Crypto merchants are nonetheless energetic on prediction markets, however fewer are prepared to take danger. New on-chain evaluation from BeInCrypto exhibits that high-conviction crypto buying and selling on Polymarket has cooled steadily since early January, after peaking twice in late December and the primary week of the brand new yr.

The information doesn’t monitor informal customers or passive viewers. As an alternative, it focuses on wallets that actively positioned orders and offered liquidity on crypto-related markets, providing a clearer sign of dealer sentiment.

Sponsored

Sponsored

Excessive-Conviction Crypto Exercise Peaked, Then Light

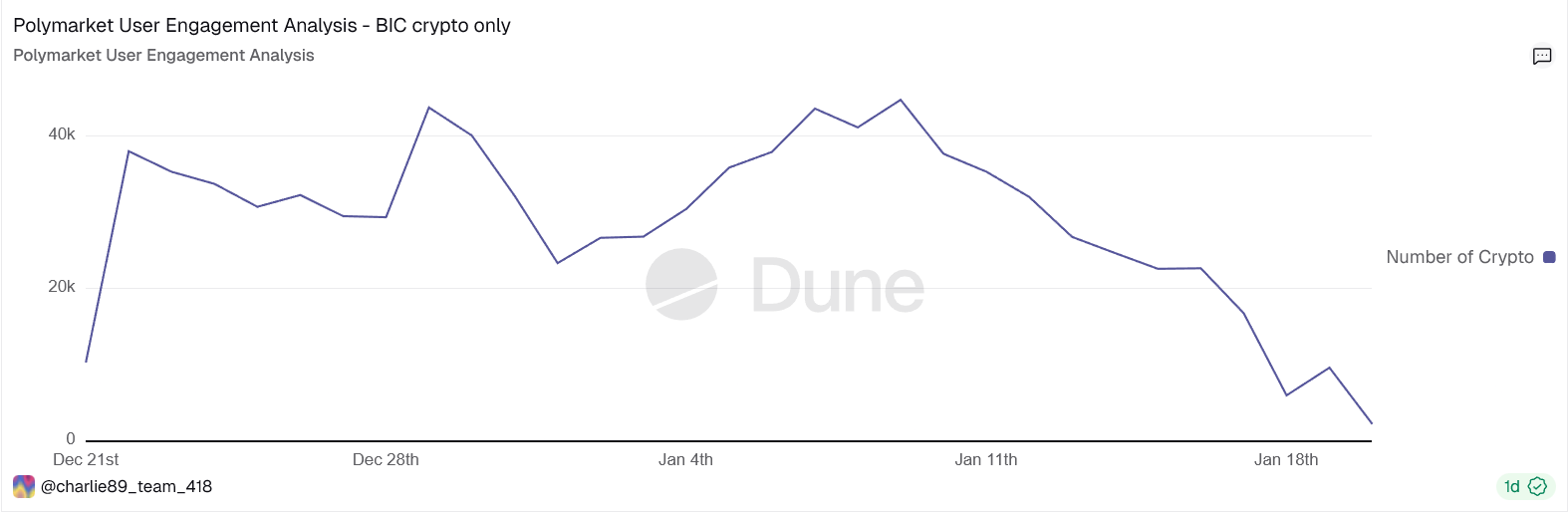

BeInCrypto analysts noticed each day maker exercise on Polymarket over the previous 30 days, filtering solely crypto-tagged markets equivalent to Bitcoin and Ethereum value outcomes, meme cash, NFTs, and airdrops.

As a result of the dataset counts makers solely, it captures wallets actively risking capital, not merchants merely filling current orders. The outcomes present two clear engagement waves.

The primary occurred in late December, when each day energetic crypto makers climbed into the high-30,000 vary. The second, and stronger, wave got here in early January, with exercise peaking round 40,000–45,000 wallets.

Nonetheless, after January 9, the development reversed. Every day crypto maker exercise declined constantly via mid-January, falling again towards the low-20,000 vary earlier than dropping sharply on the finish of the window.

Bitcoin Engagement Confirms the Broader Cooldown

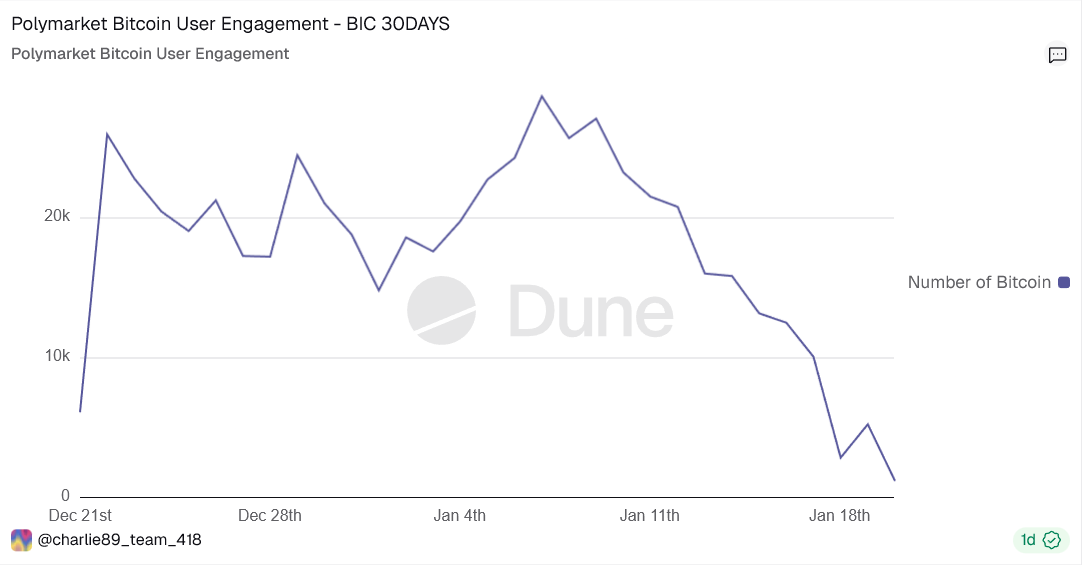

Bitcoin-focused markets adopted the identical sample.

Sponsored

Sponsored

A separate Dune chart monitoring Bitcoin-only maker wallets exhibits sturdy engagement in late December and early January, adopted by a persistent decline.

By January 18, the variety of energetic Bitcoin makers fell to 2,875 wallets, down sharply from the five-figure ranges seen earlier within the interval.

This confirms the slowdown was not restricted to area of interest crypto bets or altcoin narratives. The pullback prolonged to Bitcoin, the platform’s most liquid and constantly traded crypto class.

Weekly Knowledge Exhibits Polymarket Dominance, however Shifting Habits

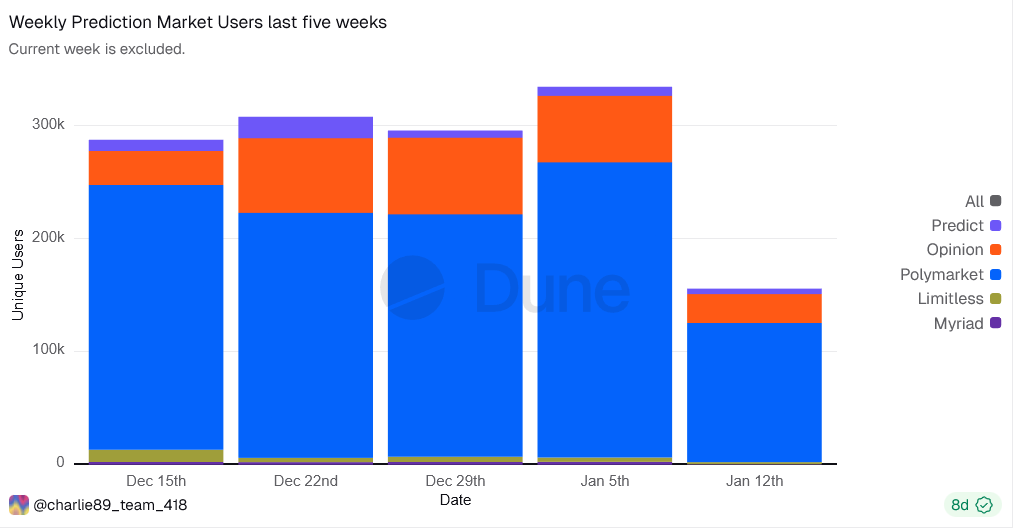

Weekly information throughout prediction market platforms provides context. Polymarket continues to account for almost all of weekly prediction market customers, dwarfing smaller opponents in absolute phrases.

Sponsored

Sponsored

Throughout peak weeks in late December and early January, whole weekly customers throughout platforms reached the high-200,000s to low-300,000s.

But whereas whole customers remained elevated, the composition of exercise modified. Maker participation in crypto markets declined whilst general platform engagement stayed comparatively excessive.

This divergence suggests merchants didn’t depart prediction markets altogether. As an alternative, they grew to become extra selective about when and the way a lot capital they had been prepared to commit.

Sponsored

Sponsored

Liquidity Suppliers Step Again Earlier than Customers Disappear

The maker-only filter is crucial to understanding the sign.

Liquidity suppliers have a tendency to tug again earlier than broader consumer numbers fall. When volatility drops or narratives lose momentum, merchants typically cease posting new orders whereas nonetheless monitoring markets or buying and selling opportunistically.

That sample seems clearly within the information. Crypto maker exercise declined steadily after early January, suggesting a cooling of conviction fairly than a sudden collapse in curiosity.

This conduct mirrors dynamics seen in DeFi and derivatives markets, the place funding charges, open curiosity, and liquidity depth typically weaken earlier than spot volumes comply with.

Taken collectively, the info level to a transparent conclusion.

Crypto merchants haven’t deserted prediction markets. Nonetheless, fewer are prepared to offer liquidity and take directional danger in comparison with early January.

In plain phrases, prediction markets are signaling a risk-off shift in crypto sentiment, seen first amongst high-conviction merchants.