- Solana’s energetic addresses and transaction quantity have surged, supporting the latest rebound

- Worth has damaged out of a multi-month downtrend and reclaimed key assist close to $135.5

- Momentum, derivatives positioning, and liquidation knowledge all lean cautiously bullish whereas assist holds

Solana’s on-chain metrics have expanded sharply over the previous week, pointing to renewed demand constructing beneath the latest worth rebound. Lively addresses jumped 56% week-over-week to roughly 27.1 million, whereas weekly transactions climbed to round 515 million. That scale issues. Sustained utilization tends to point out up earlier than worth power, not after.

Exercise alone doesn’t often spark rallies, although. What makes this transfer totally different is timing. The expansion in utilization aligned intently with worth stabilizing contained in the $119.8 to $135.5 demand zone. That overlap offers the restoration some construction, moderately than leaving it depending on sentiment alone. It additionally hints that capital is rotating again into Solana’s ecosystem with intent, not simply chasing short-term strikes.

Nonetheless, this assist wants consistency. If exercise drops again beneath latest averages, conviction fades shortly. For now, utilization metrics counsel patrons have regained management below worth, however that edge must be maintained.

SOL Breaks Out of a Multi-Month Downtrend

Worth motion has began to verify the shift. Solana broke free from its multi-month regression downtrend after patrons defended the $119.8 low and pushed worth again above descending resistance. That transfer mattered, particularly as a result of it wasn’t instantly rejected.

The breakout reclaimed the $135.5 to $147.1 zone and flipped it into assist. Beforehand, rallies saved failing beneath this space. This time, worth held, buying and selling close to $142 and persevering with to kind increased lows. So long as $135.5 stays intact, the construction favors continuation moderately than a return to the prior vary.

That stated, shedding this zone would reopen draw back threat towards $119.8. For now although, the chart helps a transition out of correction mode and right into a restoration section, even when upside nonetheless must be confirmed.

Momentum Begins to Catch Up With Construction

Momentum indicators are starting to align with the bettering construction. The MACD crossed increased from detrimental territory, with the MACD line rising above the sign line and the histogram flipping optimistic. That shift displays fading promote strain moderately than an overextended transfer, which is often a more healthy setup.

Earlier bounces lacked this sort of affirmation and pale shortly. This time, the crossover got here after assist was reclaimed, not earlier than. Increasing histogram bars counsel the pattern power is strengthening, although that wants follow-through. If momentum flattens right here, consolidation turns into extra doubtless.

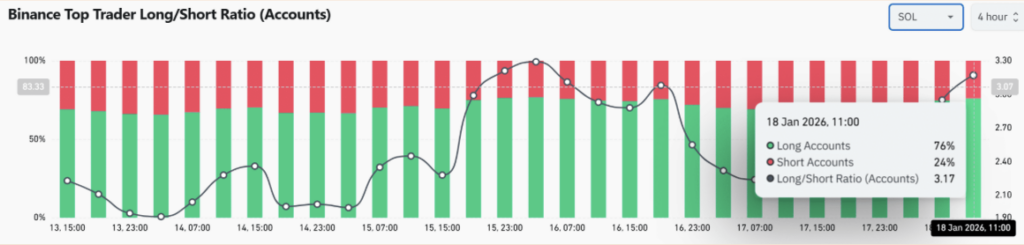

Merchants Lean Lengthy, however With out Extra

Derivatives knowledge reveals confidence rebuilding, however not in an overheated means. On Binance, prime dealer accounts are holding roughly 76% lengthy publicity versus 24% shorts, pushing the lengthy/brief ratio to about 3.17. That’s elevated, however not excessive. Overcrowding often begins displaying up nearer to 4.0 and above.

What stands out is positioning conduct. Lengthy publicity elevated after the technical breakout, not forward of it. That alignment reduces the chance of rapid distribution. Nonetheless, leverage stays delicate. A break beneath $135.5 might unwind longs shortly, so this degree continues to hold weight.

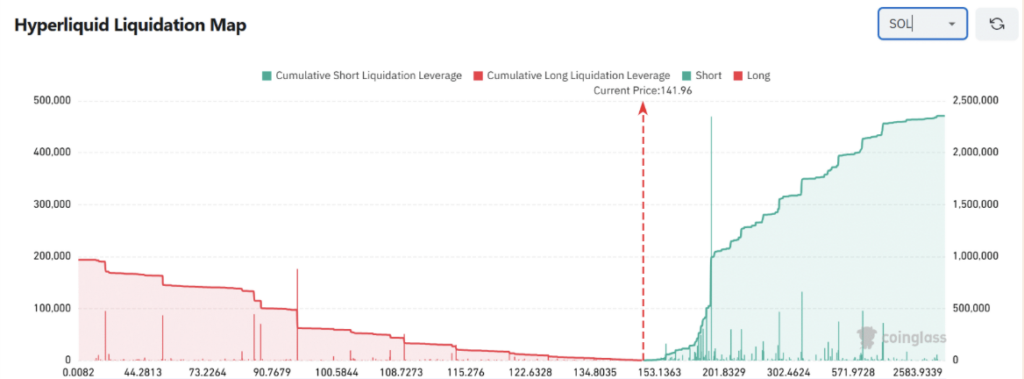

Liquidation Information Tilts the Danger Greater

Hyperliquid liquidation knowledge provides one other layer. There’s dense short-side liquidity stacked above present worth, particularly round $153, then increased close to $201 and even into the $300+ area. Beneath $135, lengthy liquidation clusters stay comparatively skinny.

That imbalance reduces draw back cascade threat and creates a possible upside magnet. If worth pushes increased, pressured brief liquidations might speed up momentum. After all, liquidity doesn’t transfer worth by itself, it wants a set off. However proper now, construction and momentum are aligned with these incentives.

The Larger Image for SOL

Taken collectively, Solana’s rebound appears to be like more and more grounded in measurable demand moderately than speculative enthusiasm. Rising community exercise, a confirmed trendline breakout, bettering MACD momentum, and long-leaning however managed derivatives positioning all level in the identical path.

So long as SOL holds above the $135.5 assist zone, overhead brief liquidity stays a legitimate upside driver. If that degree fails, momentum doubtless stalls and worth consolidates earlier than trying one other transfer.

For now, the sting belongs to the bulls, nevertheless it’s conditional.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.