It was an odd week in crypto. XRP provide simply bought thinner, with U.S. spot ETFs locking up 1.20% of the token’s whole market cap — $1.52 billion that’s now off the open market and in chilly compliance storage.

However over within the meme coin land, the SHIB burn charge hit a wall, collapsing 86.14% in 24 hours and throwing chilly water on the deflation hype. After which there’s Justin Solar, who casually introduced he would pay $30 million for an hour-long dialog with Elon Musk.

TL;DR

- XRP ETF holdings now at $1.52 billion, equal to 1.20% of the entire market cap.

- SHIB burn charge nosedives 86.14% in 24 hours, dropping to only 749,000 SHIB burned.

- Justin Solar says he would pay $30 million to speak to Elon Musk for 60 minutes.

XRP sees $1.52 billion provide reduce, however worth response is bizarre

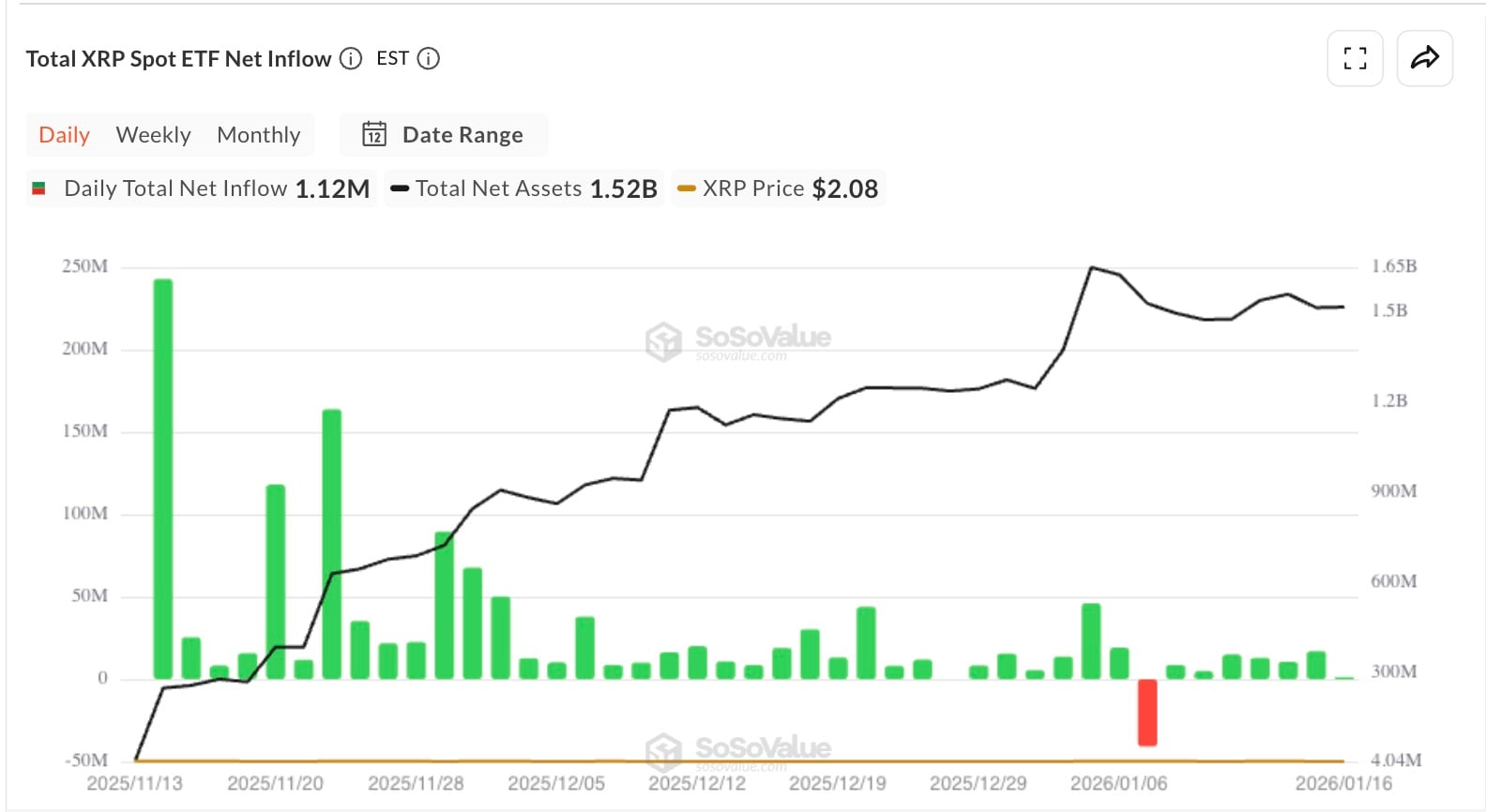

U.S. XRP ETFs have now purchased $1.52 billion value of XRP, in line with SoSoValue, locking up 1.20% of all the market cap — however the token’s worth has not moved in any respect. It’s a basic mismatch: provide is drying up, however costs are caught.

This week, inflows added as much as simply $56.83 million, which is a far cry from December’s numbers. Again then, single-week flows often crossed $200 million. The large query is whether or not that is only a non permanent slowdown or whether it is extra of a long-term pattern.

However the worth remains to be not cooperating. XRP is caught close to $2.05, brushing up in opposition to short-term resistance at $2.10, and searching misplaced beneath its 200-day transferring common at $2.32. Even with provide cuts from the ETFs, there was no breakout. Nothing too aggressive there. It’s only a range-bound chop.

That’s the place issues get a bit awkward. It might be a delayed bullish setup — ETF accumulation main a bigger transfer — or it might be a failed bullish catalyst, with not sufficient retail follow-through to matter.

If XRP can’t break by way of $2.32 quickly, it’d fall into its personal liquidity lure: fewer tokens accessible, however fewer consumers exhibiting up. If the influence of an ETF just isn’t priced in actual time, market contributors are prone to look elsewhere.

Shiba Inu (SHIB) suffers brutal 86.14% metric collapse

Within the final 24 hours, SHIB’s burn charge dropped by 86.14%, falling to a laughable 749,126 tokens burned, as per Shibburn portal. That’s not a typo. It is likely one of the weakest each day burns in months. For a challenge that has burned by way of over 410 trillion tokens in whole, a drop like that is unacceptable.

The entire thing is made worse by the truth that the Shiba Inu coin had simply printed a golden cross between its 23-day and 50-day MAs, which led to hypothesis that the worth would possibly chase the 200-day common at $0.0000096.

However with each day burns hitting all-time low and on-chain quantity stalling, issues aren’t wanting promising.

The worth is caught at 0.$00000841, holding onto the trendline help that was made after Christmas. If it breaks $0.000008, the construction caves and the golden cross will get invalidated earlier than it ever mattered.

To place it merely, SHIB wanted deflation to indicate that it was gaining steam. As a substitute, it gave holders silence — and that silence is the place the market’s pullback often begins.

TRON founder Justin Solar open to paying Elon Musk $30 million

Generally, the largest quote of the day just isn’t concerning the worth chart, however what hides within the reply part.

When prompted by the viral query — “$30M or 24 hours with Elon Musk?” — TRON founder Justin Solar replied with out hesitation.

It isn’t clear if he was joking, pitching a future collaboration, or each.

However Solar has a historical past of big-spend PR strikes, from paying $4.5M for a later canceled lunch with Warren Buffett to inserting himself into each ecosystem from Poloniex to Huobi to TUSD and shopping for a banana with duct tape for over $6 million. The final one by the way in which was provided to be despatched to area aboard Musk’s SpaceX rocket. However that’s one other story.

What makes this one totally different is the specificity of the quantity. It isn’t the greenback quantity — Solar has dropped greater baggage for dumber stunts — however the specificity: sixty minutes for $30 million. It’s a valuation of entry, not affect. And it isn’t a meme for those who can wire the funds.

In a post-Twitter, X-powered world, the place clout markets bleed into token charts, it doesn’t take a lot for a throwaway remark to set off reflexive hypothesis. TRON-Tesla stablecoin? TRX tipping integration on X?

None of that exists but. However Solar’s quote does now — and figuring out how shortly crypto can spin narratives into capital, that is likely to be all he wants.

Crypto market outlook

In response to CryptoQuant’s worth decomposition, Sunday and Saturday are nonetheless the times with the least motion throughout all days of the week. It’s actually on weekdays, particularly Tuesdays and Thursdays, that issues begin to get actually unstable.

- XRP: $1.52B ETF absorption is lifeless weight on the provision facet — if flows speed up, the worth won’t keep flat for lengthy. A break above $2.32 opens up a $2.5-$2.7 repricing window quick.

- Shiba Inu (SHIB): golden cross now dangers invalidation with out a burn charge rebound. With out it, the meme coin narrative stalls and the worth probably revisits the $0.00000800 coil zone.

- Bitcoin (BTC): faces a triple ceiling close to $100,000 — technical, structural, psychological. If Tuesday ETF flows miss expectations, weekend calm might flip into rejection. The following transfer units the tone for Q1.