- XRP’s multi-year Elliott Wave construction reveals accumulation, not dysfunction

- Wave (5) projections level to long-term targets between $15 and $22

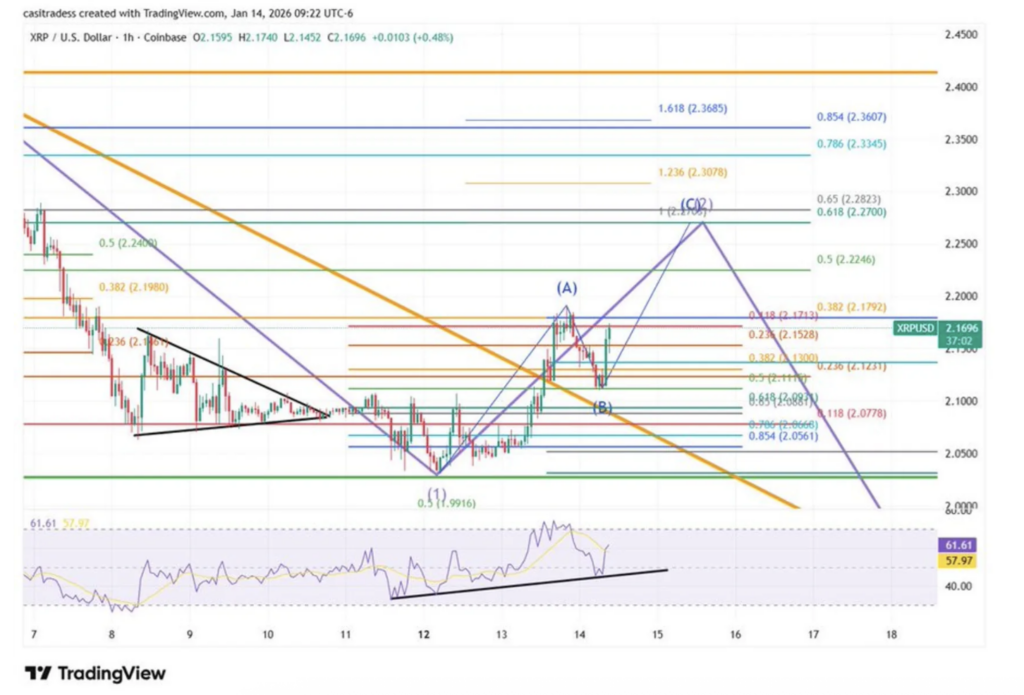

- Quick-term corrections stay essential for validating the broader bullish setup

XRP has been tracing out a surprisingly clear technical construction over the previous decade, one which doesn’t actually present up until you step again and take a look at the complete image. The broader cycle started forming someplace between 2014 and 2016, and since then, worth motion has adopted a multi-year rhythm that appears way more deliberate than chaotic.

XRP’s Lengthy Cycle Reveals Construction, Not Random Value Swings

Analysts utilizing Elliott Wave concept level out that XRP has persistently printed larger lows and well-defined absorption zones, moderately than sharp, emotional sell-offs. The primary main advance, labeled Wave (1), was adopted by a prolonged corrective section. That Wave (2) wasn’t dramatic, it was gradual, sideways, and actually a bit boring. However that’s type of the purpose.

This prolonged consolidation soaked up promoting strain over a number of years and constructed a base that didn’t collapse underneath stress. As an alternative of holders exiting, the construction suggests accumulation was quietly happening. Lengthy-term individuals stayed put, at the same time as momentum disappeared from the chart.

Wave (3) Modified the Market Construction

Current chart conduct means that Wave (3) marked essentially the most highly effective section of this cycle. XRP managed to push by way of key resistance ranges, flipping market construction within the course of. What adopted wasn’t a breakdown, however a managed pullback, generally recognized as Wave (4).

Value has remained above essential help ranges just like the 21 EMA, whereas persevering with to kind larger lows. That type of conduct often indicators well being, not weak spot. In accordance with analysts, such a correction is regular earlier than a ultimate advance, and it hints that XRP could also be organising for a a lot bigger transfer, moderately than rolling over.

Wave (5) May Outline XRP’s Subsequent Growth Section

If the construction continues to carry, Wave (5) may very well be the section that drives XRP’s subsequent main worth growth. Technical projections place potential targets between $15 and $22, with a mean estimate close to $20.50. These ranges aren’t arbitrary. They’re derived from Fibonacci extensions and measured strikes primarily based on XRP’s prior cycles.

Charts additionally present a well-recognized rhythm forming. Momentum slows close to help, stabilizes, after which resumes larger with energy. Analysts consider a powerful Wave (5) would seemingly pull in broader market participation, pushing XRP nearer to its long-term valuation potential. This isn’t blind optimism both. If XRP loses key help or breaks its upward pattern, the bullish thesis weakens shortly. For now although, the construction stays intact.

Quick-Time period Corrections Nonetheless Matter

Whereas the long-term outlook seems to be constructive, short-term worth motion can’t be ignored. The Wave (2) correction zone round $2.11 to $2.26 performs an necessary function in validating the bigger sample. A rejection close to $2.26 would align with expectations, whereas a clear breakout above $2.41 might invalidate the present Wave (2) setup altogether.

If Wave (2) holds, XRP might finally transition again right into a broader bullish pattern. Till then, short-term merchants ought to keep cautious. The construction could also be constructing one thing large, however timing nonetheless issues.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.