On Tuesday, Jan. 20, the crypto market is melting beneath macro warmth, as following all of the “tariff battle” and Greenland context, the Nasdaq 100 crashes -1.6%, the Dow flirts with a -700pt slide and gold, within the meantime, rips by $4,700 for the primary time ever.

In crypto, this carnage is represented by high-leverage XRP whale misfiring with an eye-watering $14 million loss, Bitcoin hitting $0 on a decentralized futures alternate and SHIB derivatives pulling off one of the uneven liquidation spikes on document.

TL;DR

- “Sensible cash” makes errors too, as a Hyperliquid whale opens a $74.68 million lengthy on XRP proper as the value hit a neighborhood peak.

- Bitcoin crashes to $0 on Paradex as a result of a glitch, allegedly liquidating 1000’s of merchants.

- Standard meme coin Shiba Inu (SHIB) prints an irregular 5,407,865% liquidation imbalance as shorts complete simply $0.89 in 4 hours.

XRP bull bets $74.68 million on worth rise and fails

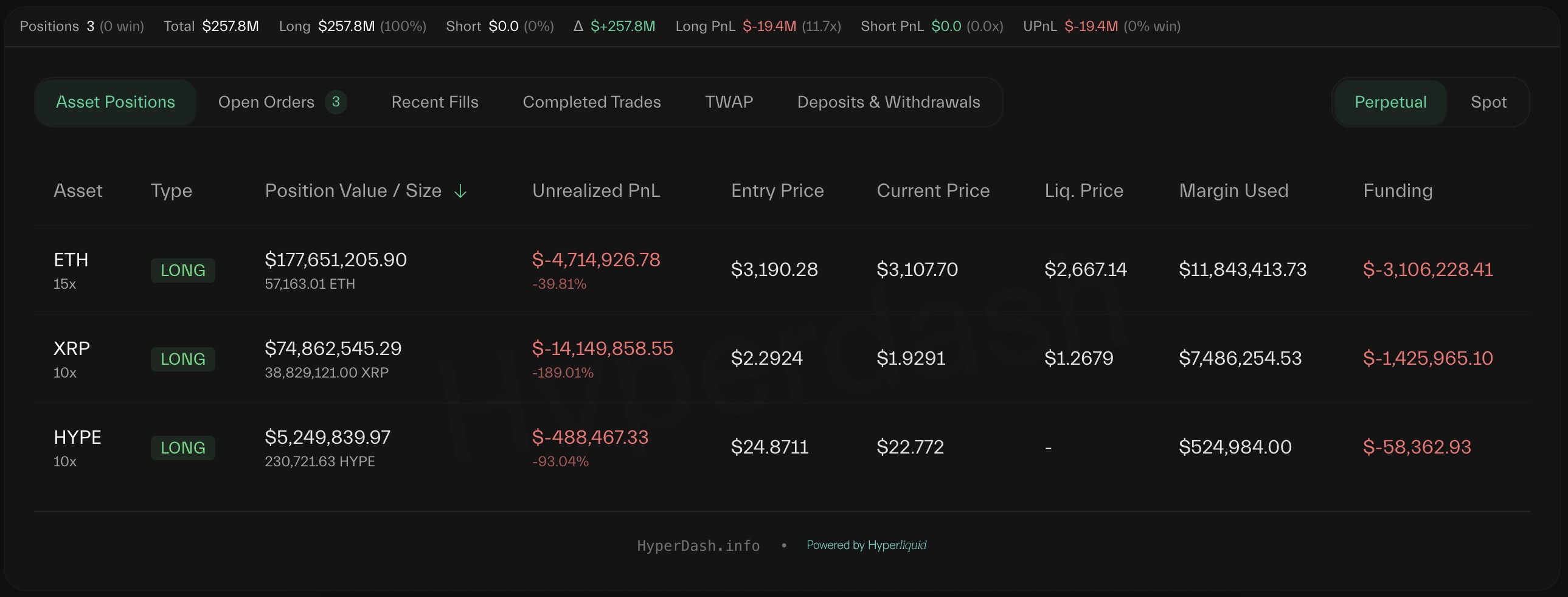

One of many largest seen XRP lengthy positions on Hyperliquid simply imploded in actual time. The pockets opened a $74,951,852.27 place price 38,829,121.00 XRP utilizing 10x leverage with an entry at $2.292 — brutally timed to what turned out to be the native prime.

Morning Crypto Report: $74.68 Million XRP Bull Makes Brutal Mistake, Bitcoin Briefly Hits $0 On Decentralized Change, Shiba Inu (SHIB) Delivers 5,407,865% Liquidation Shock: What Occurred?

Ripple CEO to Go Dwell in Davos

U.At this time Crypto Evaluation: XRP’s Greatest Value Bounce, Shiba Inu (SHIB) Nonetheless Preventing, Is Ethereum (ETH) Eyeing Third $3,500 Breakout?

U.At this time Crypto Digest: XRP Hits Insane 8,700% Liquidation Imbalance, $500 Million BTC Whale Awakents to Dump Bitcoin, Shiba Inu (SHIB) Bulls Lose Management

With the present buying and selling worth of XRP at $1.9303, the unrealized loss stands at -$14,060,551.57, which is equal to -187.59%.

The liquidation worth for the place is $1.2694, in keeping with knowledge. With the present fee of drawdown, that degree isn’t just hypothetical anymore. To maintain this place, the dealer already took on $1,425,965.10 in funding prices, with margin collateral totaling $7,495,185.23. With all of the funding strain and development decay, the chances are brutal.

This loss alone is nearly 73% of the whole every day Hyperliquid PnL drawdown, which hit -$19.2 million throughout all lengthy positions. The second-worst performing lengthy from the identical portfolio is ETH, down -$4.81 million at 15x leverage, whereas a smaller HYPE place misplaced -$440,000.

For XRP, it appears to be like like it’s in a descending volatility compression, with assist at $1.66 and key resistance at $2.05. If the 20-day EMA doesn’t maintain close to $1.89, the entire bull construction is perhaps invalidated.

$0 Bitcoin worth glitch goes viral

Issues obtained slightly loopy on Jan. 19 when the decentralized futures platform, Paradex, had a glitch in its knowledge backend. This precipitated BTC to briefly register a worth of $0.

Paradex workers put a cease to some companies and managed to revive order inside seven hours, however 1000’s of customers have been nonetheless affected.

Any positions that have been executed through the crash — particularly these utilizing perpetual orders — have been processed in keeping with the protocol, which meant that consumer losses have been closing. A rollback snapshot was deployed, nevertheless it solely protected spot states, not leveraged contracts.

Earlier than it went beneath, there was a buying and selling quantity of $2.8 billion. By Jan. 20, Paradex’s open curiosity had gone up from the earlier week, which makes it seem to be customers are both betting on platform compensation or simply ignoring the dangers.

It’s most likely due to the zero-fee operations that hold making the platform interesting, although the system is a bit shaky.

Exterior the platform, the market didn’t appear too bothered by the glitch. BTC/USD throughout centralized exchanges stayed within the $90,800-$91,300 vary.

