Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth has jumped by a fraction of a proportion within the final 24 hours to commerce at $95,324, as spot Bitcoin ETFs noticed a robust return recording $1.42 billion in web inflows over the previous week.

ETF exercise was closely concentrated in the course of the week. Information reveals that Wednesday delivered the biggest single-day influx of roughly $844 million, adopted carefully by $754 million on Tuesday. Though momentum cooled towards the top of the week, together with a notable $395 million outflow on Friday, the robust midweek shopping for was sufficient to push complete weekly inflows to their highest degree since early October. At the moment, spot Bitcoin ETFs attracted round $2.7 billion, highlighting the dimensions of the renewed curiosity.

The most recent influx development means that institutional buyers are progressively returning to Bitcoin by means of regulated funding merchandise after a interval of warning. Vincent Liu, chief funding officer at Kronos Analysis, stated that ETF inflows point out long-only allocators re-entering the market. He added that ETF shopping for, mixed with decreased promoting from giant Bitcoin holders, or whales, helps tighten efficient provide.

On-chain information reveals whale promoting strain has eased in comparison with late December, decreasing a key supply of distribution and draw back threat. Ethereum ETFs additionally posted constructive inflows, although at extra modest ranges in comparison with Bitcoin. The strongest influx day occurred on Tuesday, with roughly $290 million, adopted by $215 million on Wednesday. Nevertheless, late-week promoting weighed on efficiency, with Friday seeing roughly $180 million in outflows, trimming complete weekly inflows to round $479 million.

Regardless of the improved move information, analysts stay cautious. Market observers notice that short-lived spikes in ETF inflows have traditionally led to temporary worth rebounds relatively than sustained rallies. Analysts argue that Bitcoin will probably want a number of consecutive weeks of robust and constant ETF demand to assist a sturdy uptrend. With out sustained inflows, worth positive factors could proceed to face resistance and fade in periods of weaker demand.

Bitcoin Worth Consolidates Above Key Assist After Bullish Breakout

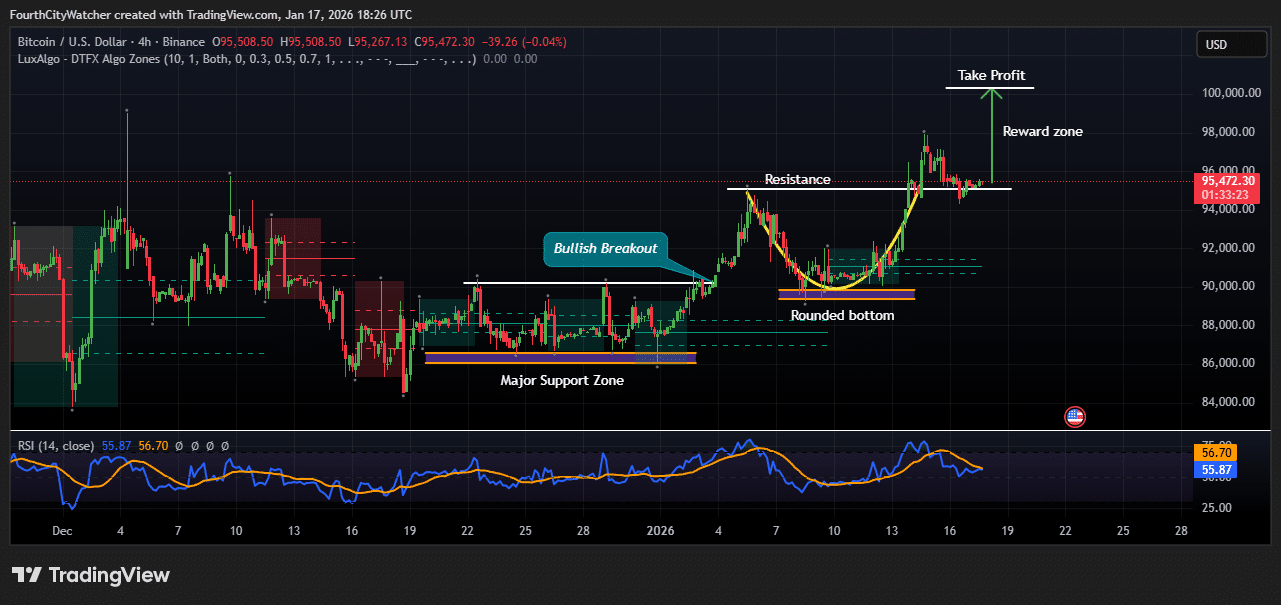

Bitcoin (BTC) reveals regular consolidation after a robust bullish breakout, in accordance with the most recent 4-hour chart, as worth trades at $95,470 on the time of writing. The chart highlights a significant assist zone close to the $86,000–$88,000 vary, the place Bitcoin beforehand fashioned a strong base.

This space acted as a requirement zone, absorbing promoting strain and setting the stage for a rebound. From this degree, BTC started forming a rounded backside sample, a traditional bullish construction that always indicators a gradual shift from bearish to bullish momentum. The bullish bias was confirmed after the value broke above a key resistance zone round $91,000–$92,000, labeled as a bullish breakout on the chart. Following the breakout, Bitcoin rallied sharply towards the $97,000–$98,000 space, the place sellers quickly stepped in. This degree now acts as short-term resistance.

Presently, BTC is transferring sideways slightly below resistance, suggesting wholesome consolidation relatively than weak point. Worth is holding above the previous resistance zone, which has now flipped into assist round $94,500–$95,000. This habits typically signifies that consumers are defending larger ranges whereas getting ready for a potential continuation transfer.

BTCUSD Chart Evaluation Supply: Tradingview

The chart additionally marks a reward zone focusing on the $100,000 psychological degree, aligning with the projected take-profit space. A clear break and shut above the $96,000–$97,000 resistance may open the door for a retest of six-figure costs within the close to time period.

Momentum indicators assist this outlook, with the Relative Energy Index (RSI) is hovering across the mid-50s, indicating a neutral-to-bullish momentum. Notably, RSI is neither overbought nor oversold, leaving room for additional upside if shopping for strain will increase.

The technical construction stays constructively bullish, so long as Bitcoin holds above the $94,000 assist zone. A drop beneath this degree may invite short-term pullbacks towards $92,000, however until BTC loses the main assist close to $88,000, the broader development continues to favor the bulls.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection