- Stablecoin rewards are the principle impediment slowing US crypto laws.

- Banks worry deposit flight greater than client threat.

- The talk reveals the place monetary energy is definitely shifting.

At Davos, Donald Trump as soon as once more leaned into the concept that america ought to change into the crypto capital of the world. The slogan is clear and assured. The truth behind it’s far messier. Whereas Trump desires a market construction invoice signed shortly, negotiations preserve grinding to a halt over a single difficulty that refuses to vanish. Stablecoin rewards.

Why Stablecoin Rewards Hit a Nerve

On paper, the foundations exist already. The GENIUS framework blocks stablecoin issuers from paying direct curiosity. What it doesn’t cease is platforms like Coinbase providing rewards on prime of stablecoin balances. That hole is the place the true combat lives. Banks argue it’s about security and stability. In apply, it’s about deposits. As soon as customers can maintain dollar-backed property, keep liquid, and earn yield and not using a conventional financial institution, the previous mannequin begins to look fragile.

The Coinbase Second That Modified the Tone

Brian Armstrong’s public stance that no invoice is healthier than a nasty one wasn’t rhetorical aptitude. It was leverage. Lawmakers felt it instantly. If crypto companies conform to guidelines that quietly strip away their aggressive edge, then the laws turns into symbolic quite than useful. That pushback uncovered how a lot negotiating energy the trade now holds.

This Isn’t Crypto vs Authorities Anymore

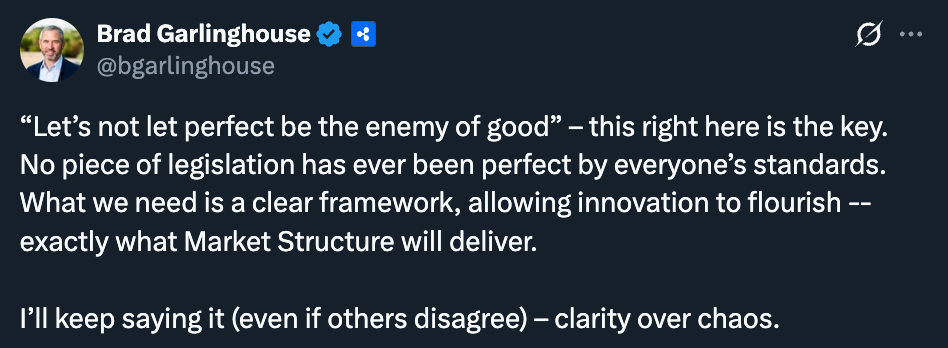

The strains have shifted. Assist from trade leaders like Brad Garlinghouse, alongside makes an attempt at mediation from figures comparable to David Sacks, present that is now not an ideological combat about whether or not crypto belongs. It’s a industrial battle between industries over who controls the way forward for dollar-based worth switch. Banks and crypto companies at the moment are overtly competing for a similar customers.

The place the Invoice Will Really Be Received or Misplaced

This laws received’t be determined by speeches about innovation or nationwide management. It would hinge on whether or not Washington acknowledges the true menace banks are responding to. Stablecoin rewards don’t simply problem merchandise, they problem dominance. That’s why this difficulty retains resurfacing, and why it’s slowing every thing down. Energy not often strikes quietly, and that is what that friction seems to be like.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.