- Ethereum is diverging from small-cap equities whereas weakening towards the Russell 2000

- ETH/BTC energy suggests selective threat urge for food inside crypto

- Altcoins might even see gentle outperformance, however affirmation continues to be wanted

Because the second-largest cryptocurrency, Ethereum tends to behave like a temper ring for the altcoin market. When ETH appears wholesome, threat often spreads outward. When it doesn’t, issues tighten quick. Proper now, the indicators are combined, and that uncertainty is exhibiting up each inside crypto and throughout conventional markets.

What’s attention-grabbing is how two relationships are telling very completely different tales. On one facet, Ethereum’s long-standing correlation with the Russell 2000 is beginning to crack. On the opposite, ETH is quietly strengthening towards Bitcoin. Put collectively, it paints a market that isn’t certain which course it needs to commit to only but.

Ethereum and the Russell 2000 Are No Longer Transferring in Sync

Traditionally, Ethereum has tracked the Russell 2000 pretty intently. Small-cap equities and ETH have usually moved in tandem, with that relationship performing as a tough directional information for altcoins extra broadly. When small caps rallied, ETH often adopted. Once they rolled over, crypto felt it too.

That hyperlink has weakened. Whereas the Russell 2000 continues pushing increased, Ethereum has been printing decrease lows underneath regular promoting strain, hovering close to the $3,294 space. The divergence is obvious on the chart and arduous to dismiss.

Based on Alphractal CEO João Wedson, this break up displays a broader disconnect between conventional finance and digital belongings. As he put it, TradFi and crypto don’t all the time transfer collectively, particularly throughout bear markets or intervals of macro transition. And this part has been costly. Ethereum has misplaced roughly $280 billion in market worth since its August 2025 peak, whereas the overall crypto market cap is down greater than $1 trillion.

Wedson outlined a couple of prospects. The divergence could possibly be momentary, it might sign a deeper shift in world threat dynamics, or crypto markets could merely be pricing in future situations forward of conventional belongings. None of these choices are particularly comforting, however they do clarify the hesitation.

ETH Quietly Positive factors Floor In opposition to Bitcoin

Regardless of its weak point versus equities, Ethereum is sending a special sign inside crypto itself. In opposition to Bitcoin, ETH is definitely holding up nicely. The ETH/BTC pair has been trending increased since October, gaining roughly 8% over that interval.

That issues. Sustained energy in ETH/BTC often factors to capital rotating away from Bitcoin and towards Ethereum, and sometimes, by extension, into altcoins. Momentum indicators again this up. The Cash Stream Index stays within the bullish 50 to 80 vary, suggesting capital continues to circulation into ETH moderately than leak out.

As a result of ETH/BTC is commonly used as a proxy for broader altcoin well being, its upward drift hints that threat urge for food hasn’t disappeared, it’s simply being selective.

Are Altcoins Beginning to Stir?

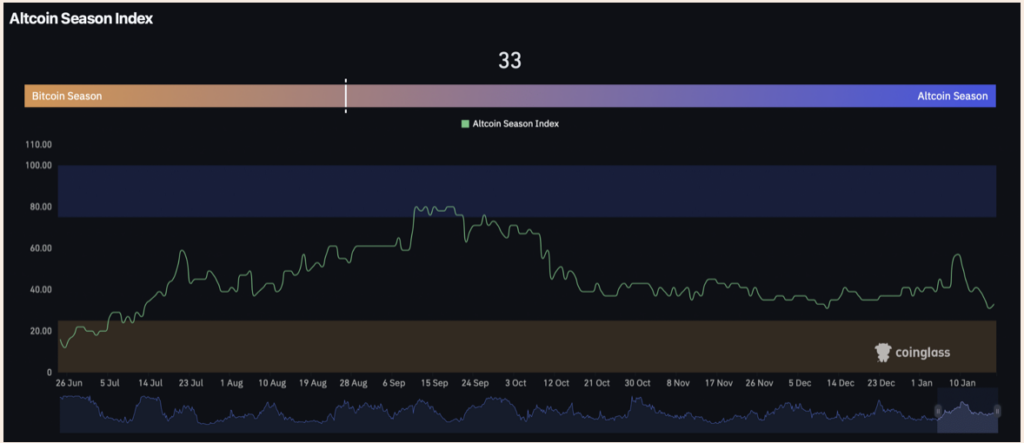

The Altcoin Season Index provides one other layer to the image. It intently mirrors actions in ETH/BTC and presents a snapshot of whether or not non-Bitcoin belongings are gaining traction. Finally test, the index sat round 33, ticking barely increased.

That alone doesn’t affirm a lot. One small transfer doesn’t make a pattern. Nevertheless it does counsel that situations could also be enhancing on the margins. For a extra convincing shift, the index would want to proceed climbing and maintain these beneficial properties.

For now, the takeaway is nuanced. Altcoins could also be positioned to outperform Bitcoin modestly, however any upside is more likely to are available in measured steps, not explosive bursts. Ethereum is holding the road, simply not all over the place without delay.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.