- Grayscale has filed an S-1 with the SEC for a spot Binance Coin ETF underneath the ticker GBNB

- The proposed fund would supply direct BNB publicity, with staking and in-kind creation included

- BNB worth remained flat close to $900 as markets await regulatory readability

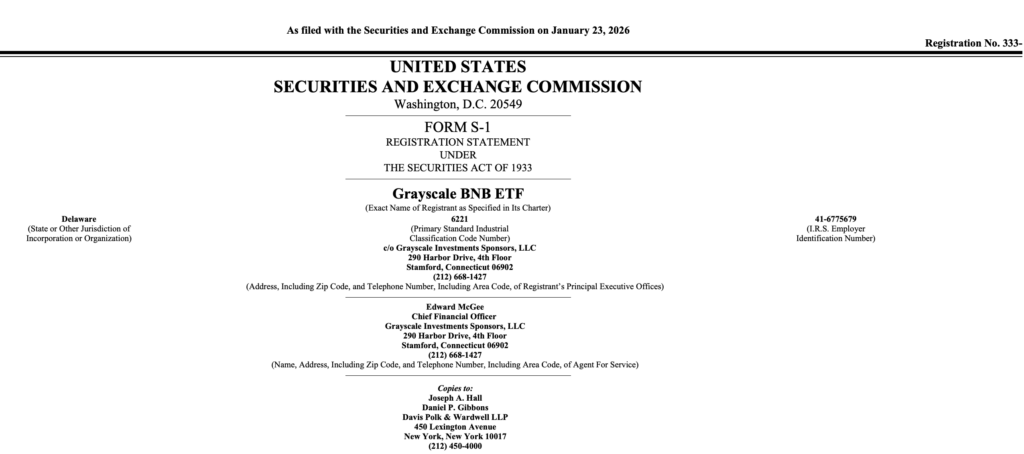

Grayscale has taken one other step in its push to deliver extra crypto property into conventional markets. The asset supervisor has filed an S-1 registration assertion with the U.S. Securities and Trade Fee for a spot Binance Coin exchange-traded fund, signaling recent ambition to increase institutional entry to BNB.

The transfer didn’t come out of nowhere. Earlier, Grayscale registered a BNB-focused belief in Delaware, a procedural step that usually hints at greater plans. By submitting the S-1, the agency has now formally positioned its proposal into the SEC’s assessment course of, becoming a member of a small however rising record of issuers seeking to wrap Binance Coin in an ETF construction.

How Grayscale’s BNB ETF Would Work

In accordance with the submitting, the proposed fund would commerce on Nasdaq underneath the ticker GBNB. Its aim is easy, give buyers direct worth publicity to Binance Coin with out requiring them to carry or handle the token themselves. For establishments particularly, that simplicity tends to matter.

Operationally, the setup appears to be like acquainted. Coinbase is listed because the prime dealer, whereas Coinbase Custody can be accountable for holding the underlying BNB. This mirrors the infrastructure Grayscale already makes use of throughout a number of of its present crypto merchandise, suggesting the agency isn’t reinventing the wheel right here.

The submitting additionally contains in-kind creation and redemption, a characteristic that has grow to be more and more customary for spot crypto ETFs. On high of that, Grayscale has flagged plans to combine staking into the fund’s construction. If applied, that would permit the ETF to generate yield moderately than merely observe BNB’s spot worth, although particulars on how staking rewards can be dealt with stay obscure for now.

Charges, Timing, and What’s Nonetheless Lacking

Whereas the S-1 confirms intent, it leaves loads unanswered. Grayscale has not disclosed the administration charge, seed capital, or any anticipated launch timeline. That uncertainty is typical at this stage, nevertheless it does restrict how a lot buyers can assess the product’s eventual competitiveness.

As with different crypto ETFs, the approval timeline will hinge on regulatory suggestions and the broader coverage stance of U.S. regulators. Till there’s extra readability from the SEC, a lot of this stays a ready sport.

A Crowded Race for a BNB ETF

Grayscale isn’t alone in chasing a Binance Coin ETF. VanEck has already filed for the same product and submitted amendments, probably placing it additional alongside within the approval queue. Elsewhere, REX Shares and Osprey Funds have taken a special strategy, proposing BNB publicity underneath the Funding Firm Act of 1940 moderately than by way of a conventional spot ETF construction.

If permitted, the BNB fund would grow to be Grayscale’s seventh single-asset crypto ETF. It will be part of a lineup that already contains Bitcoin, Ethereum, XRP, Solana, Dogecoin, and Chainlink. The rising record displays a broader technique, turning as many main digital property as potential into exchange-traded merchandise that match neatly into conventional portfolios.

Market Response Stays Muted

Regardless of the regulatory significance of the submitting, Binance Coin’s worth barely flinched. BNB traded close to the $900 degree following the information, displaying little motion throughout short-term timeframes. That muted response suggests merchants see the ETF submitting as a long-term improvement moderately than an instantaneous catalyst.

With approval removed from assured and timelines unsure, the market seems content material to attend. For now, Grayscale’s submitting provides one other layer to the evolving ETF panorama, however its actual influence will not be felt till regulators make their subsequent transfer.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.