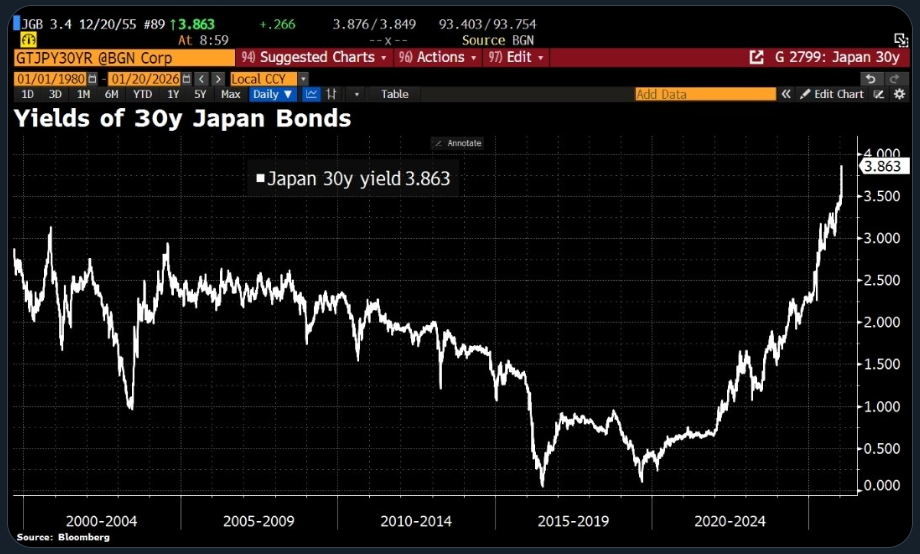

- Japan’s rising bond yields are driving a world repricing of danger.

- Tighter funding is pressuring equities and crypto alike.

- Bitcoin is behaving like a danger asset, signaling liquidity stress.

Whereas headlines chase geopolitical flashpoints, the actual stress is constructing someplace quieter. Japan’s bond market is pushing into territory not seen in many years, and that shift is forcing a world repricing of danger. For years, Japan carried large debt underneath the idea that near-zero charges would final without end. That assumption is breaking. As yields rise, the mathematics behind equities, leverage, and speculative belongings begins to alter quick.

Why Japan’s Charges Matter In every single place

This isn’t a neighborhood downside. Larger Japanese yields pull capital again towards safer returns, tightening funding situations globally. Japanese equities really feel it first, however the ripple doesn’t cease there. World shares soften, credit score spreads widen, and danger urge for food thins. This isn’t panic promoting. It’s adjustment. Markets are recalibrating to a world the place cash isn’t free anymore, and people recalibrations are typically messy.

Bitcoin Is Buying and selling Like Threat, Not Safety

Bitcoin’s habits on this atmosphere is telling. In principle, it’s supposed to profit when belief in methods erodes. In actuality, in periods of funding stress, Bitcoin trades like a high-beta danger asset. When leverage unwinds and liquidity dries up, BTC is bought alongside equities. Gold advantages from worry tied to stability. Bitcoin reacts to situations tied to liquidity.

Why This Issues Extra Than the Narrative

This isn’t a referendum on Bitcoin’s long-term thesis. It’s a reminder that completely different shocks produce completely different winners. Japan’s bond transfer is about charges, debt, and funding prices, not ideology or forex debasement. In that setup, liquidity guidelines all the things. Bitcoin isn’t failing to guard — it’s signaling what sort of stress the system is definitely underneath.

The Greater Adjustment Underway

Japan is forcing markets to confront a actuality they’ve averted for years. Debt, charges, and gravity ultimately meet. This second isn’t about one nation, and it’s not about one asset. It’s a couple of world system adjusting to tighter situations. Watching Bitcoin’s response helps decode the stress. Proper now, the issue isn’t perception. It’s liquidity.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.