OKX consumer’s determined plea

An OKX consumer making an attempt to get round restrictions on Chinese language customers has issued a determined plea after the crypto alternate froze funds, saying that the cash was wanted to cowl pressing household medical bills.

The consumer, who shared a prolonged private enchantment on X, stated about $40,000 in crypto grew to become inaccessible after OKX’s threat controls locked a number of accounts linked to identification violations. The consumer admitted the accounts had been acquired from third events to entry promotions that had been unavailable to mainland China customers.

Within the submit, the consumer stated all funds transferred into them originated from their verified private account. They described the funds as “life-saving cash” wanted for a member of the family’s surgical procedure.

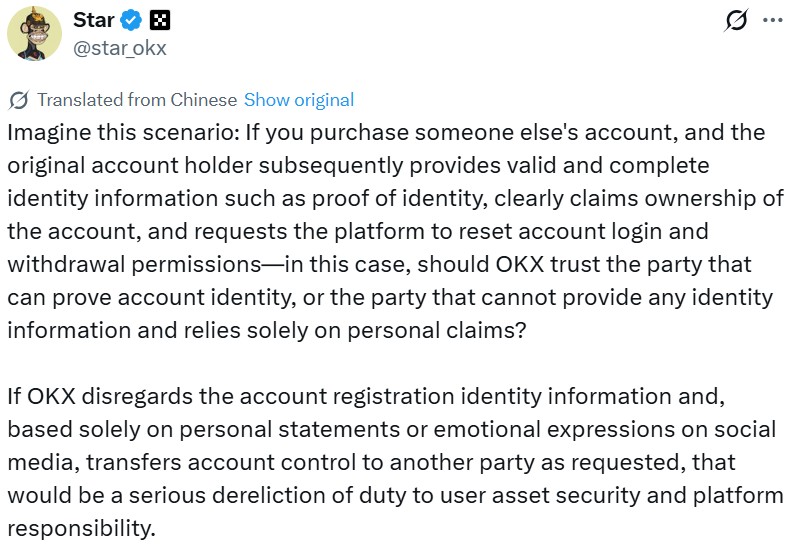

OKX founder Star Xu responded, saying that the alternate can not switch management of accounts or launch belongings based mostly on private claims, even when the claimant admits wrongdoing. Additional dealing with is feasible provided that the registered account holder steps in to supply verifiable paperwork.

The consumer later apologized to OKX and stated he would try to contact the account’s KYC-registered proprietor to hunt a decision. They added that loans from pals helped deal with the fast medical emergency.

Hong Kong cautious on gold-backed stablecoins

Hong Kong Monetary Secretary Paul Chan Mo-po has downplayed requires gold-backed stablecoins.

Chan was responding to an viewers member who steered the town discover stablecoins backed by gold, at a Saturday discussion board on the town’s upcoming price range.

He stated Hong Kong would take a step-by-step strategy to stablecoin improvement and harassed the necessity for prudence, including that proposals to hyperlink stablecoins to gold or different belongings could possibly be examined after regulatory groundwork is accomplished.

Hong Kong’s stablecoin guidelines took impact on Aug. 1 and have since attracted a protracted line of candidates hoping to capitalize on the world’s largest offshore yuan market. Nonetheless, Chan has stated solely a choose few will likely be accredited, warning that the majority candidates are more likely to be upset.

Stablecoin adoption has accelerated since US President Donald Trump signed the GENIUS Act into regulation, prompting regulators worldwide to reassess their very own stablecoin frameworks.

Gold-linked stablecoins have additionally gained traction. Tether, the issuer of the world’s largest stablecoin USDT, has continued increasing its gold-backed providing.

In October, Tether’s XAUt market cap rose by about $500 million, lifting the gold-pegged stablecoin’s market capitalization to $1.5 billion, CoinMarketCap knowledge exhibits. Since then, its market capitalization has climbed additional, to about $1.87 billion on the time of writing, as gold costs surge to report highs.

