- Rising U.S. Treasury yields are forcing coverage shifts and rising refinancing strain on U.S. debt

- International buyers are promoting Treasuries and rotating into metals, weakening danger urge for food

- Bitcoin stays cautious as capital favors gold and bonds over high-risk belongings

There’s clearly strain constructing underneath the floor of the U.S. financial system, and up to date political strikes are beginning to look much less random than they first appeared. President Donald Trump’s sudden choice to tug again the ten% tariff on the European Union feels extra like a response than a strategic pivot, particularly given what’s taking place in bond markets proper now.

The actual sign got here from rising U.S. Treasury yields, which have begun to pressure the bond market at a time when the federal government can least afford it. As mid-year elections method, increased yields translate into increased refinancing prices, and that’s not a simple promote to voters. Whereas Bitcoin managed to rebound round 1.20% on the information, calling this a breakout could be a stretch, the strain is simply simply beginning.

Analysts have began framing this second as a “capital struggle,” and that framing issues. The forces at play are structural, not short-term, and so they recommend that the calm on the floor might not final for much longer.

Europe’s de-dollarization push raises contemporary considerations

The U.S. Treasury market is now dealing with a shock that’s laborious to disregard. For many years, Asian and European international locations have parked capital in U.S. Treasuries, incomes yield whereas serving to Washington fund its rising debt pile. European buyers alone nonetheless maintain near $2 trillion in these securities, however that stability is shifting.

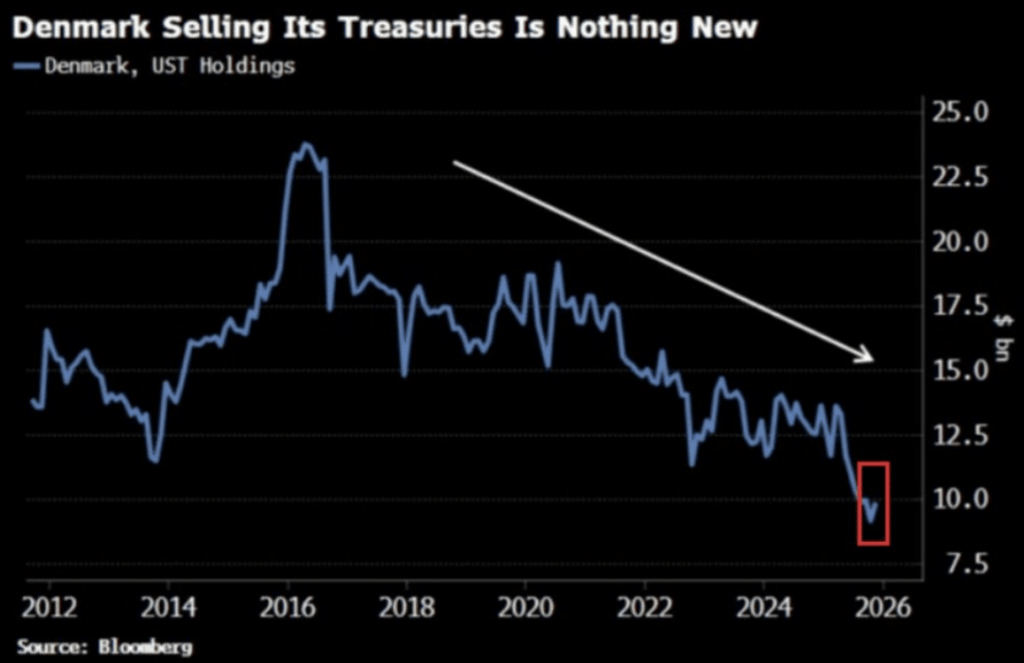

International holders are quietly stepping again. Denmark, as an illustration, has reduce its U.S. Treasury publicity to roughly $9 billion, the bottom stage in 14 years, and it’s not alone. Europe has bought about $150.2 billion in Treasuries, China offloaded $105.8 billion, and India bought $56.2 billion, all reaching multi-year extremes.