Shiba Inu (SHIB) derivatives market shocked by 5,407,865% liquidation imbalance

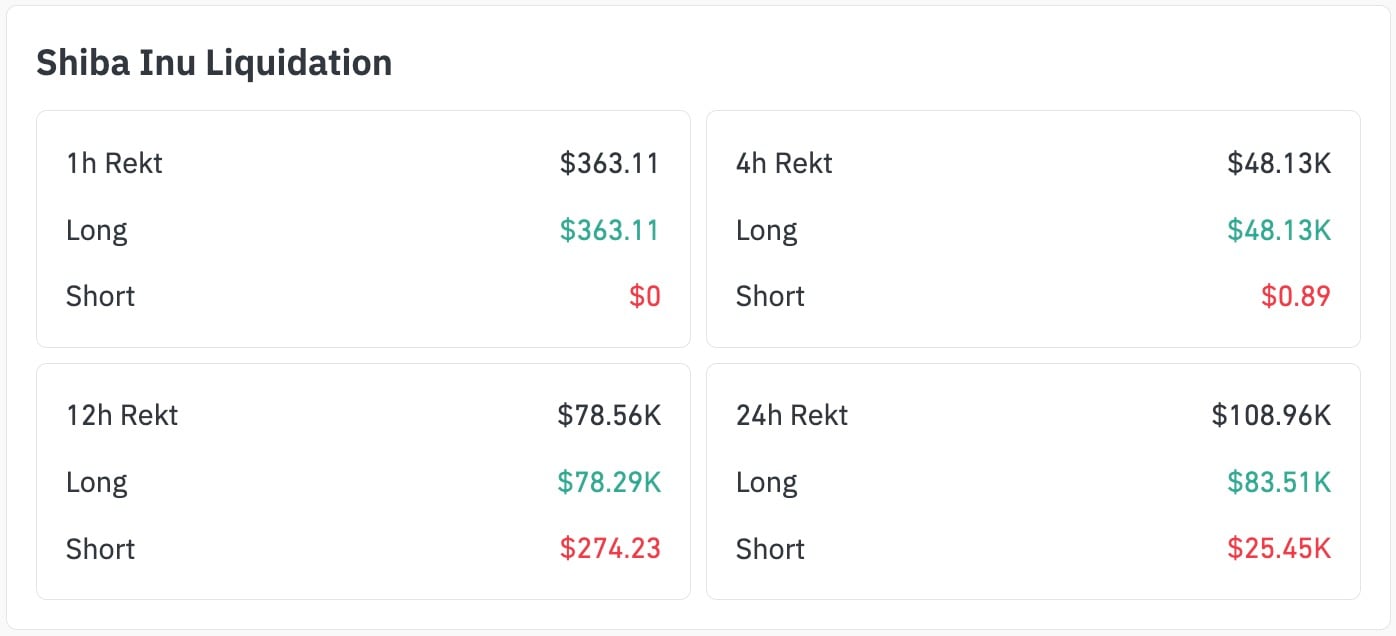

Shiba Inu lengthy futures simply had a liquidation ratio that’s onerous to imagine: $48,126.83 liquidated on the lengthy facet, versus simply $0.89 brief, as per CoinGlass. This 5,407,865% imbalance occurred over a four-hour interval as SHIB broke beneath a key assist degree at $0.000008.

The set off zone lined up with a earlier assist degree at $0.00000786, breaking the neckline of the native vary low. The drop went by a bunch of margin cease clusters on leverage exchanges.

SHIB’s every day chart reveals that it has been dropping constantly because it hit the $0.0000090 rejection zone. The following huge assist degree is at $0.00000699, which is the October swing low. There, restrict orders might stack up once more.

The size of long-side liquidations with just about no short-side counterflow highlights how asymmetrical SHIB’s derivatives market has grow to be. Many of the individuals are nonetheless web lengthy, which creates a harmful sample on any dip.

Even with all of the drama, the whole notional liquidated is definitely fairly small in greenback phrases, however the imbalance ratio is now one of many highest ever registered on an hourly foundation for a prime 30 coin.

Crypto market outlook

The general scenario for the crypto market is hostile. Proper now, the preferred choices on Deribit are for Bitcoin put choices between $75,000 and $80,000. The cryptocurrency is holding above $91,000, however there’s rising bearish strain. The Worry & Greed Index dropped 12 factors to 32, which is the bottom it has been since mid-October.

On-chain knowledge reveals holders have bought at a loss for 30 days in a row — one thing we now have not seen since This fall, 2023. However establishments and whales are shopping for into that weak spot: over 577,000 BTC added within the final 12 months, valued at round $53 billion.

Key ranges to observe:

- XRP: $1.89 is midband assist, $2.05 is breakout set off, however $1.66 stays an untouched liquidation cluster.

- Shiba Inu (SHIB): Regulate $0.00000786 for short-term protection, and $0.00000699 for absolute assist.

- Bitcoin (BTC): Demand zone is between $88,500 and $91,000, however choices merchants need blood at 80,000.

Danger is uneven throughout the board. Gold is main as a macro hedge, Bitcoin is combating for narrative assist and altcoins are the final word “scapegoat” being punished throughout leverage markets.