- Dogecoin is buying and selling in a high-timeframe accumulation zone, in accordance with technical evaluation.

- A Wave 5 enlargement might unlock giant upside if key ranges maintain.

- Conservative forecasts nonetheless count on slower, extra modest beneficial properties over time.

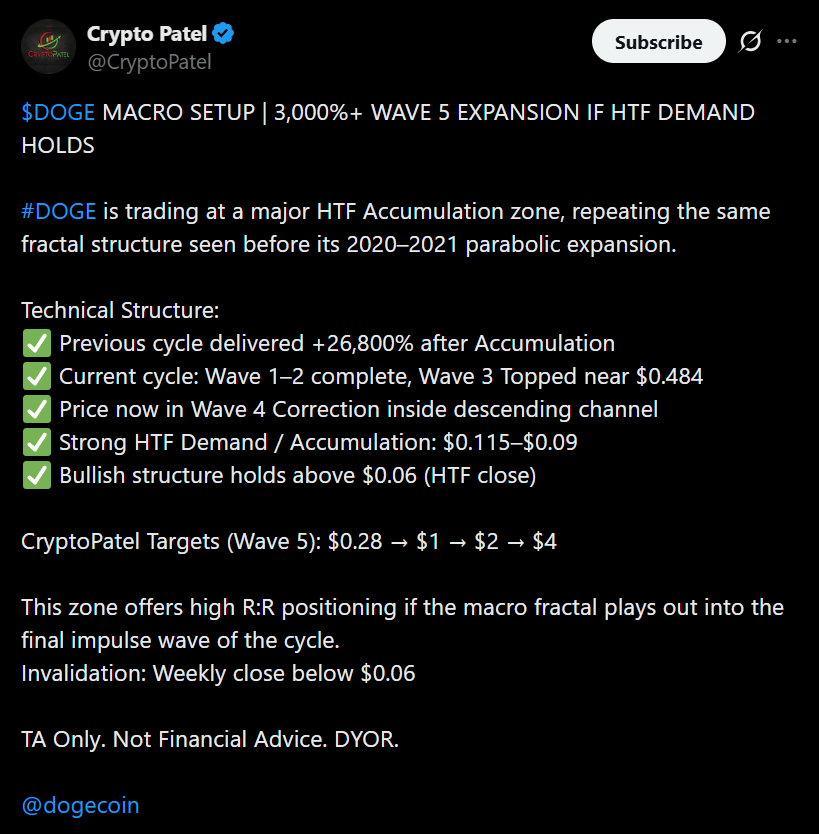

Dogecoin has been unusually quiet for months, however that calm could also be breaking. In accordance with crypto analyst Crypto Patel, DOGE is now buying and selling inside a high-timeframe accumulation zone that carefully mirrors the construction seen earlier than its explosive 2020–2021 rally. The setup has reignited dialogue round whether or not the memecoin is quietly positioning for an additional main transfer, whilst broader market sentiment stays cautious.

A Acquainted Fractal From the Final Cycle

Patel factors to a repeating macro fractal, arguing that Dogecoin is sitting at a requirement zone that beforehand preceded a parabolic enlargement. In his view, DOGE has already accomplished its Wave 1 and Wave 2, with Wave 3 topping close to $0.48 earlier within the cycle. Value motion now seems to be consolidating inside a Wave 4 correction, forming a descending channel that would act as a base for the subsequent leg increased if demand holds.

Why Wave 5 Has Merchants Speaking

The bullish thesis facilities on a possible Wave 5 enlargement. Patel notes that the earlier cycle delivered huge beneficial properties as soon as accumulation resolved to the upside, and believes an identical construction might play out once more. His outlined targets vary from $0.28 to $1, $2, and even $4 if the macro setup stays intact. Key ranges matter right here. He highlights the $0.115 to $0.09 vary as a robust accumulation zone, with the broader construction staying legitimate so long as DOGE holds above $0.06 on a weekly shut.

A Extra Conservative Outlook Exists

Not everybody shares such aggressive expectations. Broader value fashions stay much more restrained. Present projections counsel DOGE might commerce nearer to the $0.19 vary by 2027, implying regular appreciation slightly than an explosive breakout. Technical indicators nonetheless lean bearish, and general market worry stays elevated, which tempers near-term optimism.

The Danger-Reward Query

The distinction between these views captures DOGE’s actuality proper now. On one aspect, merchants see a well-known macro sample that when delivered outsized beneficial properties. On the opposite, the market stays fragile, and invalidation ranges sit uncomfortably shut. For swing merchants and longer-term speculators, the enchantment lies within the asymmetry. If the fractal holds, upside may very well be important. If it fails, the construction breaks shortly. That stress is what’s pulling DOGE again onto merchants’ radar.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.