Learn additionally

Options

No matter occurred to EOS? Neighborhood shoots for unlikely comeback

Options

Unstablecoins: Depegging, financial institution runs and different dangers loom

Crypto first movers threat changing into TradFi casualties in South Korea

A South Korean startup has accused monetary regulators of favoring established establishments and sidelining a crypto pioneer because the nation strikes to formalize its tokenized securities market.

Lucentblock, a blockchain-based fractional funding agency based in 2018, stated it faces potential closure after being excluded from the shortlist for South Korea’s deliberate over-the-counter alternate for safety token choices (STOs).

In October, three teams of candidates — the Korea Trade (KRX), Nextrade (NXT) and Lucentblock — submitted functions to the Monetary Providers Fee for preliminary approval to function a fractional funding over-the-counter alternate.

The Monetary Providers Fee (FSC) is anticipated to finalize licenses by Wednesday. If the reported shortlist is confirmed, Lucentblock can be excluded from South Korea’s first formally sanctioned STO buying and selling infrastructure.

Lucentblock CEO Huh Se-young known as for an emergency press convention on Monday, and stated that the corporate was being “pushed out of the market” regardless of working for seven years below South Korea’s regulatory sandbox.

“That is an current enterprise being institutionalized in a manner that excludes the very corporations that constructed the market,” Huh stated.

The dispute has raised broader considerations over how regulatory sandboxes transition into everlasting market buildings. Critics argue that startups invited to experiment typically lack safety as soon as formal licensing frameworks are launched, permitting bigger gamers to enter late and dominate the market.

Learn additionally

Options

‘Raider’ traders are looting DAOs — Nouns and Aragon share classes discovered

Options

Crypto leaders are obsessive about life extension. Right here’s why

Vietnam to license pilot crypto exchanges by Thursday

Vietnam will license corporations to take part in a pilot digital asset alternate program earlier than Thursday as a part of a regulatory sandbox aimed toward bringing the native crypto market below formal oversight, Prime Minister Pham Minh Chinh stated.

The instruction was issued at a nationwide convention on Jan. 6 reviewing the finance sector’s efficiency in 2025 and setting priorities for 2026.

In response to a authorities abstract of the convention, the licensing deadline was included amongst eight precedence job teams assigned to the finance sector for the yr. 5 corporations are reportedly anticipated to affix the pilot.

Authorities communications described the sandbox as a mechanism for managed crypto experimentation whereas managing dangers associated to investor safety and Anti-Cash Laundering.

Vietnam’s crypto market has lengthy operated in a authorized gray space, till Jan. 1, when the Legislation on Digital Know-how Trade got here into power. The regulation offers a authorized basis for crypto that enables for regulatory sandboxes.

Simply final week, authorities in Da Nang metropolis reportedly accredited a pilot program for stablecoin conversion to and from the Vietnamese dong.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan (Hyoseop) Yun is a Cointelegraph workers author and multimedia journalist who has been protecting blockchain-related matters since 2017. His background consists of roles as an project editor and producer at Forkast, in addition to reporting positions centered on know-how and coverage for Forbes and Bloomberg BNA. He holds a level in Journalism and owns Bitcoin, Ethereum, and Solana in quantities exceeding Cointelegraph’s disclosure threshold of $1,000.

Learn additionally

Hodler’s Digest

Binance.US scores towards SEC, Mt. Gox delay repayments, and different information: Hodler’s Digest, Sept. 17-23

Editorial Employees

7 min

September 23, 2023

Binance.US scores non permanent win towards the SEC, Mt. Gox repayments delayed to 2024, and Tether’s $1B liquidity to Tron community.

Learn extra

Asia Specific

Girl accused of $6B rip-off, China loophole for Hong Kong Bitcoin ETFs: Asia Specific

ZhiyuanSun

6 min

April 25, 2024

There’s just one manner left for Chinese language nationals to entry the Hong Kong Bitcoin ETFs, $6B rip-off accused in court docket, and extra: Asia Specific.

Learn extra