Prime Tales of The Week

Michael Saylor pushes again on criticism of Bitcoin treasury firms

Technique chairman Michael Saylor defended Bitcoin treasury firms in opposition to criticism throughout a latest look on the What Bitcoin Did podcast.

Responding to questions on smaller firms that challenge fairness or debt to purchase Bitcoin, Saylor stated the choice finally comes right down to capital allocation, arguing that firms with extra money are higher off allocating it to Bitcoin than holding it in treasuries or returning it to shareholders.

He in contrast company treasury methods to particular person investing, arguing that possession ranges range however the underlying determination to carry BTC is rational no matter firm dimension or enterprise mannequin.

Saylor additionally pushed again on the concept unprofitable firms needs to be singled out for criticism, arguing that Bitcoin holdings can assist offset weak working outcomes.

Goldman Sachs CEO says CLARITY Act ‘has an extended strategy to go‘

David Solomon, CEO of banking large Goldman Sachs, has weighed in on the pending digital asset market construction laws, motion on which was lately postponed by the US Senate Banking Committee.

In a Thursday earnings name discussing the corporate’s fourth quarter outcomes for 2025, Solomon stated many individuals at Goldman Sachs have been “extraordinarily centered” on points together with the Digital Asset Market Readability (CLARITY) Act within the US Congress as a consequence of its potential impression on tokenization and stablecoins.

A markup of the invoice scheduled for Thursday was postponed after Coinbase stated it might not help the laws as written. In a markup session, a congressional committee debates a invoice and proposes amendments whereas contemplating whether or not it ought to advance to the complete chamber for a vote.

US lawmakers press SEC over paused Justin Solar enforcement case

Three Democrats within the Home of Representatives are asking US Securities and Alternate Fee (SEC) Chair Paul Atkins to offer info associated to the company closing investigations, dismissing enforcement actions, or pausing instances via prolonged stays in “at the very least one dozen crypto-related instances,” together with Tron founder Justin Solar.

In a Thursday letter to Atkins, Representatives Maxine Waters, Brad Sherman and Sean Casten questioned the SEC’s “priorities and effectiveness” given its dismissals of the crypto-related instances. The lawmakers wrote that the company had “overtly and boldly dismissed the vast majority of its crypto enforcement instances,” together with instances involving crypto exchanges Binance, Coinbase and Kraken.

Zcash Basis says SEC closed 2023 probe into privateness coin

The inspiration behind Zcash stated that the US Securities and Alternate Fee (SEC) won’t pursue an enforcement motion in opposition to the privateness coin after the top of an investigation launched in 2023.

In a Wednesday discover, the Zcash Basis stated the SEC “concluded its assessment” over a “matter of sure crypto asset choices” and wouldn’t advocate enforcement actions or modifications. In keeping with the muse, the regulatory probe began in August 2023 after it obtained a subpoena from the SEC.

“This final result displays our dedication to transparency and compliance with relevant regulatory necessities,” stated the muse. “Zcash Basis stays centered on advancing privacy-preserving monetary infrastructure for the general public good.”

Crypto’s 2026 comeback hinges on three outcomes, Wintermute says

Final 12 months proved disappointing for a lot of cryptocurrency buyers, as Bitcoin’s conventional four-year cycle delivered a muted rally that did not spill over into the broader altcoin market. In keeping with crypto market maker Wintermute, the shift displays a structural change slightly than a brief pause, leaving any restoration in 2026 depending on a number of unsure components.

In its digital asset OTC market assessment, Wintermute stated the market’s long-standing sample of “recycling,” through which beneficial properties in Bitcoin flowed into altcoins and fueled prolonged, narrative-driven rallies, broke down in 2025.

As an alternative, liquidity concentrated in a small group of large-cap property, pushed largely by exchange-traded funds and institutional inflows. The end result was narrower market breadth and sharper divergence in efficiency, suggesting that capital turned extra selective slightly than broadly rotating throughout the market.

Most Memorable Quotations

“We’ve got obtained affirmation from DOJ that the digital property forfeited by Samourai Pockets haven’t been liquidated and won’t be liquidated.”

Patrick Witt, govt director of the US President’s Council of Advisors for Digital Property

“You one way or the other suppose that it’s OK for 400 million firms to not purchase Bitcoin, and one way or the other that’s okay, and also you’re going to criticize the 200 firms that purchased Bitcoin.”

Michael Saylor, govt chairman of Technique

“If gold and the Nasdaq have the juice, how is Bitcoin going to get its groove again? Greenback liquidity should broaden for that to occur.”

Arthur Hayes, co-founder of BitMEX

“It’s not excellent, and modifications are wanted earlier than it turns into legislation. However now could be the time to maneuver the CLARITY Act ahead if we would like the US to stay the very best place on the earth to construct the way forward for crypto.”

Chris Dixon, managing companion at a16z Crypto

“With BTC rising in a low-leverage atmosphere, it appears like quite a lot of final 12 months’s fluff was taken out, leaving bulls a tad extra life like, and bears tamed of their apocalyptic prophecies. We see quite a lot of indicators in deep oversold territory, edging to get again up.”

VanEck, international funding administration agency

“We’re the ‘hottest’ nation on the earth, and primary in AI. Information facilities are key to that growth, and holding Individuals free and safe, however the large expertise firms who construct them should ‘pay their very own means.”

Donald Trump, president of america of America

Winners and Losers

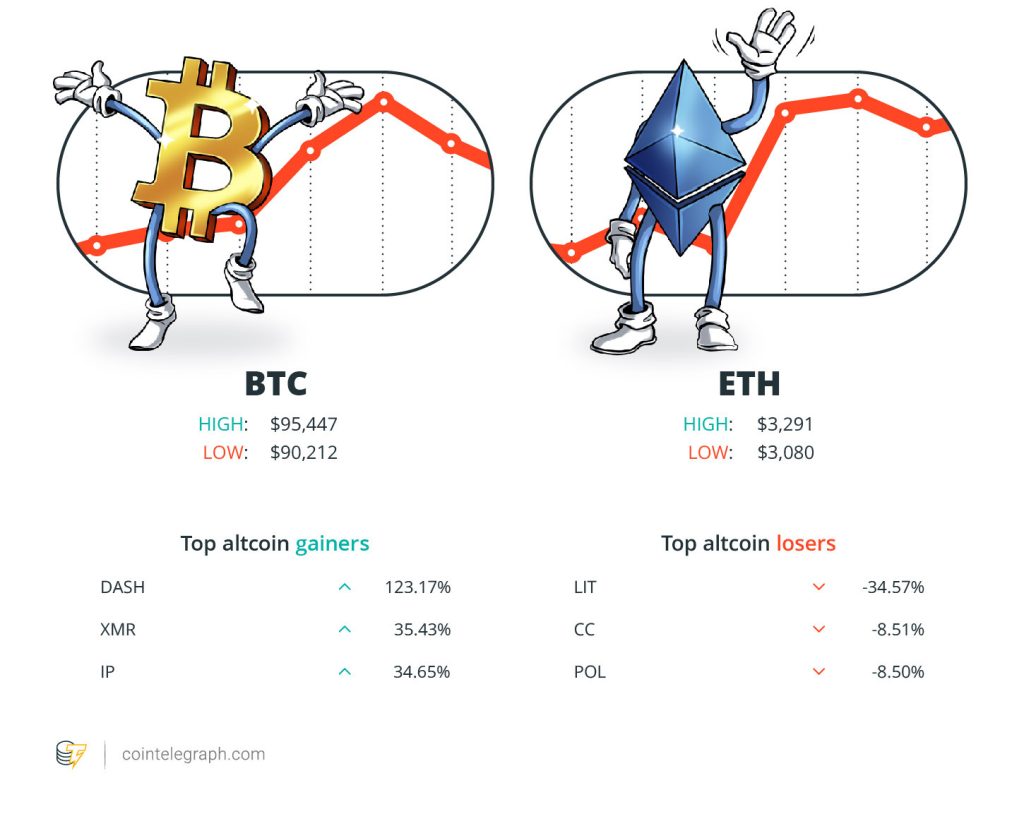

On the finish of the week, Bitcoin (BTC) is at $95,447, Ether (ETH) at $3,291 and XRP at $2.06. The full market cap is at $3.23 trillion, in line with CoinMarketCap.

Among the many greatest 100 cryptocurrencies, the highest three altcoin gainers of the week are Sprint (DASH) at 123.17%, Monero (XMR) at 35.43% and Story (IP) at 34.65%.

The highest three altcoin losers of the week are Lighter (LIT) at 34.57%, XDC Community (XDC) at 8.51% and Polygon (POL) at 8.50%. For more information on crypto costs, ensure to learn Cointelegraph’s market evaluation.

Prime Prediction of The Week

Bitcoin merchants predict ‘sturdy run-up’ as traditional chart targets $113K

As Cointelegraph reported, Bitcoin’s potential to return to a six-figure value hinges on overcoming the resistance at $98,000 — the short-term holder (STH) value foundation.

That is the important level on merchants’ radar and one which has not obtained a convincing retest lately.

“$BTC is approaching a key inflexion level,” stated Glassnode analyst Chris Beamish in a Friday put up on X, including: “Reclaiming the STH value foundation would sign that latest consumers are again in revenue, sometimes a prerequisite for momentum to re-accelerate.”

Prime FUD of The Week

Jefferies’ ‘Greed & Concern’ strategist cuts Bitcoin allocation to zero on quantum threat

Funding financial institution Jefferies’ longtime “Greed & Concern” strategist Christopher Wooden has reportedly eradicated Bitcoin from his flagship mannequin portfolio, citing mounting considerations that advances in quantum computing might undermine the cryptocurrency’s long-term safety.

In keeping with a report by Bloomberg, Wooden stated within the newest version of his Greed & Concern publication, that the ten% Bitcoin allocation he first added in late 2020 has been changed by a break up place in bodily gold and gold mining shares.

He argued that quantum breakthroughs would weaken Bitcoin’s declare to be a reliable retailer of worth for pension‑fashion buyers.

Wooden added that concern over quantum threat is rising amongst long-term, institutional buyers, warning that some capital allocators now query Bitcoin’s “retailer of worth” case if quantum timelines compress.

Crypto exchanges face ban in South Korea as Google Play updates guidelines

Google is rolling out up to date crypto app necessities in South Korea, a transfer which will considerably prohibit entry to offshore crypto exchanges by tying app availability to native regulatory clearance.

Learn additionally

Options

The blockchain tasks making renewable vitality a actuality

Options

Hazard indicators for Bitcoin as retail abandons it to establishments: Sky Wee

In keeping with South Korean media outlet News1, beginning Jan. 28, crypto change and pockets apps listed on Google Play in South Korea should add documentation proving that their Digital Asset Service Supplier registration with the nation’s Monetary Intelligence Unit (FIU) has been accepted.

Google reportedly clarified that builders itemizing crypto change and custodial pockets apps should add proof of accomplished FIU registration acceptance via its developer console.

Apps that fail to fulfill the requirement could also be blocked in South Korea, stopping new downloads and doubtlessly disrupting entry over time.

Polygon trims workforce amid $250M stablecoin funds pivot

Polygon Labs has lower personnel because it pivots extra aggressively to a payments-first technique constructed round stablecoin rails and what it calls an “Open Cash Stack,” a brand new, vertically built-in set of companies designed to maneuver cash onchain.

Learn additionally

Options

Actual AI use instances in crypto, No. 1: The perfect cash for AI is crypto

Options

From Director of america Mint to the Very First Bitcoin IRA Buyer

The layoffs got here simply days after asserting a deal price as a lot as $250 million to accumulate US crypto ATM and funds firm Coinme and pockets and developer platform Sequence.

Polygon didn’t publicly disclose what number of roles have been eradicated, however in line with a number of sources on social media platforms like X, a discount as giant of 30% in employees has been linked to the put up‑acquisition integration.

Prime Journal Tales of The Week

Right here’s why crypto is transferring to Dubai and Abu Dhabi

Dubai and Abu Dhabi within the UAE are going all out to draw crypto’s wealthiest folks and largest firms.

Bitcoin ‘bullish’ in Q1 says Willy Woo, XRP lacks CLARITY: Commerce Secrets and techniques

Willy Woo assured in Bitcoin’s value short-term… however there’s a catch. Analysts say ETH set for brand spanking new multi-year cycle, however Polymarket disagrees.

Grok faces bans… however 8 lawsuits declare ChatGPT use can kill: AI Eye

Scottish trolls fall silent as a consequence of Iranian web blackout — and why you shouldn’t take instructions from a robotic throughout a hearth.

Subscribe

Probably the most participating reads in blockchain. Delivered as soon as a

week.

Editorial Workers

Cointelegraph Journal writers and reporters contributed to this text.