- Ethereum is rising because the main chain for institutional tokenization

- Banks, tech corporations, and cost giants are actively deploying on ETH

- Tokenization is more and more seen as a long-term driver for ETH’s value

The narrative round Ethereum as the following main breakout chain is now not theoretical. It’s beginning to present up in actual institutional habits. Ethereum is quickly positioning itself as the popular blockchain for tokenization, funds, and monetary experimentation, and its tempo of institutional adoption now outstrips each different main crypto community. For a lot of giant gamers, ETH is now not another guess. It’s changing into core infrastructure.

Ethereum’s Institutional Flywheel Is Spinning Sooner

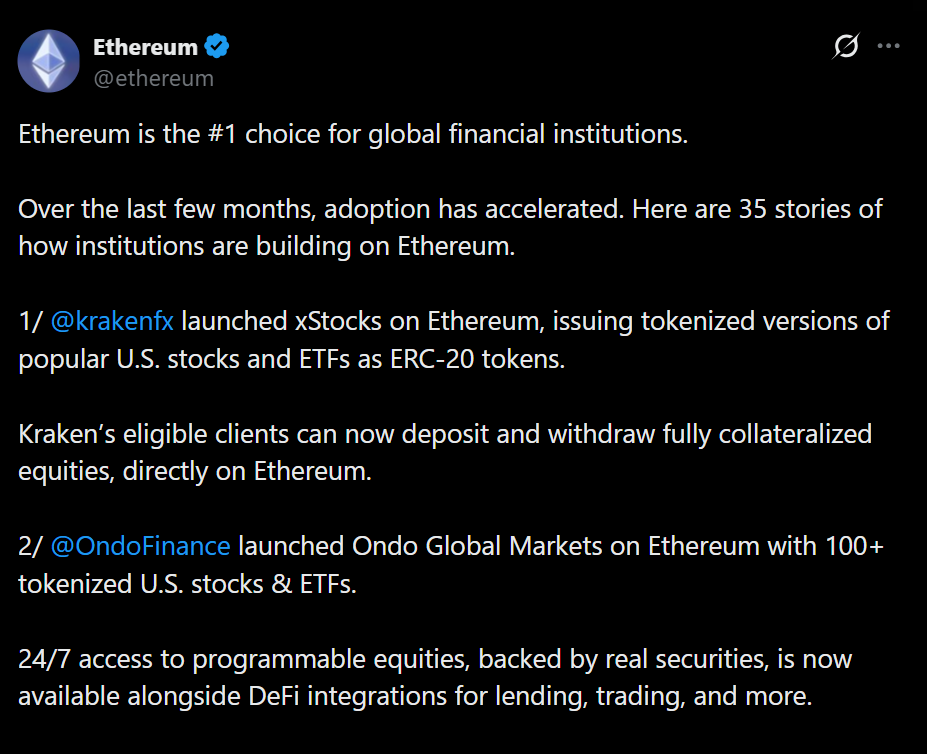

In line with a latest replace shared by Ethereum’s official X account, the community now sits on the heart of the worldwide tokenization push. Main monetary and expertise corporations are actively deploying merchandise on Ethereum, not simply testing ideas in isolation. Kraken has launched xStocks on Ethereum, issuing tokenized variations of in style US equities and ETFs as ERC-20 tokens. Eligible purchasers can deposit and withdraw absolutely collateralized shares instantly on-chain, blurring the road between conventional brokerage and decentralized infrastructure.

On the similar time, Google has entered the image with its Agent Funds Protocol, constructed on Ethereum. The system permits AI brokers to autonomously execute stablecoin funds, developed in collaboration with the Ethereum Basis, Coinbase, MetaMask, and different ecosystem gamers. It’s a concrete step towards automated finance working on public blockchain rails.

Banks Are Utilizing Ethereum, Not Simply Finding out It

Past crypto-native corporations, conventional banking establishments are additionally shifting previous pilot rhetoric. UBS, Sygnum, Submit Finance, and the Swiss Bankers Affiliation have efficiently examined deposit tokens on Ethereum, demonstrating legally binding, cross-bank settlement utilizing public blockchain infrastructure. That proof-of-concept exhibits Ethereum can assist programmable, prompt settlement between regulated establishments, a functionality legacy programs wrestle to match.

American Specific has additionally joined the wave, launching blockchain-based journey card NFTs by its Amex Passport initiative on Ethereum’s Base layer. The mission brings loyalty packages and journey data on-chain, mixing conventional shopper finance with digital possession in a manner that feels sensible reasonably than experimental.

Tokenization Is Beginning to Matter for Value

Ethereum’s increasing function in tokenization is more and more being seen as a long-term value catalyst. The ecosystem now consists of initiatives from JPMorgan, Mastercard, and different world monetary heavyweights, all utilizing Ethereum because the settlement and issuance layer. Fundstrat’s Tom Lee has repeatedly pointed to tokenization because the defining progress driver for Ethereum, arguing it might ultimately push ETH into the $7,000 to $9,000 vary over the long term.

Why Ethereum’s Place Is Totally different

What units Ethereum aside isn’t hype, it’s convergence. Monetary establishments, cost networks, AI builders, and shopper manufacturers are all selecting the identical base layer. That sort of alignment is uncommon in crypto. As extra real-world belongings and monetary flows migrate on-chain, Ethereum is quietly changing into the default venue the place all of it settles.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.