping in with a lot conviction. Capital flows again this up too, with CMF sitting barely detrimental, pointing to ongoing outflows reasonably than accumulation.

If strain continues, draw back ranges round $72 come into focus first, adopted by the $68 to $65 zone. On the upside, Litecoin would wish to reclaim $82 to $85 with actual quantity to shift momentum, then push by $90. The $100 stage stays a a lot bigger ceiling for now.

Does Litecoin Have a Path Again to $100?

In the intervening time, it doesn’t seem like Litecoin has the energy to reclaim $100 cleanly. Every bounce try runs into promoting strain pretty rapidly, and the shortage of aggressive patrons is noticeable. That stated, the charts don’t actually level to an imminent collapse towards $50 both.

As a substitute, the extra probably final result is prolonged weak spot. A gradual grind decrease or sideways, with LTC caught inside a broader bearish development for longer than many would love. It’s not dramatic, however it’s not inspiring both.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.