This helps clarify why Trump’s tariff retreat seems extra defensive than diplomatic. As Treasuries had been dumped, yields surged, with the 30-year yield pushing shut to five% and power spreading throughout the curve. With round 26% of the $39 trillion U.S. federal debt maturing within the subsequent 12 months, increased yields imply refinancing turns into painfully costly, quick.

Bitcoin reveals indicators of warning as investor confidence weakens

Macro volatility continues to form how buyers are positioning themselves. Trump’s tariff rollback and his softer tone on Greenland triggered a short risk-on transfer, sending roughly $50 billion into markets, with about 60% of that flowing into Bitcoin and driving short-term BTC-led momentum.

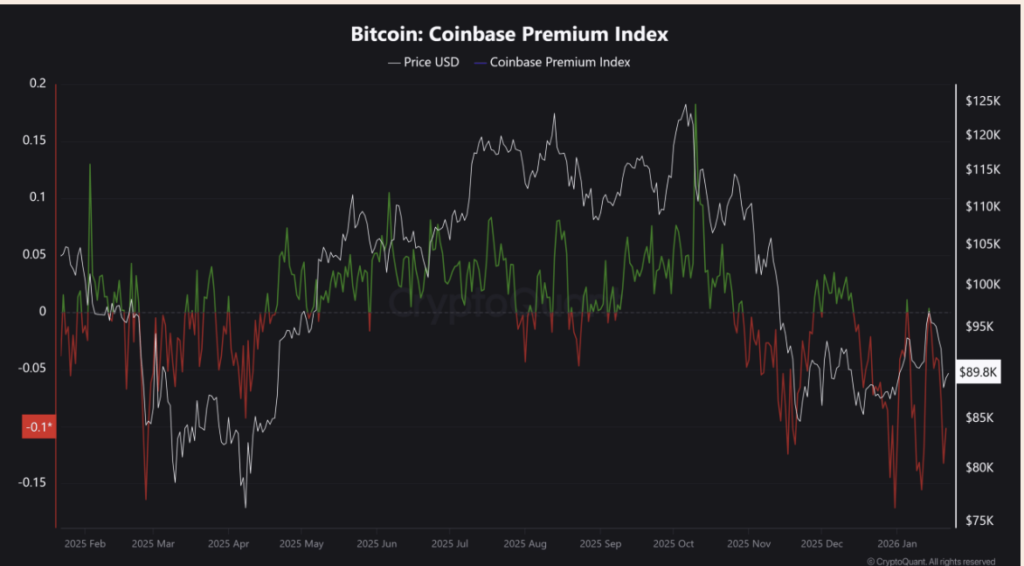

Nonetheless, underlying confidence stays fragile. Bitcoin’s Coinbase Premium Index sits round -0.1 and has stayed detrimental because the October crash, an indication that U.S. buyers are nonetheless hesitant. Traditionally, sustained Bitcoin bull runs are likely to align with the CPI peaking, and that merely hasn’t occurred but.

The current Treasury sell-off provides one other layer of warning. With metals rallying and overseas capital stepping again from U.S. debt in what seems like a coordinated transfer, stress is constructing beneath the financial system. In that atmosphere, high-yield bonds develop into extra enticing, pulling capital away from danger belongings like Bitcoin, not less than for now.

Bullish gold predictions are set to form Bitcoin’s trajectory

Even this early into 2026, investor preferences are already taking form. With the U.S. deficit underneath strain and Treasuries being bought off, metals are again in focus. Gold is up roughly 12% and flirting with document highs, with near-term targets round $5,000 per ounce as buyers search for shelter from rising yields.

This rotation has weighed on Bitcoin’s relative power. The BTC-to-gold ratio has fallen to a two-year low, dipping beneath 18 ounces of gold for the primary time since late 2023, a transparent sign that capital is leaning towards conventional protected havens. Analysts argue this will solely be the start, not the top.

Goldman Sachs just lately lifted its year-end gold forecast to $5,400 an oz., citing sustained demand. Russia has already benefited considerably from rising gold costs, whereas India’s silver imports have surged to a document $5.9 billion in simply 4 months. Collectively, these traits level to international locations stockpiling metals whereas decreasing publicity to U.S. debt, a combination that might proceed to cap Bitcoin’s upside till macro confidence stabilizes.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.