Be part of Our Telegram channel to remain updated on breaking information protection

XRP worth faces heightened draw back dangers following large outflows from US Spot XRP exchange-traded funds (ETFs) amid risk-off sentiment within the broader crypto market.

Rising US and Japan bond yields sign macroeconomic stress, dragging the entire crypto market capitalization 32% under its October 2025 peak.

BTC, ETH, and XRP retested their lowest ranges in additional than two weeks after crypto and inventory markets digested US President Donald Trump’s contemporary spherical of tariff threats.

The potential tariffs are an try by the administration to persuade Denmark to rethink its management of Greenland.

The S&P 500 index fell 1.9%, whereas gold costs surged to a brand new all-time excessive of round $4,885/ounce, and the crypto market capitalization dropped to $3 trillion, down from almost $3.2 trillion, in accordance with Coingecko information.

XRP dropped almost 1% within the final 24 hours to commerce at $1.90 as of 4:39 a.m. EST, with an intraday low of round $1.89.

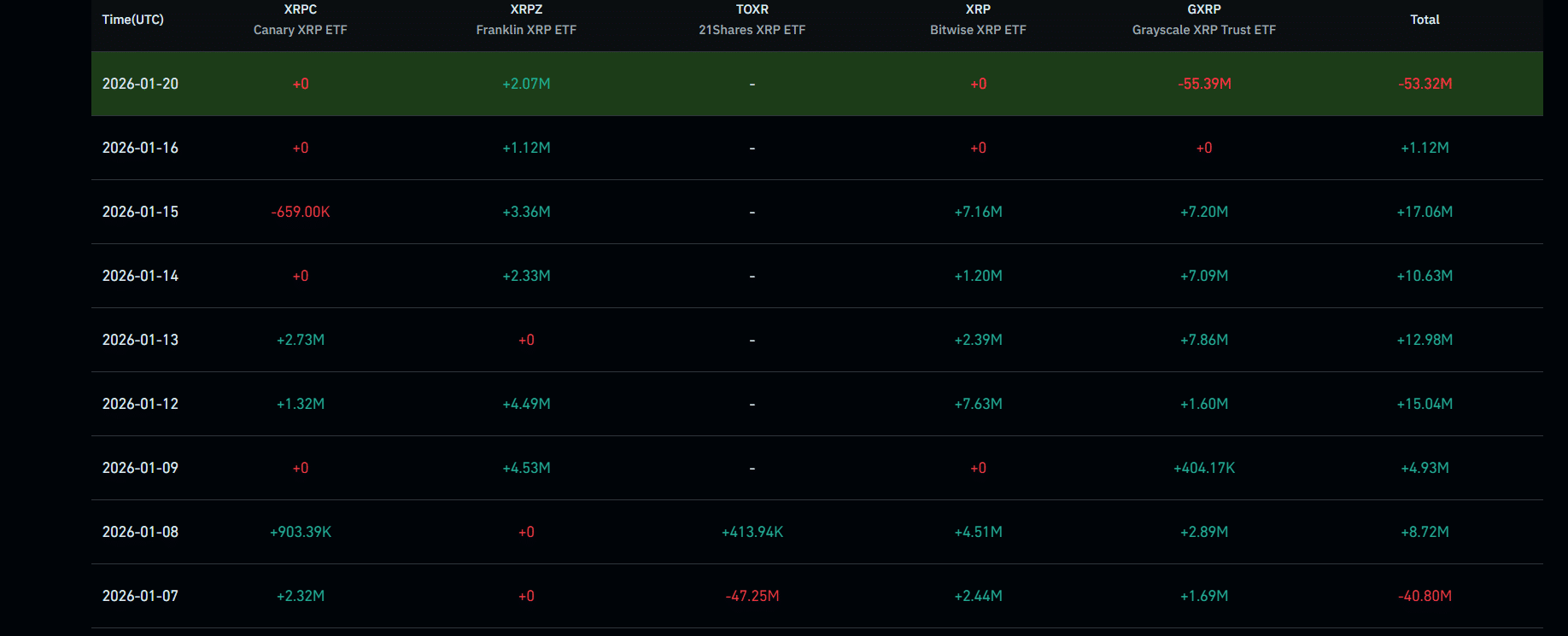

Spot XRP ETFs Data $53.32 Million in Internet Outflows

In line with Coinglass information, spot XRP ETFs recorded $53.32 million in web outflows on Tuesday, January 20, marking their second-ever day by day capital outflow and the biggest since they started buying and selling in November 2025.

The outflow was from Grayscale’s GXRP ETF, which recorded a complete outflow of $55.39 million. In the meantime, Franklin’s XRPZ recorded $2.07 million in inflows.

Following the newest outflow, whole web inflows since launch now stand at $1.22 billion.

The current bearish spell was not distinctive to XRP, as most different crypto ETFs additionally noticed outflows. Particularly, the BTC ETFs recorded $479.70 million in outflows, whereas the ETH ETFs recorded $230 million.

Can XRP Stabilize or Is Extra Draw back Forward?

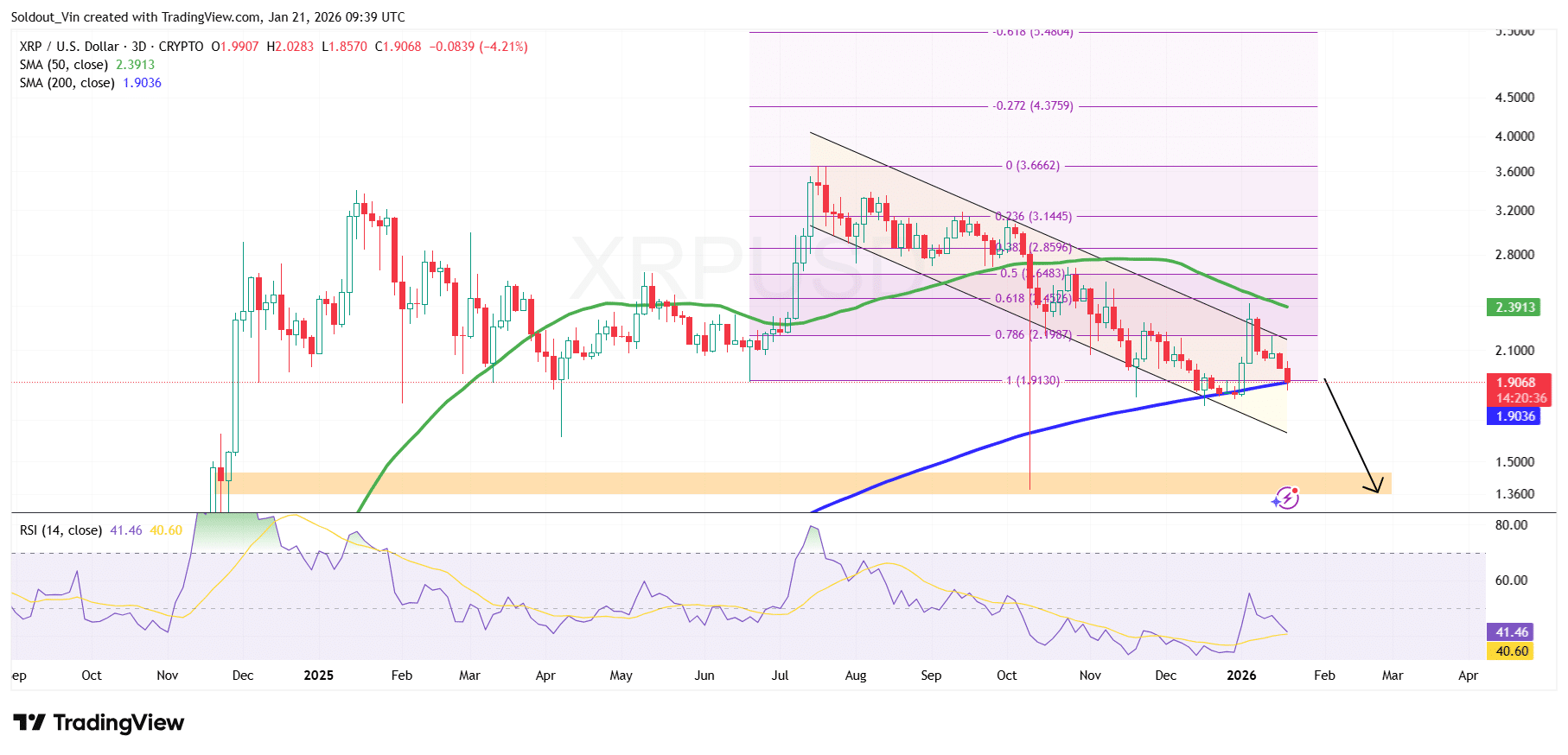

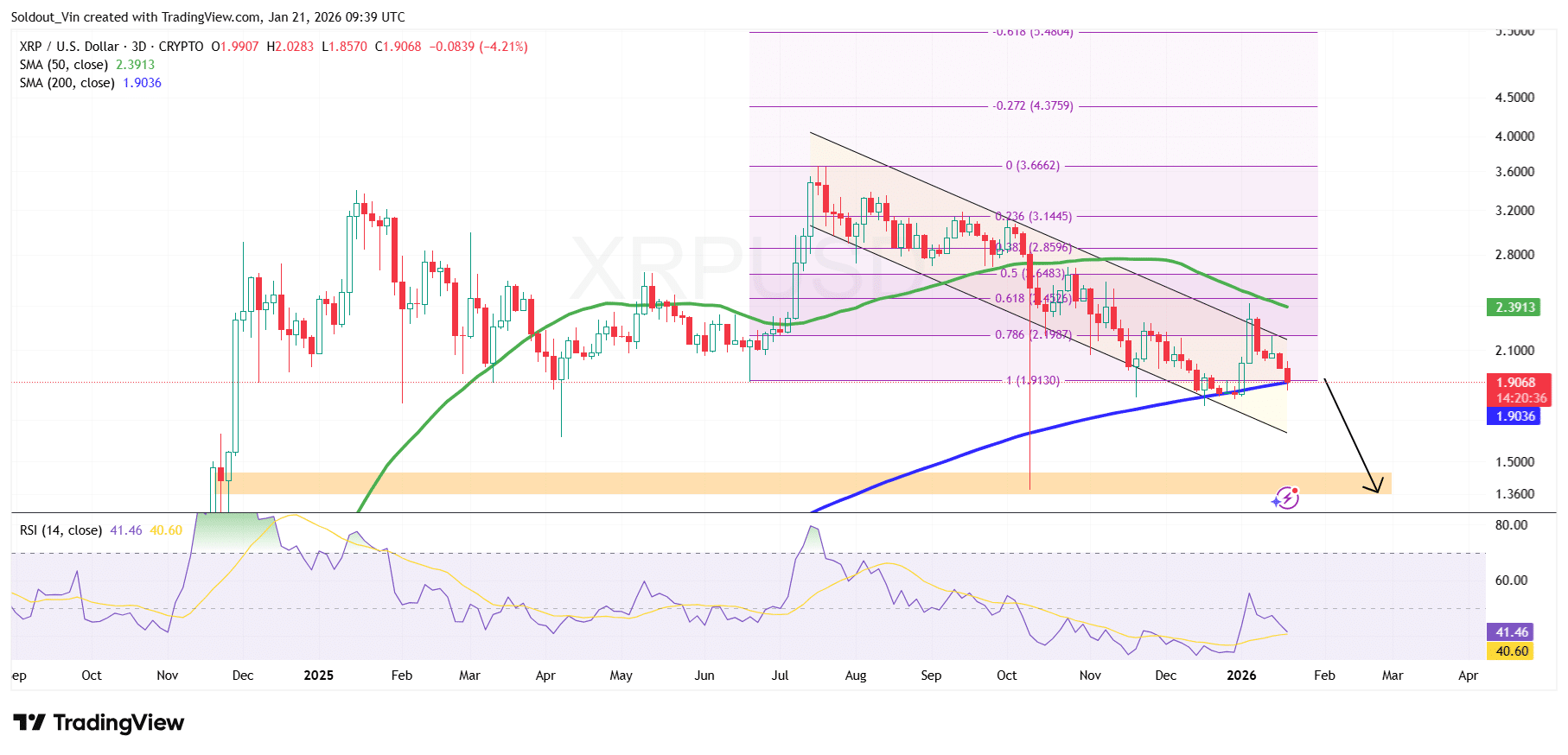

XRP worth is at present buying and selling round $1.90–$2.00, sitting straight on high of the 200-day Easy Shifting Common (SMA) close to $1.90, which has develop into a vital long-term assist stage. The worth stays properly under the 50-day SMA at $2.39, highlighting persistent medium-term bearish stress.

After peaking close to the $3.60–$3.70 area, XRP entered a chronic corrective part, forming a falling channel sample.

Regardless of this, XRP has thus far managed to defend the $1.85–$1.90 zone, an space that additionally aligns with a significant Fibonacci extension stage from the prior advance.

The 50-day SMA stays downward-sloping, signaling that development momentum has not but shifted in favor of the bulls. So long as the value of XRP trades under this SMA.

Overhead, the $2.20–$2.40 area stands out as a heavy resistance band, combining the descending channel high and the 50-day SMA.

XRP’s Relative Energy Index (RSI) is at present hovering round 41, under the impartial 50 stage. This means weak momentum, although RSI shouldn’t be but deeply oversold.

The upper-timeframe XRP/USD chart suggests the Ripple token could try a short-term stabilization above the $1.85–$1.90 assist zone, given the confluence with the 200-day SMA. A sustained maintain right here may permit for an additional corrective transfer towards $2.10–$2.30, the place prior breakdown ranges and channel resistance converge.

A decisive day by day or multi-day shut above the $2.30–$2.40 area can be required to weaken the bearish construction.

On the draw back, a clear break under the 200-day SMA and $1.85 assist would considerably change the bearish construction. Because of this, XRP may slide towards the $ 1.35–$ 1.50 demand zone.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection