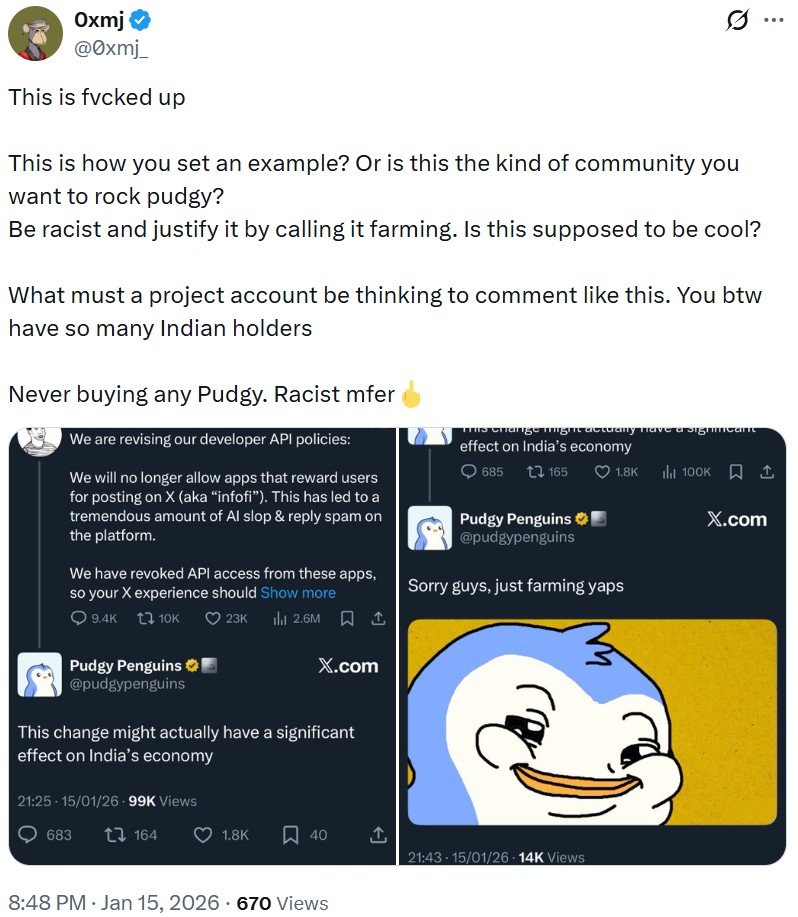

Pudgy Penguins makes enemies in India

Non-fungible token model Pudgy Penguins has drawn backlash over a now-deleted put up on X that singled out Indian social media customers.

The controversy adopted a current announcement by X product head Nikita Bier that the platform will prohibit functions from rewarding customers for posts, a class also known as “infofi,” citing the unfold of AI-generated spam and low-quality content material.

In crypto circles, the change impacts customers who earn rewards by farming engagement, together with so-called “yaps” on platforms comparable to Kaito.

In response to Bier’s announcement, the Pudgy Penguins X account posted, “This variation may even have a big impact on India’s financial system.”

Whereas some customers figuring out themselves as Indian mentioned they discovered the put up humorous, others didn’t take it as calmly. A number of accused the model of selling racist stereotypes, prompting additional criticism after the Pudgy Penguins account supervisor appeared to comply with up by saying the put up was supposed for “farming yaps.”

Different commenters mentioned the problem went past racism, arguing the put up mirrored poor model judgment for a mission that markets itself as family-friendly.

Pudgy Penguins later deleted the put up. The corporate didn’t reply to Journal’s request for remark.

Ex-digital yuan boss acquired Ether bribes

A state tv documentary has alleged that former Folks’s Financial institution of China official Yao Qian accepted 2,000 ether in bribes and later cashed out a part of the holdings.

In keeping with state broadcaster CCTV, Yao acquired 2,000 ether in 2018 from a crypto entrepreneur with the surname of “Zhang” in trade for utilizing his affect to assist facilitate a token issuance and abroad trade itemizing. Investigators additionally mentioned Yao accepted an extra 12 million yuan (about $1.72 million) in money bribes.

Yao later liquidated 370 ETH in 2021, producing roughly 10 million yuan, or $1.43 million. Investigators mentioned their suspicions intensified after funds traced to the ether liquidation had been used to assist pay for a Beijing villa value greater than $2.9 million, which was registered underneath the title of Yao’s relative.

Authorities mentioned the case was established by means of a mixture of onchain transaction evaluation, tracing of fiat flows and the seizure of {hardware} wallets from Yao’s workplace.

Yao beforehand led the early growth of China’s central financial institution digital foreign money, the digital yuan. He was positioned underneath investigation in April 2024, expelled from the Communist Social gathering and faraway from public workplace in November over crypto bribery allegations.

A number of main cryptocurrency-related actions have been banned in phases in China, together with a crackdown on mining and buying and selling in 2021.

Learn additionally

Options

Get your a reimbursement: The bizarre world of crypto litigation

Options

The Street to Bitcoin Adoption is Paved with Complete Numbers

Japan’s largest card firm assessments stablecoin funds

Japanese bank card community JCB, banking group Resona Holdings and fintech agency Digital Storage have introduced a stablecoin pilot aimed toward retail funds.

The pilot will take a look at in-store funds utilizing US greenback and Japanese yen-denominated stablecoins at bodily retail areas.

JCB, Japan’s largest home card community, will oversee the infrastructure wanted for retailers to just accept stablecoin funds from each native customers and vacationers. Whereas extensively utilized in Japan, JCB’s worldwide attain is extra restricted than that of Visa or Mastercard.

Japan was among the many first main economies to approve and launch a regulated stablecoin pegged to its native foreign money. Different jurisdictions have since accelerated their very own stablecoin regulatory efforts following the passage of the GENIUS Act within the US.

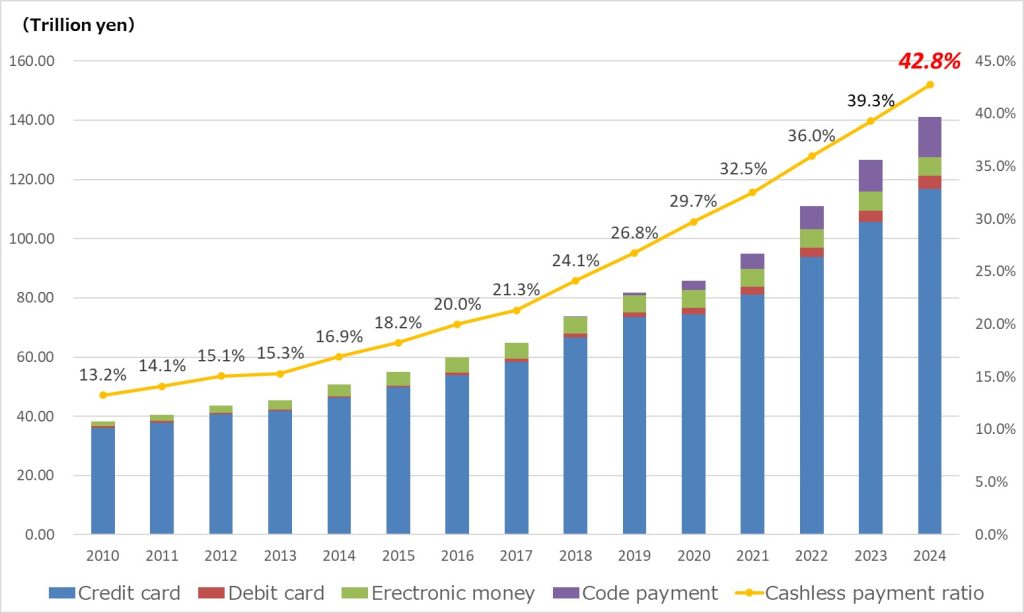

Japan stays extra reliant on money than its East Asian friends comparable to South Korea and China, though that dependence has been declining. Cashless funds accounted for about 30% of transactions in 2020, rising to 42.8% in 2024.

Japan’s stablecoin drive comes as a part of broader authorities efforts to digitize Japan’s financial system. Up to date cashless cost figures for 2025 are anticipated to be launched within the first quarter of 2026.

Learn additionally

Options

Coinbase hack exhibits the regulation most likely gained’t defend you: Right here’s why

Options

House loans utilizing crypto as collateral: Do the dangers outweigh the reward?

South Korea crypto trade affiliation enters possession warfare with the federal government

South Korea’s cryptocurrency exchanges have reportedly opposed a authorities proposal to cap possession stakes held by main shareholders.

The Digital Asset Alternate Alliance (DAXA), an trade group representing the nation’s 5 largest crypto exchanges, mentioned that it has “critical considerations” about obvious authorities plans to restrict main shareholders’ possession to between 15% and 20%.

Such a regulation may hinder the event of the home digital asset trade and market, DAXA mentioned.

The group added that the proposal may drive home merchants to abroad platforms, doubtlessly diluting the most important shareholders’ accountability for the custody and administration of consumer belongings, thereby undermining the said objective of consumer safety.

South Korean regulators are nonetheless drafting the nation’s cryptocurrency regulatory framework, after lacking a December deadline. Lawmakers from the ruling social gathering have mentioned they plan to submit their very own proposal in January.

In keeping with trade sources cited by native media, the Monetary Companies Fee just lately submitted a proposal to lawmakers that included the possession cap. The FSC reportedly argued that crypto exchanges operate as crucial market infrastructure, making it essential to forestall extreme focus of earnings.

Subscribe

Essentially the most participating reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan (Hyoseop) Yun is a Cointelegraph employees author and multimedia journalist who has been overlaying blockchain-related subjects since 2017. His background contains roles as an project editor and producer at Forkast, in addition to reporting positions centered on know-how and coverage for Forbes and Bloomberg BNA. He holds a level in Journalism and owns Bitcoin, Ethereum, and Solana in quantities exceeding Cointelegraph’s disclosure threshold of $1,000.