GameFi tokens had been left for useless after a brutal 2025. The sector ended the yr down roughly 75%, wiping out most investor curiosity. However early 2026 is beginning to present one thing completely different.

Utilization knowledge and costs are quietly turning up throughout a couple of gaming-focused chains. It’s nonetheless early, however for the primary time in months, the numbers counsel GameFi could also be stabilizing — with a handful of tokens transferring first.

GameFi Is Displaying Early Indicators of Life Once more — What Offers

The primary sign comes from on-chain utilization.

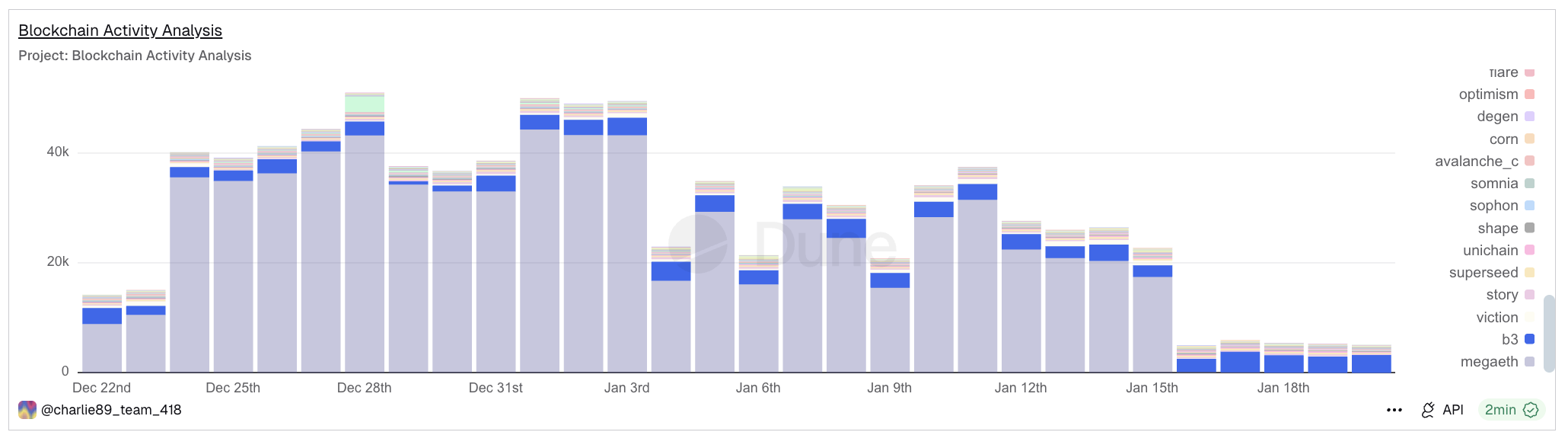

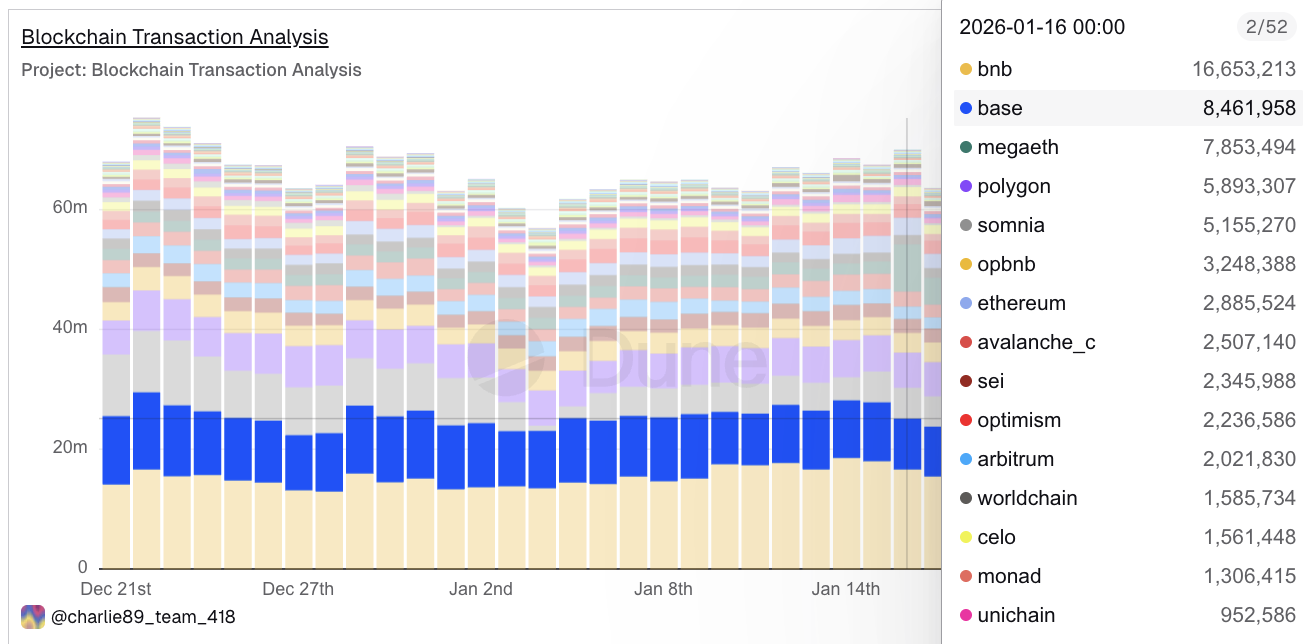

Whereas scanning early-2026 Dune analytics dashboard knowledge throughout EVM chains, one metric stood out: common transactions per energetic pockets. This measures the depth of exercise, not simply the pockets depend. Over the previous 4 consecutive days, B3, the gaming layer constructed on Base, has led all main chains on this metric, beating Optimism, Mantle, Stream, and others.

Sponsored

Sponsored

That issues as a result of actual gaming conduct reveals up as repeated actions by the identical customers.

Base itself is reinforcing this sign. Past B3’s dominance in per-wallet exercise, Base has additionally ranked close to the highest in whole each day transactions over the identical interval, indicating that gaming exercise is feeding into broader community utilization.

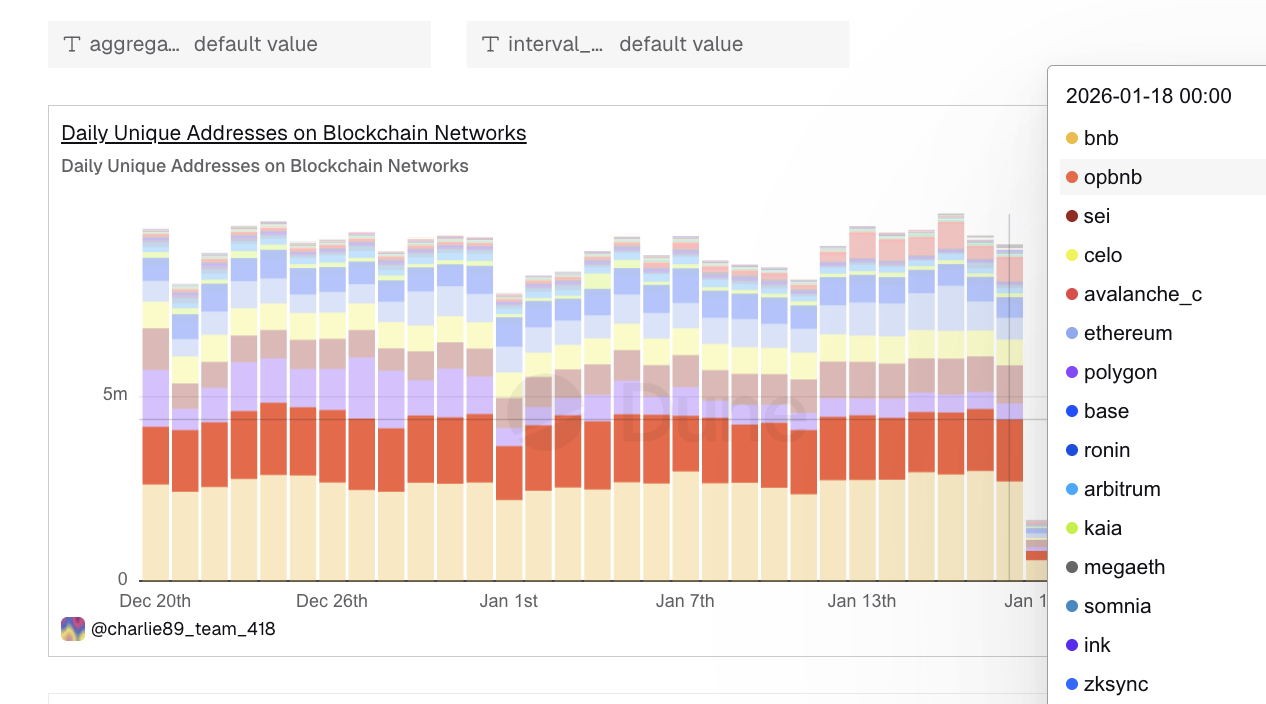

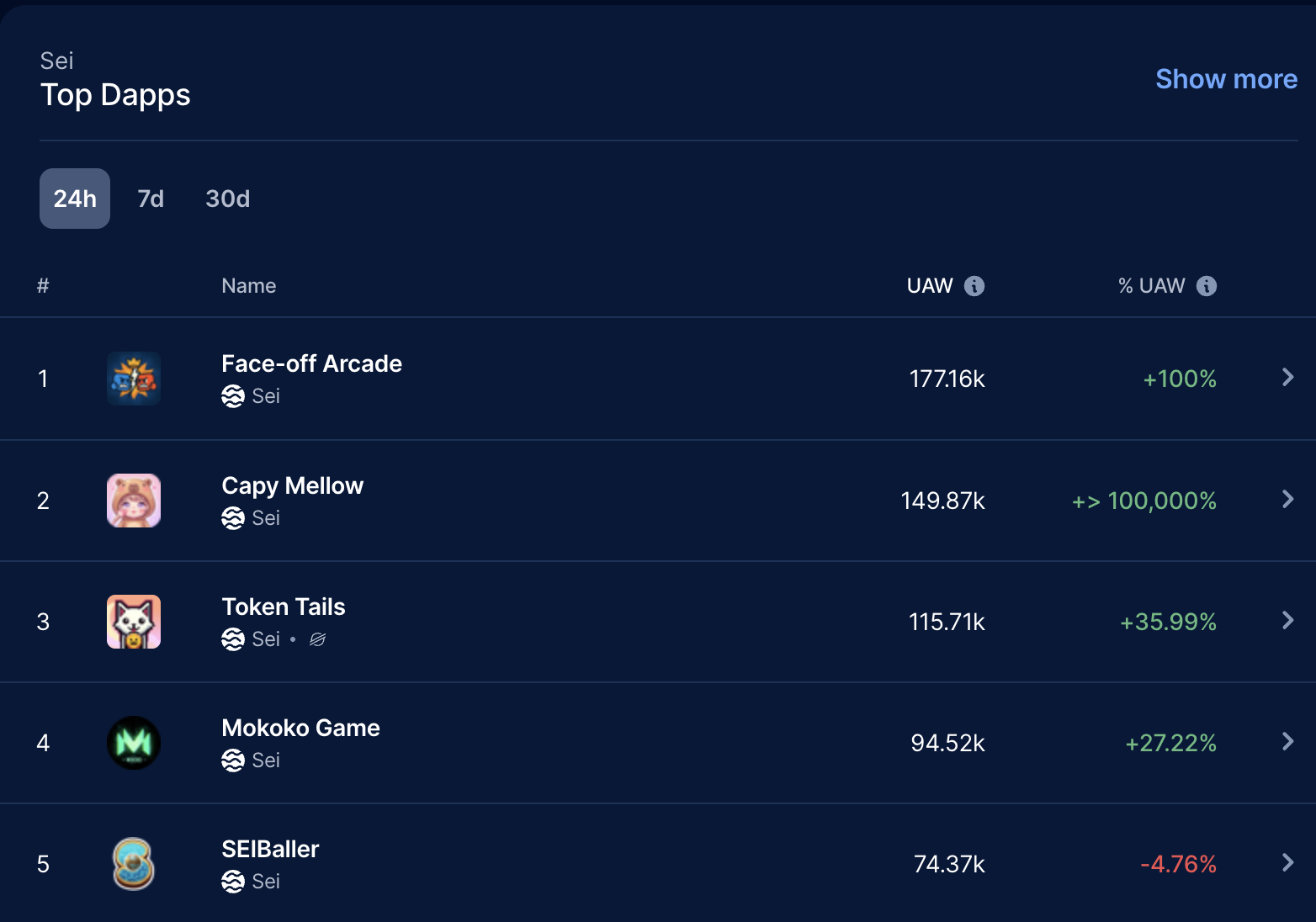

An identical sample is showing on Sei, one other gaming-heavy chain. Over the previous a number of days, Sei has persistently stood out in each day distinctive addresses.

When damaged down additional, DappRadar knowledge reveals a number of Sei-based video games posting sharp 24-hour development in energetic wallets.

Context issues right here. GameFi fell almost 75% in 2025.

As the primary month of 2026 begins, these alerts are beginning to line up, as highlighted by specialists like Yat Siu, Chairman of Animoca Manufacturers.

This doesn’t imply GameFi is again in full pressure. However it does counsel that the worst section of abandonment could also be passing.

When requested what actually issues for a GameFi restoration, and which indicators buyers ought to concentrate on past short-term worth strikes, Robby Yung, CEO of Animoca Manufacturers, stated in an unique commentary to BeInCrypto:

Sponsored

Sponsored

“For the GameFi class usually, I feel that there must be a strong, participating product underlying the token (as at all times),” he stated.

That brings the main target to cost. A small group of established GameFi tokens is already responding.

Axie Infinity (AXS): Sentiment Surge and Construction Align

Axie Infinity is rising as one of many strongest leaders within the GameFi rebound. AXS is up roughly 117% over the previous seven days, clearly outperforming most large-cap gaming tokens as January progresses.

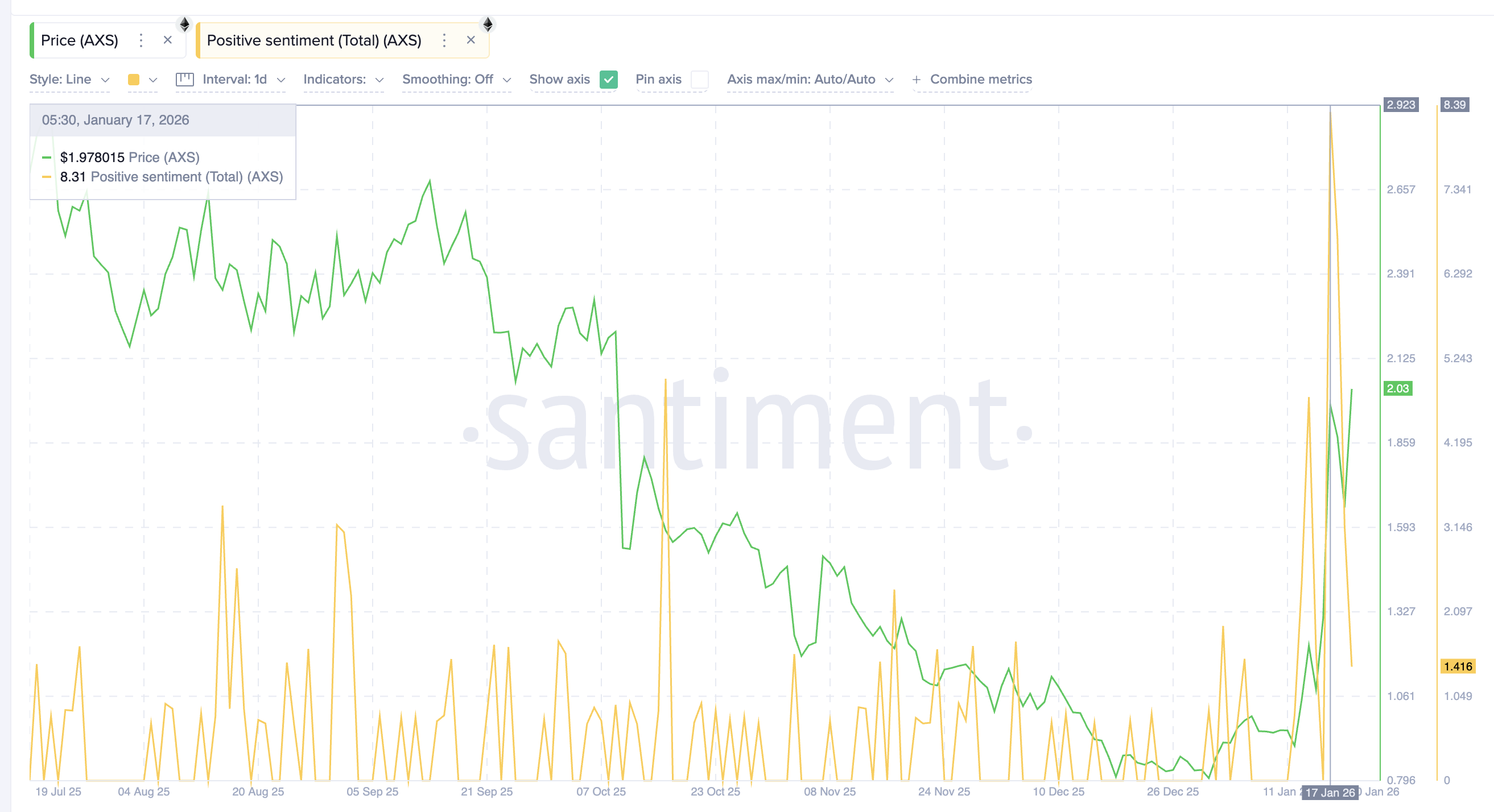

One cause Axie is transferring forward of the pack is enhancing sentiment, pushed by a shift in how the neighborhood views the venture. On January 17, constructive sentiment for AXS spiked to eight.31, the very best stage seen in over six months. Optimistic sentiment tracks how usually a token is mentioned favorably throughout social and on-chain channels, and spikes of this measurement normally replicate renewed engagement quite than late-stage hypothesis.

