- Grayscale filed to launch a spot BNB ETF within the US

- The fund would commerce on Nasdaq and maintain BNB straight

- The transfer displays accelerating momentum in crypto ETFs

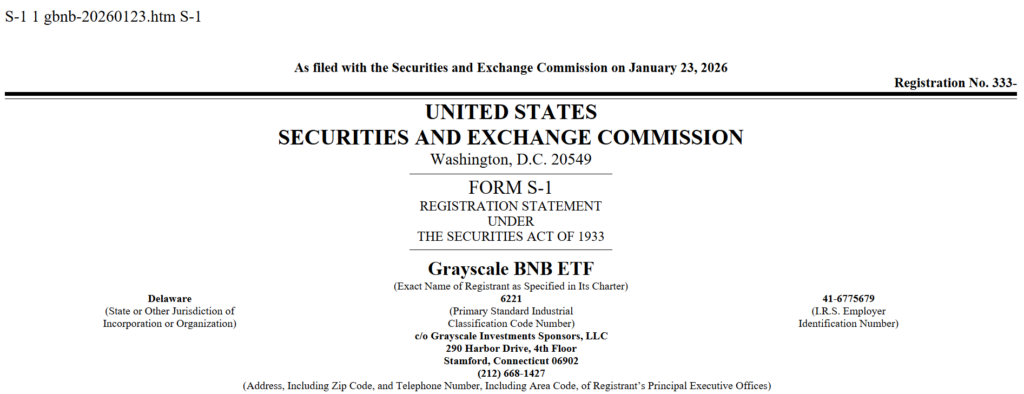

Grayscale is pushing additional into altcoin publicity after submitting to launch a BNB-focused exchange-traded fund in the USA. The proposed product would give buyers direct publicity to BNB, the native token of the BNB Chain, at a time when crypto ETFs are increasing nicely past Bitcoin and Ethereum. If permitted, the fund would commerce on Nasdaq underneath the ticker GBNB, including one other main asset to the rising checklist of regulated crypto funding autos.

What the Proposed BNB ETF Seems Like

Based on the submitting, the Grayscale BNB ETF would maintain BNB tokens straight and goal to trace the asset’s market worth, minus bills. Financial institution of New York Mellon is listed because the switch agent, whereas Coinbase Custody would deal with asset storage. Structurally, it mirrors how different spot crypto ETFs are designed, protecting issues easy and acquainted for conventional buyers.

BNB at the moment ranks among the many largest crypto property by market capitalization, making it a pure candidate as ETF issuers broaden their scope past the same old names.

Why This Submitting Issues Now

Grayscale isn’t alone in eyeing BNB. One other main asset supervisor filed for the same product final yr, signaling rising confidence that regulators could now be open to a wider vary of crypto ETFs. The regulatory backdrop has shifted noticeably, with funds tied to property like Solana, XRP, Dogecoin, Hedera, and Chainlink already reaching the market.

This submitting matches right into a broader sample. Crypto ETFs are not area of interest experiments. They’re turning into a typical wrapper for accessing digital property inside conventional portfolios.

What It Indicators for BNB and the Market

An permitted BNB ETF would decrease the barrier for US buyers who need publicity with out managing wallets or custody themselves. Whereas approval doesn’t assure quick inflows, it provides legitimacy and accessibility, two elements that are inclined to matter over time moderately than in a single day.

For the broader market, it reinforces the concept that crypto publicity is turning into modular. Property as soon as thought-about exchange-native are steadily being packaged into acquainted monetary merchandise.

Conclusion

Grayscale’s transfer to launch a BNB ETF exhibits how far crypto ETFs have developed. What began with Bitcoin has expanded right into a multi-asset race to satisfy investor demand. Whether or not GBNB turns into a serious influx driver stays to be seen, however the path is obvious. Crypto is more and more assembly buyers the place they already are.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.