- A decade-old Bitcoin whale has been steadily promoting small parts of a 5,000 BTC stash at six-figure costs

- On-chain information reveals long-term holder promoting has largely cooled, with establishments absorbing remaining provide

- Rising whale dominance on exchanges suggests short-term volatility, even because the broader construction stabilizes

Twelve years in the past, Bitcoin was barely taken severely. It was a digital experiment buying and selling round $332, one thing tech boards debated greater than monetary desks. Quick ahead to January 18, 2026, and that very same experiment is now sitting on the heart of some of the disciplined exit methods the crypto market has ever seen.

New information from Lookonchain reveals {that a} long-dormant OG holder, somebody who’s held 5,000 BTC for over a decade, has offered one other 500 BTC, value roughly $47.77 million. This wasn’t a panic transfer. It was deliberate. Since December 2024, this whale has been trimming the place slowly, promoting into six-figure costs and turning an unique $1.66 million wager right into a half-billion-dollar consequence, whereas nonetheless holding on to half the stack.

What This Whale Conduct Actually Alerts

This sort of promoting tells you numerous about mindset. The whale isn’t treating Bitcoin like a speculative commerce anymore. It’s extra like long-term household wealth. By promoting in small chunks, threat will get decreased with out sacrificing future upside. There’s persistence right here, not urgency.

As an alternative of dumping every thing and rattling the market, the holder sells during times of robust demand. That strategy has helped them lock in a median value north of $106,000, whereas protecting value motion comparatively secure. It’s virtually textbook, and actually, sort of uncommon.

Market Sentiment Isn’t as Bearish as It Seems to be

When historic wallets transfer, concern spreads quick. In crypto, outdated cash waking up are sometimes learn as a warning signal. However the information suggests this isn’t misery promoting. It seems to be extra like a valuation milestone being met.

In an odd approach, these gross sales are needed. They supply the liquidity that establishments must enter at scale. Spot Bitcoin ETFs, company treasuries, and different giant allocators can’t construct positions until somebody is prepared to promote. With out OG holders taking income, the market merely wouldn’t have sufficient provide to perform at this measurement.

On-Chain Information Exhibits the Strain Has Eased

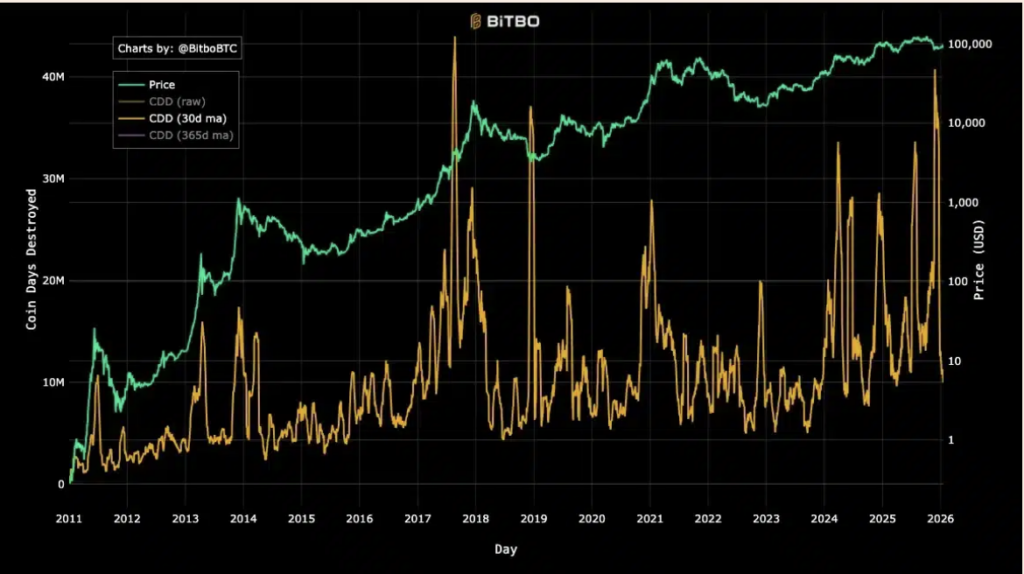

To see whether or not this promoting hinted at one thing extra harmful, AMBCrypto checked out Bitcoin’s Coin Days Destroyed metric. CDD measures the financial weight of transactions by factoring in how lengthy cash have been held earlier than being moved. Older cash shifting equals increased CDD.