That sentiment shift traces up with a elementary catalyst highlighted immediately by Robby Yung, who addressed Axie’s latest power:

“The catalyst, on this case, was a change within the tokenomic mannequin for AXS, which was very well-received by the neighborhood, and led to an uptick in shopping for because the neighborhood was reinvigorated, so that is very a lot a grass roots-led motion,” he talked about.

Whereas that sentiment studying has cooled barely, it stays elevated in comparison with latest weeks, holding consideration centered on AXS.

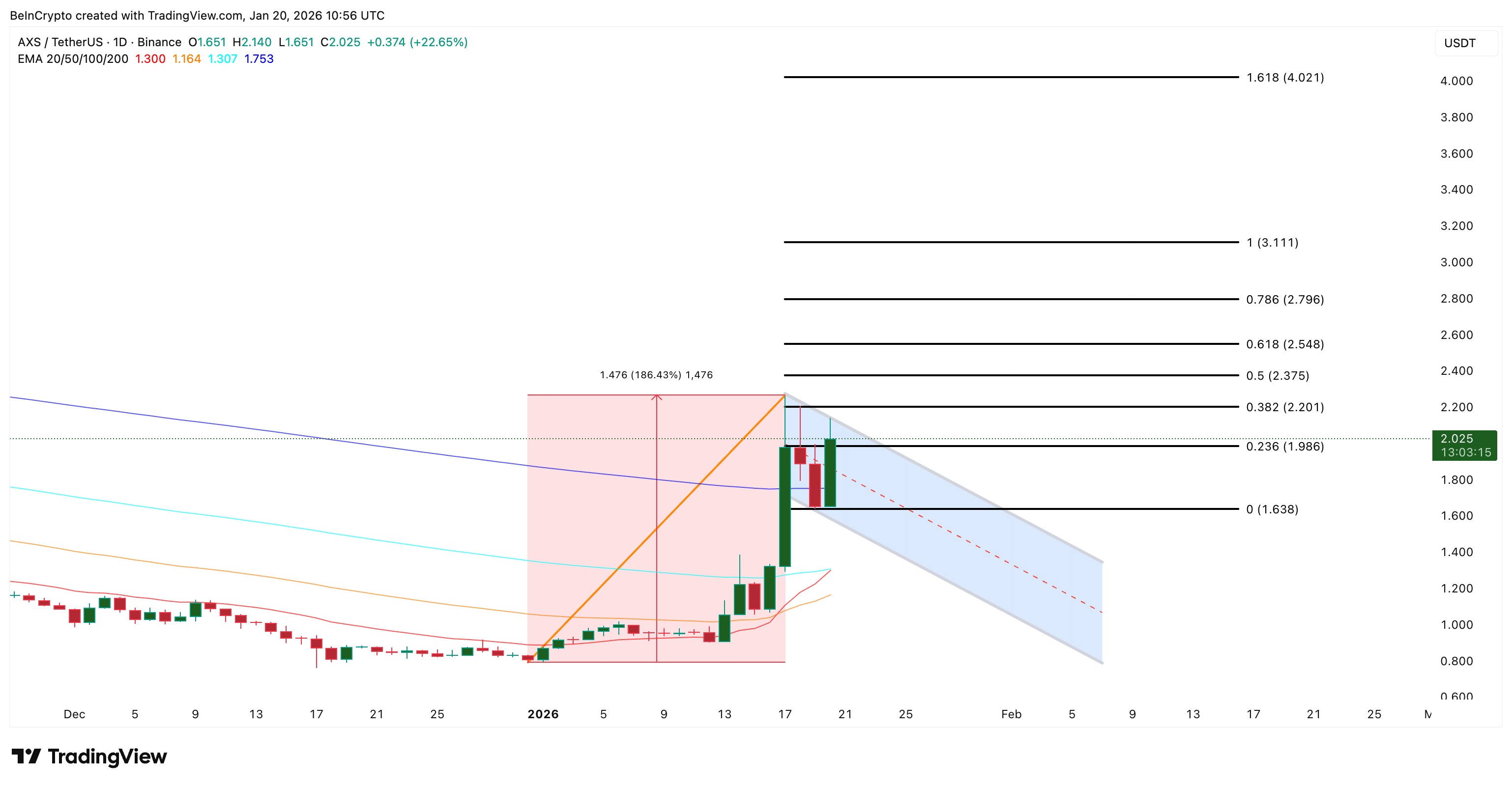

From a worth perspective, AXS started its rally in early January and is now consolidating after a pointy vertical transfer. This pause resembles a bull-flag construction, the place worth digests beneficial properties with out breaking the pattern. So long as greater lows proceed to carry, the sample stays constructive quite than exhausted.

Pattern assist is tightening. The 20-day exponential transferring common (EMA) is rising towards the 100-day exponential transferring common, which regularly acts as a medium-term pattern filter. A confirmed bullish crossover would reinforce the continuation case. A clear each day shut above $2.20 would sign a breakout from consolidation and open upside towards $3.11 and even greater.

Sponsored

Sponsored

Invalidation ranges are properly outlined. A sustained drop under $1.98 would weaken the bullish construction. A deeper transfer under $1.63 and ultimately the 100-day transferring common line would invalidate the setup.

The Sandbox (SAND): Axie’s Bellwether Impact Spills Into Bigger GameFi Tokens

The Sandbox is starting to comply with Axie Infinity’s lead, reinforcing the concept the GameFi rebound is spreading past a single token. SAND is up roughly 27% over the previous seven days and almost 9% within the final 24 hours, a notable transfer for one of many largest gaming tokens by market worth.

That sequencing issues. Axie moved first, and Sandbox is reacting after, regardless of SAND being the chief by way of market cap. This traces up with how Robby Yung framed the sector dynamic, noting that Axie usually units the tone for broader GameFi strikes. As he put it,

“AXS may be very a lot a bellwether on this class, so once we see motion there, it’s more likely to be excellent news for the remainder of the sector,” he stated.

On-chain knowledge helps the constructive outlook. Since January 16, SAND’s change circulate stability has flipped sharply. Earlier within the month, change balances confirmed web inflows of about 4.36 million SAND, signaling energetic promoting. That has now reversed into web outflows of roughly 2.33 million SAND, that means tokens are being pulled off exchanges quite than ready on the market.

Shopping for strain rising alongside worth power is a constructive sign, particularly for a large-cap token.

From a worth construction standpoint, SAND is forming a cup-and-handle sample, one other breakout formation. The rounded base developed by December, adopted by a robust restoration leg in early January. Worth is now consolidating within the deal with zone. A clear each day shut above $0.168 would break the neckline and open upside towards $0.190, with extension potential towards the $0.227 zone.

Sponsored

Sponsored

Invalidation stays clear. Shedding $0.145 weakens the construction, whereas a drop under $0.106 would invalidate the bullish setup solely.

Decentraland (MANA): Whale Accumulation Indicators Early Positioning

Decentraland is the weakest short-term performer amongst main GameFi tokens, however that could be precisely why it’s attracting large cash. MANA is up about 7% over the previous 24 hours and roughly 15% over the previous seven days, lagging Axie Infinity and The Sandbox in share phrases.

What stands out is how whales are positioned throughout that relative underperformance.

Since January 17, wallets holding massive MANA balances have elevated their mixed holdings from roughly 1.00 billion tokens to 1.02 billion, an addition of about 20 million MANA, virtually $3.2 million, in just some days. At one level, whale balances briefly reached 1.03 billion earlier than some gentle trimming. That pullback was shallow and adopted by renewed accumulation, suggesting positioning quite than distribution.

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

From a worth construction perspective, MANA seems to be breaking out of an inverse head-and-shoulders sample on the each day chart. This sample usually marks a transition from downtrend to restoration when it holds. The breakout zone sits close to $0.159, with power enhancing on greater closes.

For affirmation, MANA wants a each day shut above $0.161. If that holds, upside targets open close to $0.177, $0.20, and doubtlessly $0.221, with prolonged resistance close to $0.24 if GameFi momentum broadens.

A drop again under $0.152 would weaken the breakout, whereas a transfer underneath $0.137 would invalidate the whole construction.

MANA could also be transferring final, however whale conduct suggests it could not keep that manner if the GameFi narrative continues to rebuild.