- Stablecoins have gotten a essential bridge between DeFi and conventional finance

- Ripple’s technique prioritizes institutional adoption over short-term worth strikes

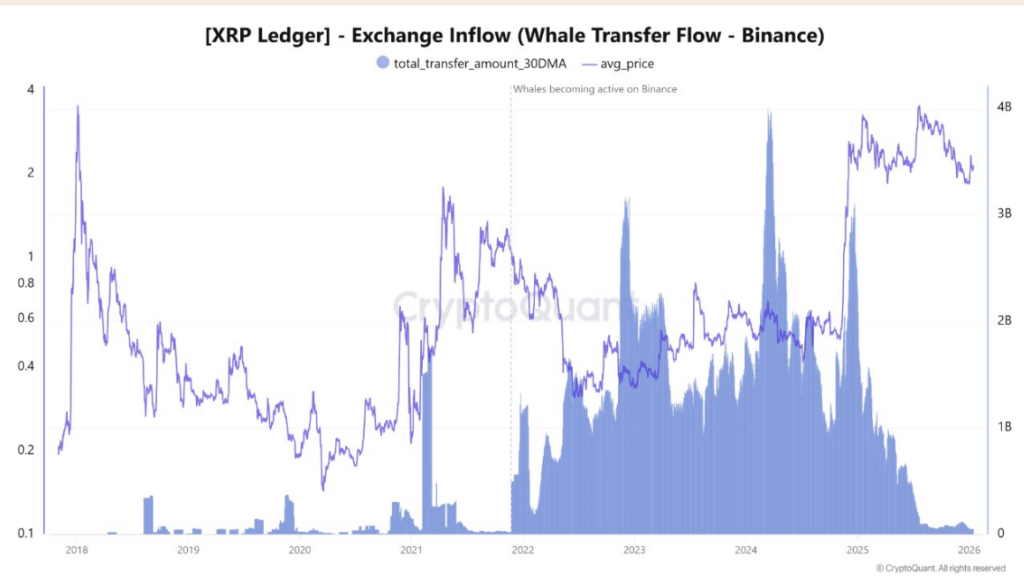

- Whale conduct and on-chain knowledge level to accumulation, not promoting

There’s little debate at this level that stablecoins sit on the heart of the bridge between DeFi and conventional finance. They’re the connective tissue. And in that context, blockchains that may supply a local, layer-1 stablecoin are likely to look extra enticing to banks and controlled monetary gamers. The trade-off, although, is that these methods normally favor gradual buildouts over fast worth pops, which isn’t at all times straightforward for holders to sit down via.

Ripple’s Stablecoin Technique Is Enjoying the Lengthy Recreation

Ripple matches this sample virtually completely. In a latest transfer, the corporate partnered with LMAX to combine its native stablecoin, RLUSD, instantly into LMAX’s infrastructure. On the floor, it’s one other step geared toward growing adoption and making Ripple’s ecosystem extra appropriate with institutional workflows. It’s not flashy, but it surely’s deliberate.

Nonetheless, the announcement stirred debate amongst XRP holders. Many have been anticipating worth to reply extra aggressively, and that hasn’t occurred. Regardless of a gentle stream of partnerships, institutional-facing initiatives, and even stable XRP ETF flows, the market response has been muted. Worth, no less than within the quick time period, simply hasn’t stored up.

XRP vs Solana Exhibits a Totally different Story Relying on the Lens

Up to now in 2026, XRP has continued to path Solana in relative efficiency, and on a chart, that hole can look irritating. However zooming out adjustments the narrative a bit. Through the 2025 cycle, XRP restricted its losses to roughly 12%, whereas SOL noticed drawdowns nearer to 35%. That sort of resilience doesn’t normally occur by chance, even when it goes underappreciated in actual time.

That distinction raises a good query. Are Ripple’s latest strikes truly laying the groundwork for one thing long term, even when worth hasn’t reacted but? The market typically rewards momentum first, and construction later, which may distort notion within the second.

Whale Habits Suggests Conviction, Not Distribution

Wanting again at 2025 provides some clues. XRP outperformed a variety of property throughout that interval, and it coincided with a number of significant strategic selections. GTreasury’s $1 billion acquisition and Ripple’s partnership with BDACS to increase institutional custody companies in South Korea weren’t headline grabs, however they mattered. These strikes added infrastructure, not hype.

Quick ahead to now, and on-chain knowledge appears to echo that very same sample. In keeping with CryptoQuant, whale inflows to Binance have dropped to their lowest degree since 2021. In easy phrases, giant XRP holders aren’t speeding to promote. If something, they’re sitting tight, which says greater than any single worth candle ever might.

XRP’s Setup Appears Quiet, however Deliberately So

This conduct strains up with the broader thesis that XRP’s underperformance on shorter timeframes could also be deceptive. Whereas it continues to lag another large-cap property in near-term momentum, the underlying setup appears totally different. The phrase that retains arising is conviction.

A mixture of regular on-chain exercise and Ripple’s gradual, institution-first technique factors extra towards accumulation than distribution. It’s not thrilling, and it doesn’t transfer quick, but it surely tends to matter over longer horizons. Due to that, XRP’s longer-term outlook heading deeper into 2026 could also be extra supported than present worth motion suggests.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.