Again in November 2025, when Bitcoin fell from its $126,000 peak, CDD spiked sharply. That was actual distribution. Lengthy-term holders have been promoting in measurement. Right now, that image seems to be very totally different. CDD has dropped to round 9.96 million, far under latest highs.

That cooldown suggests most long-term sellers are finished. A number of early traders are nonetheless lively, however the bulk of outdated provide seems to have already modified fingers. Establishments, quietly, appear to be absorbing what’s left.

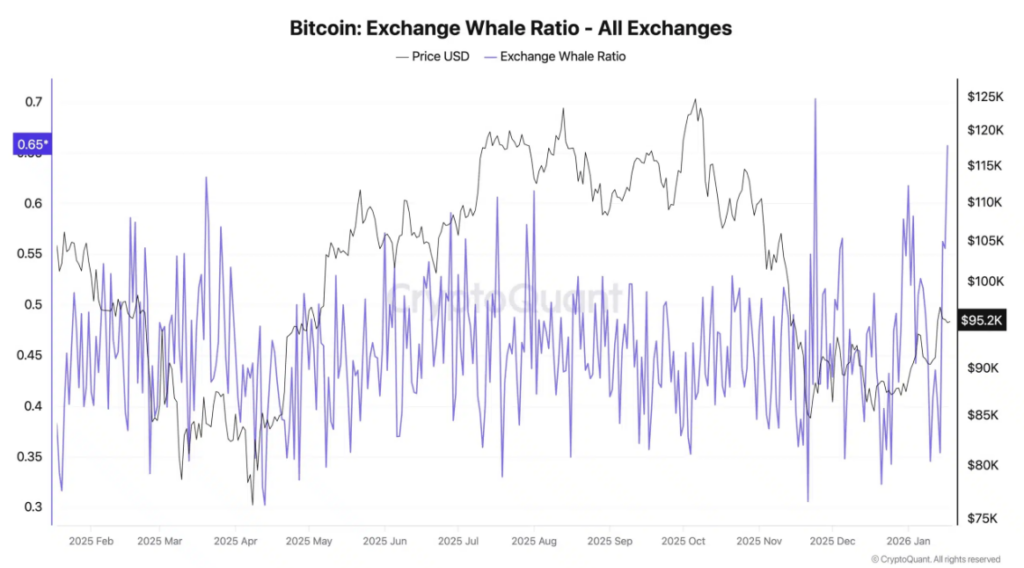

The Whale Ratio Provides a Brief-Time period Twist

Not all alerts are calm although. The Change Whale Ratio, sitting close to 0.657 at press time, factors to short-term fragility. This metric tracks how a lot of whole change influx comes from the highest ten largest transfers.

Something above 0.5 is often a pink flag. At present ranges, greater than two-thirds of Bitcoin flowing into exchanges is coming from only a handful of huge gamers. That means retail demand has cooled, leaving value extra delicate to the actions of some massive wallets.

So whereas long-term promoting strain has eased, the market nonetheless feels top-heavy close to the $95,000 space. It doesn’t imply collapse, nevertheless it does imply volatility can present up quick.

A Totally different Sort of Market in 2026

As January 2026 unfolds, the info factors to a structural reset fairly than a breakdown. The promoting that outlined late 2025, pushed by OG exits, ETF outflows, and leverage getting worn out, has largely run its course.

What’s changing it seems to be totally different. In mid-January alone, establishments absorbed roughly 30,000 BTC from the market. Throughout that very same interval, miners produced simply 5,700 BTC. That imbalance issues.

Bitcoin is not simply reacting to hypothesis. It’s being redistributed, slowly, from early believers to long-term allocators. The chart should chop, sentiment should swing, however beneath all of it, the construction feels… sturdier than earlier than.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.