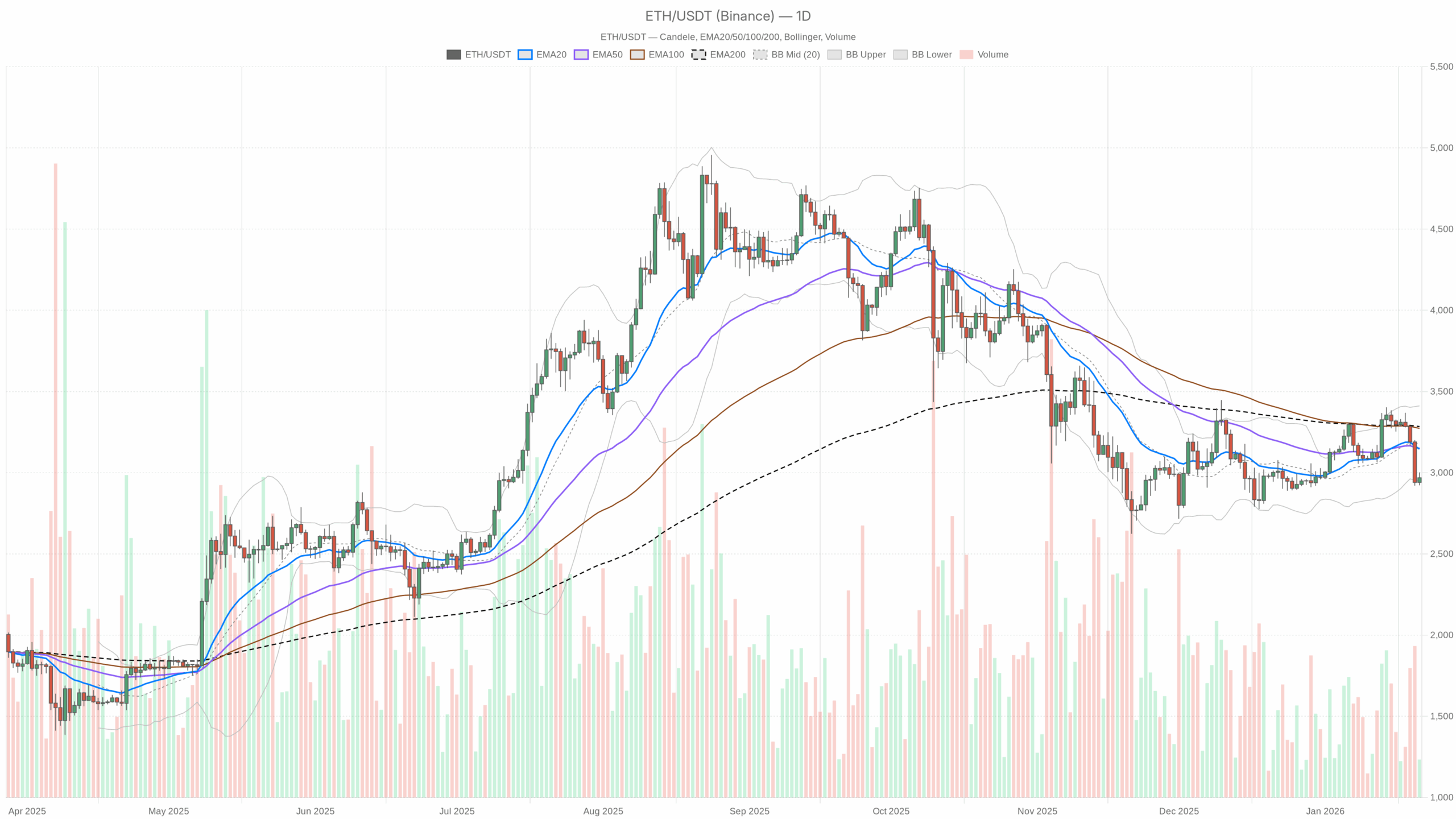

ETH remains to be buying and selling defensively, with the Ethereum value sitting round $2,970, pinned close to the decrease Bollinger Band on the each day chart and under each key shifting common.

Fundamental situation from the each day chart: nonetheless bearish, however nearing a choice level

The each day timeframe is clearly bearish for ETHUSDT and defines the principle situation. This isn’t a market in stability; sellers have had the higher hand, and dip consumers are solely simply starting to indicate up intraday.

Day by day pattern and EMAs

Value: $2,968.65

EMA20: $3,145.61 | EMA50: $3,149.67 | EMA200: $3,284.50

Value is decisively under the 20, 50, and 200-day EMAs, and people shorter EMAs have rolled over below the 200-day. That could be a traditional downtrend construction: rallies are being bought, not adopted by.

Human learn: so long as ETH sits below roughly $3,150–3,200, the market is treating bounces as alternatives to scale back threat, not begin a brand new bull leg.

Day by day RSI

RSI(14) each day: 39.87

RSI is under 50 however not but deeply oversold. Momentum is damaging however not capitulatory.

Human learn: bears are in management, however that is extra a grind decrease than a flush. There may be nonetheless room for one more leg down earlier than traditional oversold exhaustion kicks in.

Day by day MACD

MACD line: 13.37 | Sign: 42.70 | Histogram: -29.33

The MACD line is under its sign with a damaging histogram. The unfold is critical however not but turning up.

Human learn: draw back momentum remains to be energetic. There isn’t any clear signal but that the promote wave has absolutely run its course, however we’re far sufficient into it that you just begin awaiting a momentum slowdown over the following periods.

Day by day Bollinger Bands

Center band: $3,178.86

Higher band: $3,411.44 | Decrease band: $2,946.28

Shut: $2,968.65 (simply above the decrease band)

ETH is hugging the decrease band after a transfer down from the midline.

Human learn: value is within the decrease volatility envelope, which frequently means two issues directly: the downtrend is legitimate, and we’re coming into a zone the place mean-reversion bounces change into extra seemingly on quick timeframes. The larger query is whether or not these bounces can reclaim the mid-band close to $3,180; till they do, they’re simply reduction rallies in a downtrend.

Day by day ATR (volatility)

ATR(14) each day: $115.21

Day by day realized volatility is elevated however not at panic ranges.

Human learn: a typical each day swing of round $100–120 means a 3–4% transfer both means is totally regular right here. Place sizing has to respect that, in any other case tight cease placements close to apparent ranges are prone to get shaken out.

Day by day pivot ranges

Pivot level (PP): $2,964.18

R1: $3,006.47 | S1: $2,926.36

Value is buying and selling nearly precisely on the each day pivot, after having probed close to the decrease Bollinger Band.

Human learn: the market is at an intraday determination stage. Holding above the pivot favors a short-term bounce towards $3,000–3,010, whereas a sustained break under $2,930 opens up continuation to recent lows contained in the each day downtrend.

Market context: risk-off, BTC-dominant setting

Crypto whole market cap is round $3.10T, down roughly 2.1% in 24h, whereas 24h quantity is up over 32%. That’s the form of combine you see in a de-risking part, with costs slipping whereas exercise spikes.

Bitcoin dominance sits close to 57.5%, and ETH’s share of market cap is about 11.5%. In plain language, capital is preferring Bitcoin over Ethereum and altcoins. Mixed with the Excessive Worry studying (24), the larger image is defensive, as merchants are decreasing beta and searching for perceived security.

On-chain DeFi exercise (Uniswap, Curve, and so forth.) is seeing robust charges. Nonetheless, on this macro tape, increased DEX exercise is extra seemingly pushed by hedging, stablecoin rotations, and volatility buying and selling than a clear, risk-on rotation into ETH.

Decrease timeframes: intraday bounce inside a bigger downtrend

1H chart: weak however stabilizing

Value: $2,968.64

EMA20: $2,993.12 | EMA50: $3,070.71 | EMA200: $3,183.79

RSI(14): 35.25

MACD line: -35.13 | Sign: -41.94 | Histogram: +6.81

Bollinger mid: $2,976.64 | Higher: $3,014.69 | Decrease: $2,938.60

ATR(14): $25.12

Pivot PP: $2,965.92 | R1: $2,971.79 | S1: $2,962.76

On the 1H, ETH remains to be in a downtrend, with value below all EMAs, however the very short-term momentum is making an attempt to show. RSI is within the 30s, weak however not washed out, whereas the MACD histogram has flipped constructive though each traces stay under zero.

Human learn: sellers are dropping a little bit of steam intraday, however they nonetheless personal the construction. Any bounce towards the 1H 20 EMA close to $2,990–3,000 is, for now, only a check of resistance until ETH can really sit above it.

With value hovering across the hourly pivot at $2,965–2,972 and ATR round $25, short-term scalps can simply see $25–50 swings with out altering the larger image. Above $3,015 (higher 1H band) would sign a extra significant intraday squeeze, whereas under $2,940 reasserts bearish management.

15m chart: micro stability in a bearish regime

Value: $2,968.64

EMA20: $2,968.94 | EMA50: $2,978.27 | EMA200: $3,075.03

RSI(14): 48.63

MACD line: -2.94 | Sign: -3.17 | Histogram: +0.23

Bollinger mid: $2,968.86 | Higher: $2,982.84 | Decrease: $2,954.89

ATR(14): $8.48

Pivot PP: $2,968.33 | R1: $2,969.38 | S1: $2,967.60

The 15-minute chart is basically flat round its 20 EMA and mid-Bollinger band, with RSI near 50 and a touch constructive MACD histogram.

Human learn: very short-term, the market is catching its breath. The microstructure is impartial, but it surely sits inside a bearish hourly and each day context. That normally favors fading sharp spikes relatively than chasing them, until a transparent breakout by increased timeframe ranges seems.

Ethereum value situations from right here

Bullish situation: imply reversion and short-covering

For a reputable bullish path, ETH wants to show this short-term stabilization right into a sustained transfer again towards the each day mid-range.

What a bullish continuation would appear to be:

- On the 15m / 1H, value holds above the hourly pivot close to $2,965 and begins closing above the 1H 20 EMA round $2,990–3,000.

- RSI on the 1H climbs again above 50 whereas MACD crosses its sign and prints a rising constructive histogram.

- That opens room towards the higher 1H Bollinger Band and 1H EMA50 within the $3,050–3,100 space.

- On the each day, ETH then must assault the Bollinger midline close to $3,180. A reclaim and each day shut above that stage could be the primary severe argument that the downtrend is shifting right into a broader vary.

Key bullish set off zone: a sustained break and each day shut above roughly $3,150–3,200 (20/50-day EMAs). That will sign that sellers are dropping their grip on the medium-term pattern and that the present transfer was a corrective pullback relatively than the beginning of a deeper bear part.

What invalidates the bullish case: if ETH fails to carry above the $2,930 area and begins closing each day candles close to or below the decrease Bollinger Band (sub-$2,950) with RSI sliding towards the low 30s, the narrative shifts from imply reversion to momentum continuation and the bullish situation will get pushed a lot additional out in time.

Bearish situation: pattern continuation and attainable acceleration

The bears already management the upper timeframe. The query is whether or not they can flip this into one other impulsive leg decrease relatively than letting the market base.

What a bearish continuation would appear to be:

- On the 15m / 1H, makes an attempt to reclaim $3,000 are repeatedly rejected, with value stalling at or under the 1H 20 EMA.

- Hourly RSI stays caught below 45, and the MACD histogram rolls again to damaging after this temporary pause.

- A decisive transfer under $2,930 (close to S1 and simply contained in the decrease each day band) triggers stops and brings in recent trend-followers.

- Day by day RSI pushes towards the low 30s whereas MACD widens additional damaging, indicating momentum is re-accelerating, not cooling.

From there, the draw back targets come extra from volatility than from any clear horizontal ranges. With each day ATR round $115, a continuation leg might simply discover one other $100–150 decrease in a single session with none structural change.

Key bearish affirmation: a number of each day closes under the pivot area round $2,960 and chronic buying and selling close to or below the decrease Bollinger Band. In that setting, each small intraday bounce is suspect and extra prone to be bought into.

What invalidates the bearish case: if consumers can pressure a each day shut again above $3,150–3,200 (20/50-day EMAs) and preserve it there, the present bearish regime on the each day chart could be in severe doubt. A shift of each day RSI again above 50 alongside this transfer would verify that the downtrend has transitioned into no less than a broad vary, if not the early phases of a brand new uptrend.

How to consider positioning round this Ethereum value zone

All three timeframes agree on one factor: ETH is in a bearish regime. The disagreement is about tempo. Day by day and hourly charts present a transparent downtrend, whereas the 15m is simply marking time across the native pivot. That’s usually what you see close to inflection factors, when the market is deciding whether or not to show a pause right into a reversal or simply one other step-down.

In a backdrop of Excessive Worry and excessive BTC dominance, aggressive lengthy publicity in ETH is a wager towards the present macro temper. It will possibly work, but it surely depends on mean-reversion and short-covering relatively than on a clear risk-on rotation into ETH. Conversely, shorts are buying and selling with the pattern, however they’re doing so late within the transfer and with volatility elevated, which raises the chance of violent squeeze days.

Regardless of the bias, threat must be sized for each day swings of no less than 3–4%. Merchants must be very clear about which timeframe they’re buying and selling. A 15m bounce can look spectacular whereas nonetheless being fully irrelevant to the each day downtrend. The important thing battleground ranges proper now are roughly $2,930 on the draw back and $3,150–3,200 on the upside. Habits round these zones will let you know whether or not ETH is establishing for one more leg decrease or for a broader consolidation.

If you wish to monitor markets with skilled charting instruments and real-time information, you may open an account on Investing utilizing our companion hyperlink:

Open your Investing.com account

This part comprises a sponsored affiliate hyperlink. We might earn a fee at no extra value to you.

This text is a market commentary and is for informational functions solely. It’s not funding, buying and selling, or monetary recommendation, and it shouldn’t be handled as a advice to purchase or promote any asset. Cryptoassets are extremely unstable and may end up in whole lack of capital. At all times do your individual analysis and assess your individual threat tolerance earlier than making buying and selling selections.