- XRP fell under $2 amid a broader crypto market correction.

- Heavy liquidations and geopolitical tensions fueled risk-off habits.

- Quick-term stress stays, however longer-term expectations are nonetheless intact.

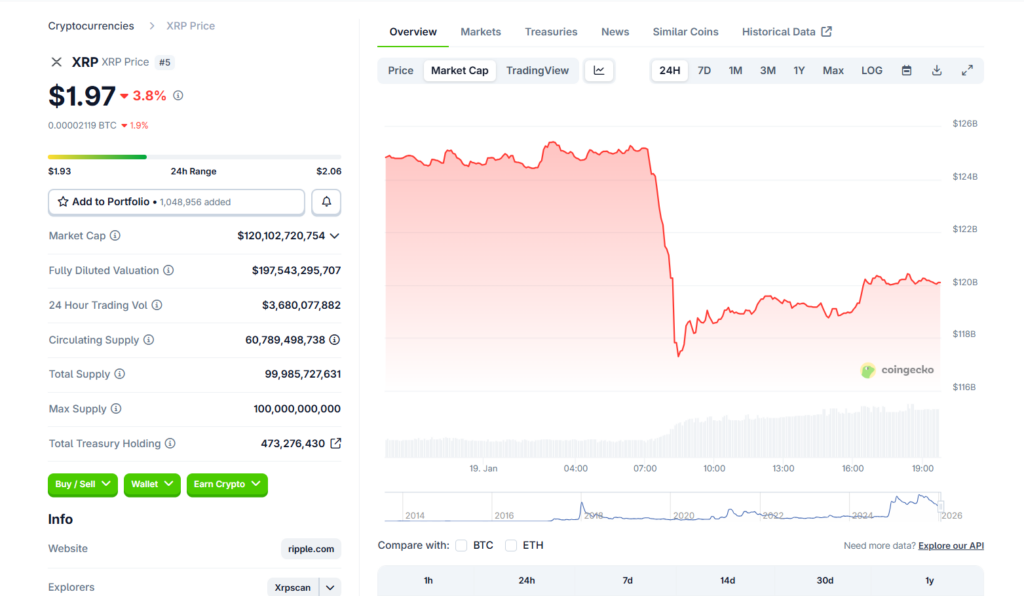

XRP noticed a pointy pullback right now, sliding from round $2.06 to $1.97 and wiping out current features. In line with CoinGecko, the token is down 4.1% over the past 24 hours, 6.2% on the week, and greater than 8% throughout the previous two weeks. Zooming out additional, XRP stays practically 40% under its January 2025 ranges, although it has nonetheless managed to carry a modest 3.8% acquire on the month-to-month chart. The transfer has reignited debate over whether or not XRP’s current bounce was a real restoration or just a useless cat bounce.

A Market-Large Reset Is Driving the Transfer

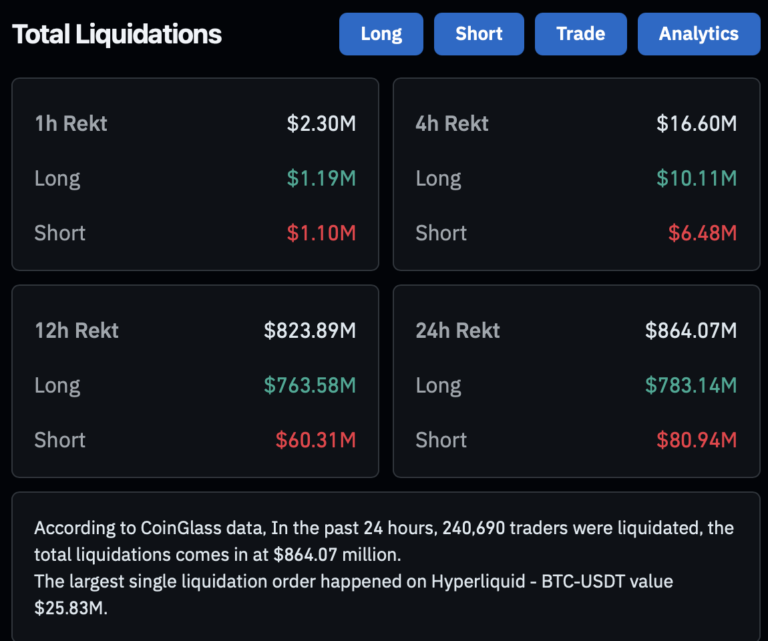

XRP’s decline didn’t occur in isolation. The broader crypto market is present process a correction after Bitcoin failed to carry above $97,000 and slid again towards $92,000. As typically occurs, altcoins adopted BTC decrease. In line with CoinGlass information, greater than $864 million in leveraged positions had been liquidated throughout the crypto market prior to now 24 hours, including pressured promoting stress and accelerating draw back strikes.

Geopolitical Danger Provides One other Layer

Past technical elements, rising geopolitical pressure seems to be weighing on sentiment. Current developments surrounding the US and Greenland have launched contemporary uncertainty, with President Trump signaling an aggressive stance based mostly on nationwide safety considerations. Opposition from NATO allies and discuss of navy assist for Denmark have added to investor nervousness. In risk-sensitive markets like crypto, these headlines are likely to push contributors towards de-risking somewhat than including publicity.

Why XRP Nonetheless Seems Susceptible Quick-Time period

The October 2025 market crash left lasting scars, and confidence has but to totally get well. Many traders are nonetheless leaning defensive, rotating into belongings like gold and silver somewhat than high-volatility tokens. In that context, XRP may stay below stress within the coming weeks, particularly if Bitcoin struggles to reclaim key ranges and macro uncertainty persists.

Why the Longer-Time period Case Isn’t Lifeless

Regardless of the present weak spot, XRP’s broader narrative hasn’t disappeared. The asset had a robust run in 2025, and expectations for 2026 stay elevated. CNBC not too long ago labeled XRP the “hottest crypto commerce of 2026,” reflecting continued institutional and retail curiosity. If market situations stabilize and threat urge for food returns later within the 12 months, XRP may nonetheless discover room to regain momentum.

For now, although, the market is sending a transparent message. Warning is in management, and rallies will want stronger affirmation earlier than confidence returns.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.