XRP is wanting much less like a unstable cryptocurrency and extra like an artificial stablecoin — it has been fluctuating close to $2 with bizarre consistency whereas the market offers with overleveraged optimists.

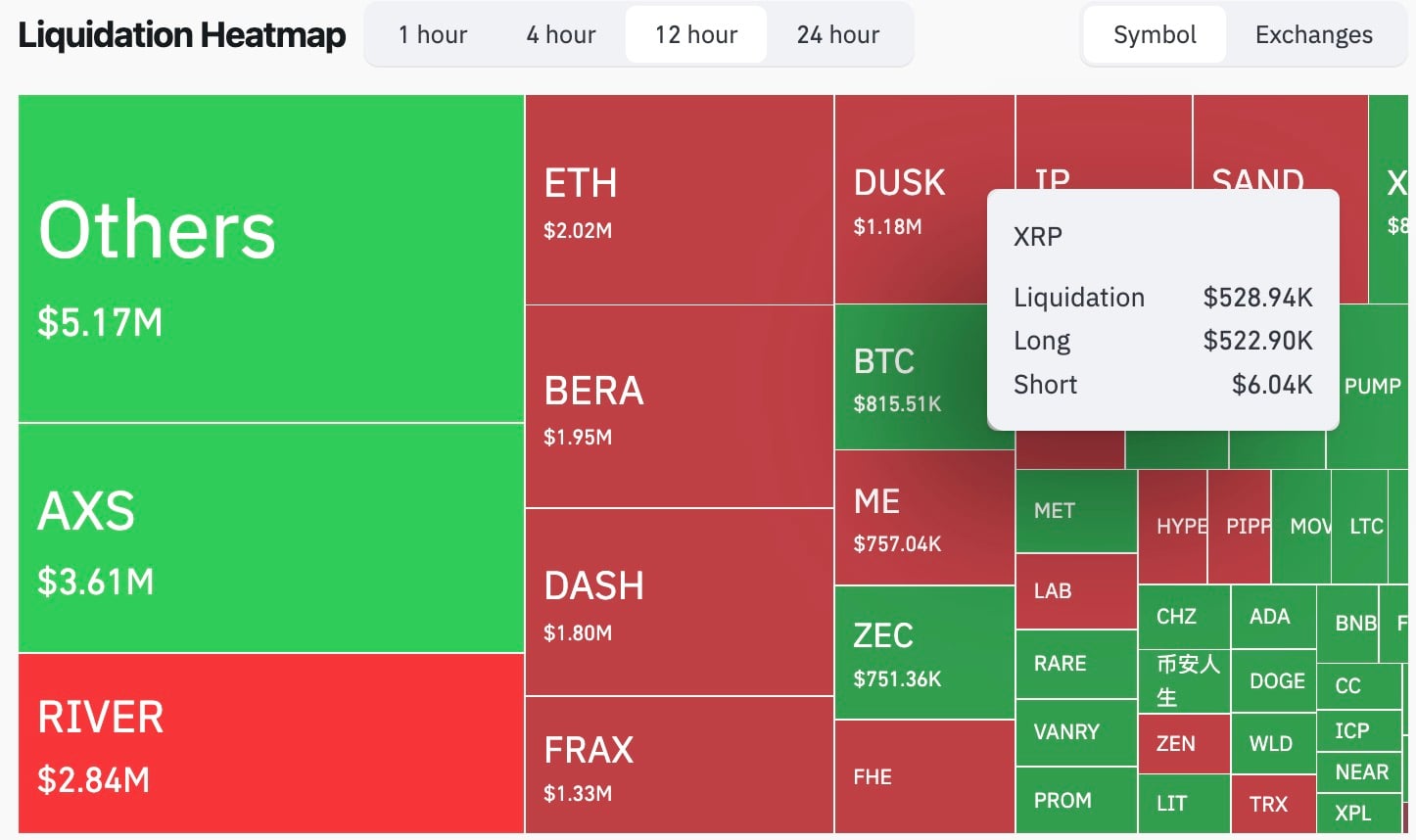

Within the final 12 hours, XRP noticed $528,940 in liquidations, with lengthy positions accounting for a mind-boggling $522,900. Brief sellers have been barely registered — it was simply $6,040, as per CoinGlass.

That’s an 8,700% imbalance between longs and shorts. Only for context, Bitcoin’s liquidations throughout the identical interval added as much as $815,000, however with a way more even break up. Ethereum misplaced $2.02 million, principally from each side.

XRP’s liquidation profile, then again, appears like a troublesome spot for bulls, however a inexperienced carpet for affected person bears.

The coin has been buying and selling just about flat at round $2.053, with minimal deviation regardless of the lengthy squeeze. This uncommon worth stability, together with frequent lengthy liquidations, factors to both algorithmic reloading or systematic leverage mispricing.

The market is perhaps treating $2 as a type of unstated reversion level — it could possibly be a psychological anchor, an institutional entry level, or perhaps it’s simply an exhaustion zone after the rallies triggered by XRP ETFs.

How has XRP turn into $2 stablecoin?

XRP’s worth motion suggests passive distribution: decrease highs, a static base and nonstop liquidation. The $2 deal with is turning into a magnet — each wick above will get offered, and each dip beneath will get purchased again by the identical liquidity-hungry bots that gasoline these recurring squeezes.

If this retains up, XRP would possibly turn into the primary stablecoin that’s not backed by the federal government or by fiat cash, however by the market’s need to capitalize on leverage.

Proper now, it’s at $2.05, unchanged from earlier than the liquidation. However the imbalance remains to be there. Hold an eye fixed out for a breakdown below $2.04 — that’s the place the algorithms cease defending and actual sellers begin to step in.