- Crypto’s Trump-driven narrative has largely run its course

- Institutional capital is now shaping market construction and threat

- Bitcoin is hardening as a reserve asset whereas altcoins face greater requirements

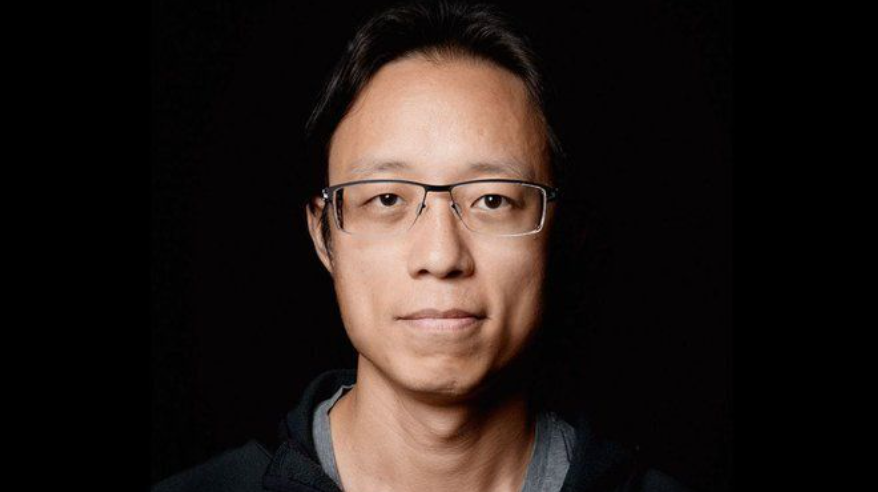

Crypto’s 2025 value motion leaned closely on expectations tied to Donald Trump. Professional-crypto rhetoric, coverage hints, and political momentum mattered greater than fundamentals for a lot of the 12 months, and markets reacted rapidly, generally emotionally. In line with Animoca Manufacturers chairman Yat Siu, that dependence was a mistake. In his view, crypto relied an excessive amount of on political hope as a substitute of structural actuality, and as soon as these expectations cooled, the market was pressured to reassess what truly drives long-term worth.

Establishments Are Rewriting the Guidelines

Siu argues that institutional capital is not a background drive in crypto markets. It’s now shaping how belongings commerce, how threat is priced, and the way traders take into consideration time horizons. Bitcoin is more and more being handled as a reserve-style asset relatively than a campaign-driven commerce, and that shift is already altering habits throughout the market. Altcoins, specifically, are underneath stress. Narrative alone not works, and initiatives are being pressured to show financial relevance, money move potential, or strategic utility.

Even Animoca Manufacturers is adjusting to this actuality. Siu notes that the corporate is positioning itself extra like a digital asset treasury than a pure development or hype-driven operation, reflecting a broader transfer towards self-discipline and balance-sheet considering.

Crypto and AI Are Beginning to Converge

Past market construction, Siu factors to a deeper pattern forming between crypto and synthetic intelligence. Autonomous AI brokers want impartial, censorship-resistant rails to function independently, and crypto networks match that requirement much better than conventional monetary methods or closed platforms. From this angle, proudly owning crypto might develop into a sensible hedge on AI adoption, particularly if brokers start managing belongings and executing selections with out centralized management.

That is much less about hypothesis and extra about infrastructure. If AI methods are anticipated to behave autonomously, they want monetary rails that can’t be switched off arbitrarily, and crypto would be the most direct choice out there.

Why Hong Kong Nonetheless Performs a Key Function

From his base in Hong Kong, Siu sees a singular mixture of deep capital markets, regulatory attain, and proximity to Asia’s main tech hubs. That blend provides the area an edge as establishments construct globally related digital finance infrastructure, notably as crypto markets mature and combine extra deeply with conventional finance.

What the Shift Actually Means

The Trump-driven part gave crypto momentum and a spotlight. Establishments are actually giving it construction and path. As politics fades into the background, fundamentals are beginning to matter once more, and markets have gotten extra selective. From right here, crypto seems to be much less like a headline commerce and extra like a system being formed by long-term capital.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.