Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth has dropped 4% within the final 24 hours to $89,427 as Michael Saylor’s firm, Technique, continues its aggressive accumulation of the cryptocurrency.

Final week, the corporate bought 22,305 BTC for $2.13 billion, at a median worth of $95,284 per coin, based on a U.S. Securities and Alternate Fee submitting. This newest buy introduced Technique’s complete Bitcoin holdings to 709,715 BTC, purchased for roughly $53.92 billion at a median price of $75,979 per coin.

JUST IN: 🇺🇸 Michael Saylor’s STRATEGY now holds 709,715 bitcoin price $64.5 BILLION

3.3% of the full provide 🔥 pic.twitter.com/00lCgEXZgn

— Bitcoin Archive (@BitcoinArchive) January 20, 2026

The corporate now holds about 3.37% of the full 21 million BTC provide and three.55% of the 19.98 million at present in circulation, based on Blockchain.com. Technique’s current shopping for spree marks its largest Bitcoin acquisition since February 2025, when it bought over 20,000 BTC for round $2 billion. Earlier this month, the corporate additionally purchased 13,627 BTC ($1.3 billion), signaling a pointy acceleration in shopping for in contrast with most of final 12 months.

Technique Maintains Bitcoin Accumulation

The surge in purchases got here amid Bitcoin briefly surpassing $97,000 and Technique’s shares (MSTR) rising previous $185, boosted additional by Morgan Stanley Capital Worldwide’s (MSCI) resolution to not exclude digital asset treasury firms from its market index.

Regardless of the current worth pullback, Technique stays dedicated to its Bitcoin accumulation technique. Analysts recommend that the market is now specializing in which digital asset treasury firms can survive via disciplined administration and lifelike expectations.

James Butterfill of CoinShares emphasised that long-term success will depend on credible enterprise fashions, disciplined treasury practices, and prudent dealing with of digital property on company steadiness sheets. Technique’s continued shopping for underscores Michael Saylor’s conviction that Bitcoin ought to stay a core a part of company treasury technique, whilst volatility in cryptocurrency markets persists.

Bitcoin Assessments Main Help Zone Close to $85K

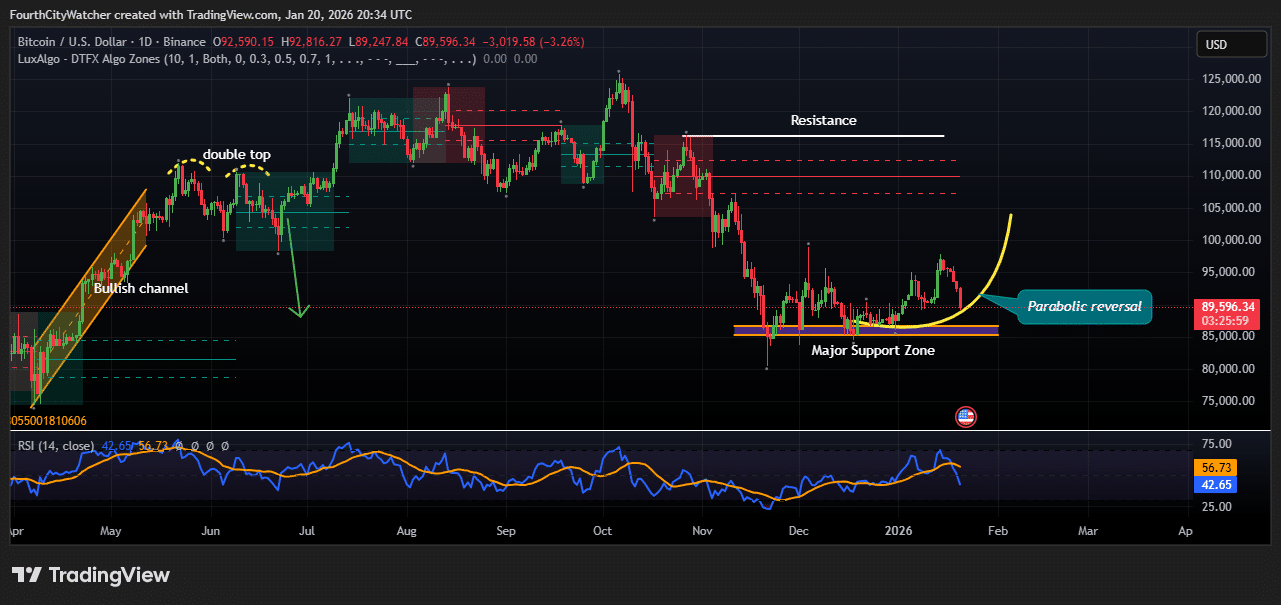

Bitcoin has pulled again to $89,596, marking a 3.26% drop prior to now 24 hours, however technical indicators point out a possible rebound could also be forming. The every day chart reveals Bitcoin at present hovering close to a significant assist zone round $85,000–$87,000, which has traditionally acted as a robust flooring for worth declines.

Analysts are watching this stage carefully, as a bounce from right here may set off a parabolic reversal, pushing costs again towards $100,000. Earlier worth motion reveals Bitcoin forming a bullish channel in April–Might 2025, adopted by a double prime sample in June, which led to a big correction within the months that adopted.

The market then entered a protracted downtrend, dealing with repeated resistance ranges close to $115,000 and $110,000, which it failed to interrupt a number of occasions. The repeated rejection at these highs bolstered promoting strain, whereas the assist zone now serves as a key space for potential accumulation by traders.

BTCUSD Chart Evaluation Supply: Tradingview

The Relative Energy Index (RSI) is at present at 42.65, indicating that Bitcoin is neither oversold nor overbought however is approaching a stage that always precedes upward momentum. Merchants are possible monitoring RSI together with worth motion on the assist zone to determine entry factors for a possible bullish transfer.

If Bitcoin manages to carry above the assist space and good points upward momentum, the chart suggests a parabolic restoration path towards earlier resistance ranges. Nevertheless, failure to defend this zone may result in additional draw back, doubtlessly testing decrease ranges close to $80,000. Total, market sentiment stays cautious, with traders balancing optimism over a possible rebound with considerations over near-term volatility.

This technical setup highlights the continued tug-of-war between consumers and sellers, emphasizing that Bitcoin’s subsequent main transfer will rely upon the way it reacts to the present assist zone and whether or not it could reclaim momentum towards $100,000 and past.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection