Be part of Our Telegram channel to remain updated on breaking information protection

Bitcoin is searching for the $90,000 reclaim as US President Donald Trump dropped tariff threats and dominated out seizing Greenland from an ally by pressure.

Trump’s theatrics and consequent tensions have saved markets on edge this week, prompting traders to take the newest developments with a pinch of salt at the same time as reduction was palpable.

BTC has edged up a fraction of a proportion to commerce at $89,955 as of 1:19 a.m. EST, with an intraday low of $87,304 and a excessive of $90,295, in line with Coingecko knowledge.

The crypto market additionally edged as much as $3.13 trillion in market capitalization. In consequence, the full liquidations within the crypto market got here in at $605 million.

Trump Backs Off EU Tariffs, Markets Edge Increased

Crypto traders eased again into threat after President Donald Trump struck a calmer tone on Greenland and signaled a path towards a deal that pulled some warmth out of markets.

In response to Trump, he had reached the “framework of a future deal” involving NATO over Greenland, and indicated he would maintain off on the tariff risk.

JUST IN: Trump says the US has outlined a framework for a future deal involving Greenland after a gathering with NATO Secretary Basic Mark Rutte

Tariffs scheduled for Feb. 1 have been postponed.

Negotiations will probably be led by VP JD Vance and Secretary of State Marco Rubio…— Laura Shin (@laurashin) January 21, 2026

“It’s a long-term deal. It’s the final word long-term deal. It places everyone in a wonderful place, particularly because it pertains to safety and to minerals,” Trump informed reporters.

Whereas talking on the World Financial Discussion board in Davos, Trump mentioned he wouldn’t impose the tariffs and dominated out using pressure within the dispute over the Danush territory.

“I received’t try this,” the U.S. President mentioned at Davos of an assault to safe Greenland.

“Okay? Now everybody’s saying,’ Oh, good,’ that’s in all probability essentially the most vital assertion I made as a result of folks thought I might use pressure. I don’t have to make use of pressure, I don’t need to use pressure, I received’t use pressure.”

Trump’s phrases got here as markets waited to see the total extent of EU commerce retaliation over the Greenland situation.

Because the crypto markets edged increased, gold costs remained largely regular after hitting a document excessive close to $4,900/ounce within the earlier session.

Silver costs rose 1% to $94.03 per ounce, just under document highs of $95.89/oz hit earlier this week.

Bitcoin Worth Set For A Rally Again Above $100K

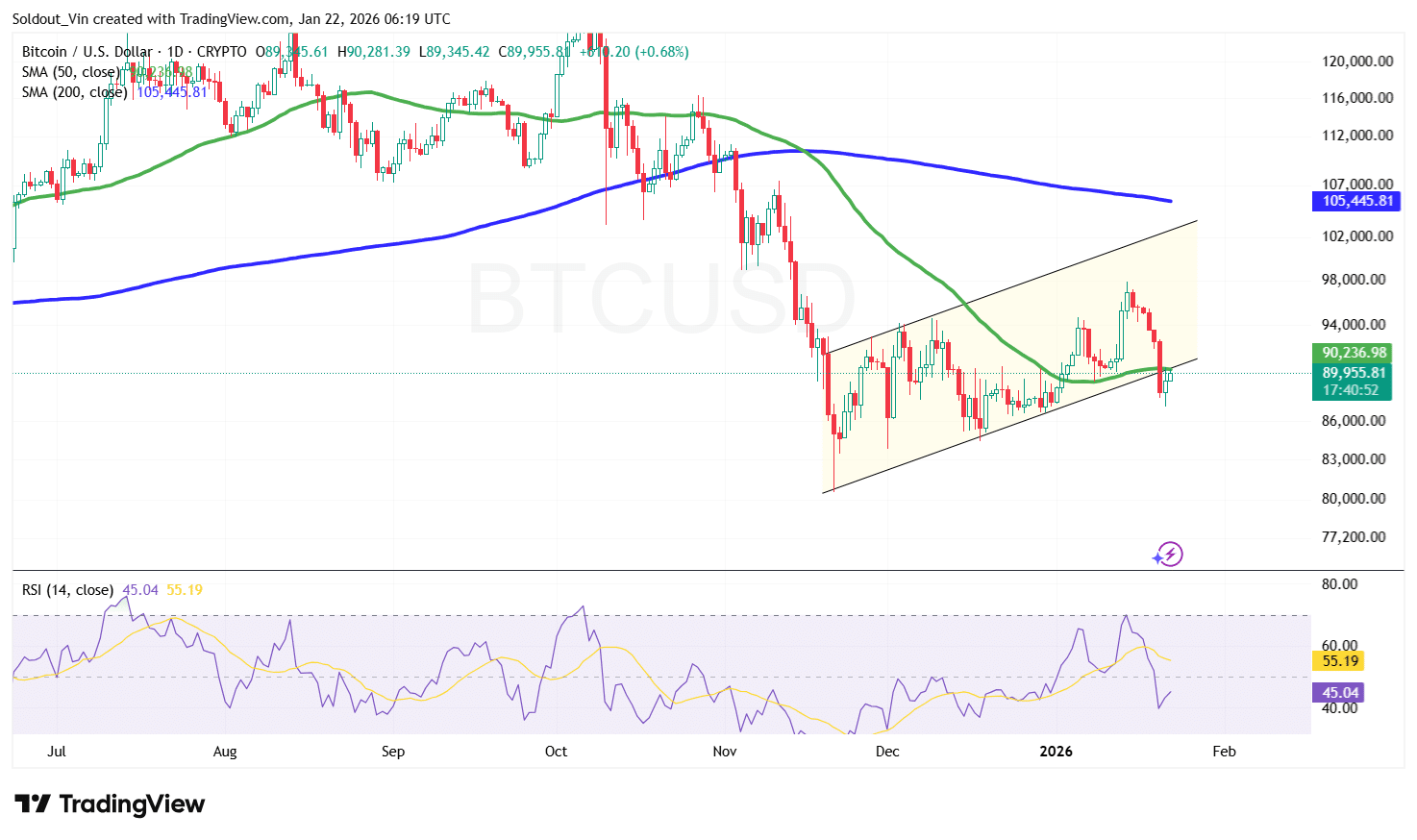

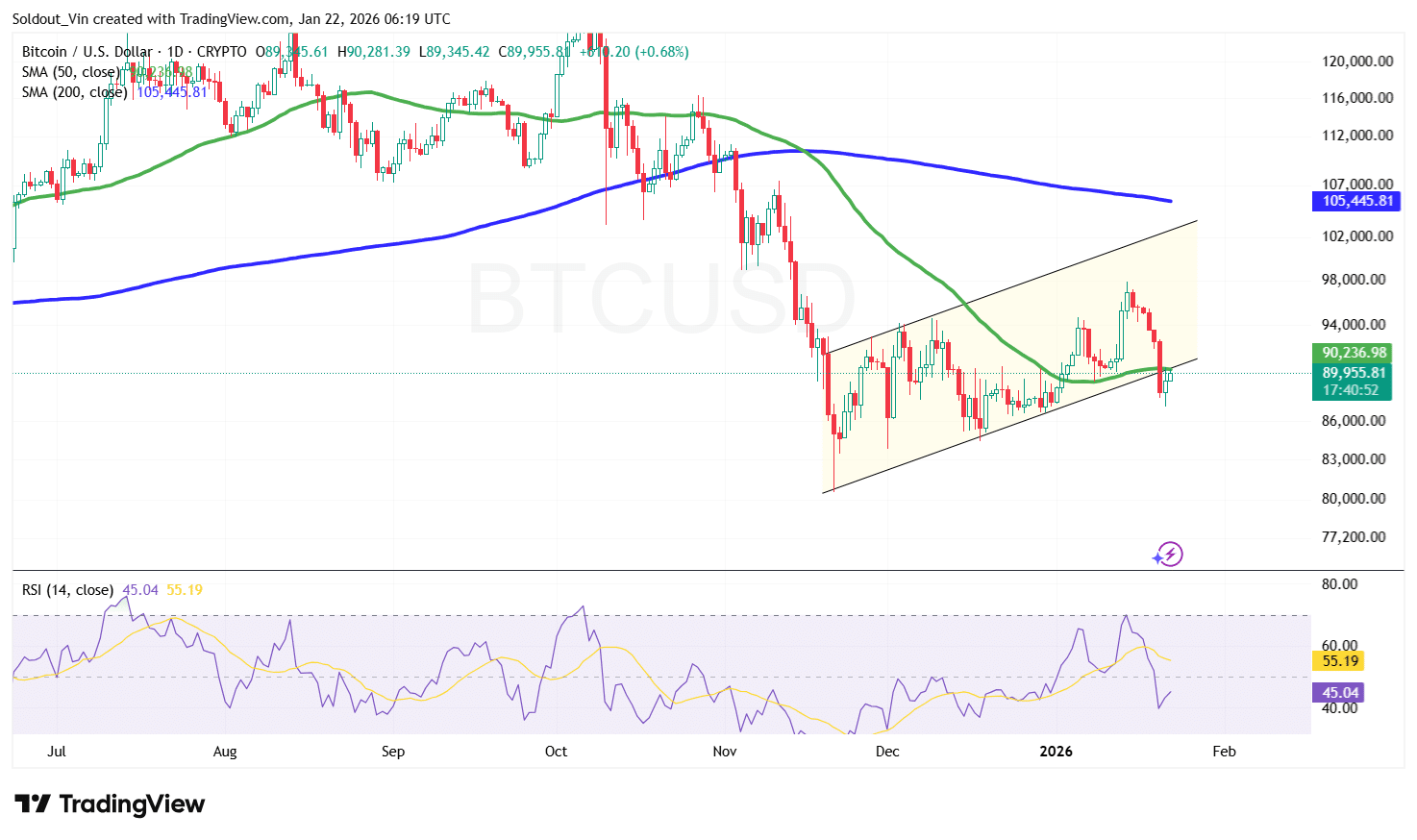

Bitcoin worth is presently consolidating close to the $89,000–$90,000 area, holding simply above short-term help round $87,000–$88,000, which consumers have defended following the sharp sell-off from November highs.

This consolidation comes after a robust decline from the $115,000 space, the place promoting stress accelerated and compelled the worth of BTC right into a corrective section. Demand stepped in close to the $82,000 zone. The rebound from this space suggests draw back momentum has slowed in the long run.

Bitcoin is buying and selling across the 50-day Easy Transferring Common (SMA) close to $90,200, however stays nicely beneath the 200-day SMA round $105,000, which continues to behave as main resistance on the upside.

The downward slope of the 200-day SMA signifies the broader development stays bearish until Bitcoin can reclaim this stage and maintain above it.

Bitcoin’s Relative Power Index (RSI) is hovering round 45, sitting beneath the impartial 50 mark. This means momentum stays weak, although not oversold, leaving room for a restoration try if shopping for stress will increase.

From the 1-day BTC/USD chart, Bitcoin worth is buying and selling inside a rising channel following the sell-off. This construction usually represents a bearish continuation sample, with worth presently buying and selling between channel help and resistance. A transfer towards the $94,000–$98,000 resistance zone is feasible, the place the higher channel boundary aligns with prior rejection ranges.

A clear breakout above $98,000, adopted by a reclaim of the 200-day SMA close to $105,000, can be the primary significant sign of a development reversal.

For Bitcoin to realistically goal a sustained transfer again above $100K, it could want a confirmed development shift, which can name for an in depth above the $95,000 zone.

Conversely, failure to interrupt above channel resistance may set off one other pullback, with $88,000 appearing as preliminary help, adopted by the $85,000 demand zone if promoting stress returns.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection