- XRP ETFs have accrued $1.71 billion in belongings underneath administration.

- Value has lagged regardless of inflows, hovering close to the $2 degree.

- A delayed ETF-driven rally stays potential, although timing is unclear.

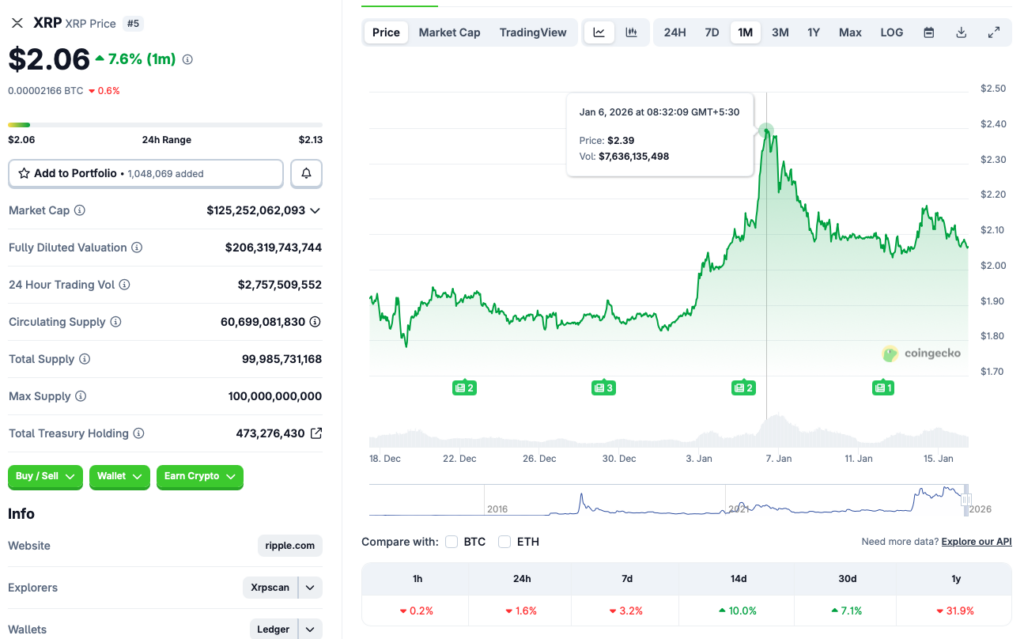

XRP-linked ETFs have quietly constructed up $1.71 billion in belongings underneath administration, in line with knowledge shared by XRP-Insights. On paper, that degree of accumulation seems to be bullish. In worth phrases, although, XRP hasn’t adopted via the way in which many traders anticipated. After briefly touching $2.39 on January 6, the token has slipped again towards the $2 vary, struggling to carry upside momentum at the same time as institutional publicity continues to develop.

Value Motion Tells a Combined Story

Current efficiency highlights that pressure. In accordance with CoinGecko, XRP is down about 1.6% over the past 24 hours and three.2% over the previous week. Zooming out additional, the token stays practically 32% beneath its January 2025 ranges. On the similar time, shorter-term charts paint a barely brighter image, with XRP up roughly 10% over the previous two weeks and seven.1% over the past month. The result’s a market caught between accumulation and hesitation.

Can ETF Demand Spark a Breakout?

ETF inflows had been a defining power within the 2025 crypto cycle. Each Bitcoin and Ethereum pushed to new highs as ETF demand ramped up, reshaping how establishments accessed digital belongings. XRP might observe an identical path, however timing issues. The asset final traded above $3 in July 2025, when it reached an all-time excessive close to $3.65, earlier than getting into a protracted downtrend.

Historical past suggests endurance could also be required. Ethereum’s ETF launch in 2024 didn’t instantly translate into larger costs, with significant upside solely arriving roughly a yr later. XRP’s ETFs could also be following an identical sample, the place structural demand builds first and worth responds later.

Why Expectations Stay Elevated

Regardless of near-term weak point, optimism hasn’t vanished. CNBC lately labeled XRP the “hottest crypto commerce of 2026,” and a number of other analysts anticipate ETF inflows to speed up over the approaching months. That backdrop helps clarify why many traders stay centered on the $3 degree, at the same time as broader market sentiment stays cautious.

For now, macro headwinds and a typically risk-off atmosphere are weighing on momentum. If financial situations stabilize and capital flows return to development belongings, XRP’s ETF-driven basis might turn out to be extra seen in worth motion. Whether or not that occurs in January stays unsure, however the buildup suggests the story isn’t completed but.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.